Use the information from Problem 29 and calculate the stock price with the clean surplus dividend. Do

Question:

Data From Problem 29

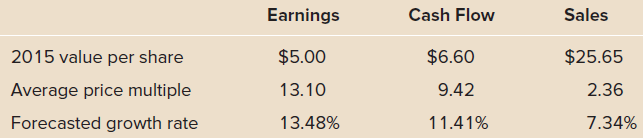

Assume the sustainable growth rate and required return you calculated in Problem 27 are valid. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model.

Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some Chapter 6 Common Stock Valuation 217 valuation estimates for the firm. Assume the values provided are from year-end 2015. Also assume that the firm€™s equity beta is 1.40, the risk-free rate is 2.75 percent, and the market risk premium is 7 percent.

Dividends per share .......................$ 2.04

Return on equity .............................9.50%

Book value per share ....................$17.05

What are the sustainable growth rate and required return for Beagle Beauties? Using these values, estimate the current share price of Beagle Beauties stock according to the constant dividend growth model.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin