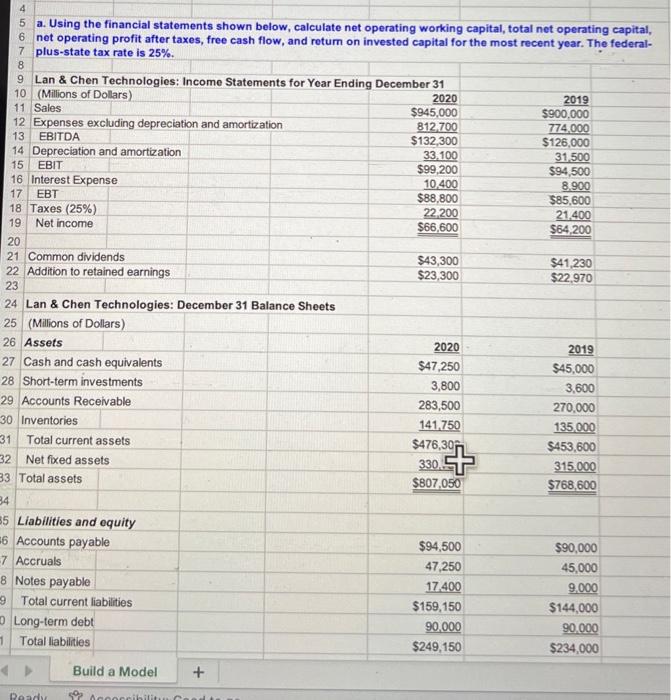

Question: a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and

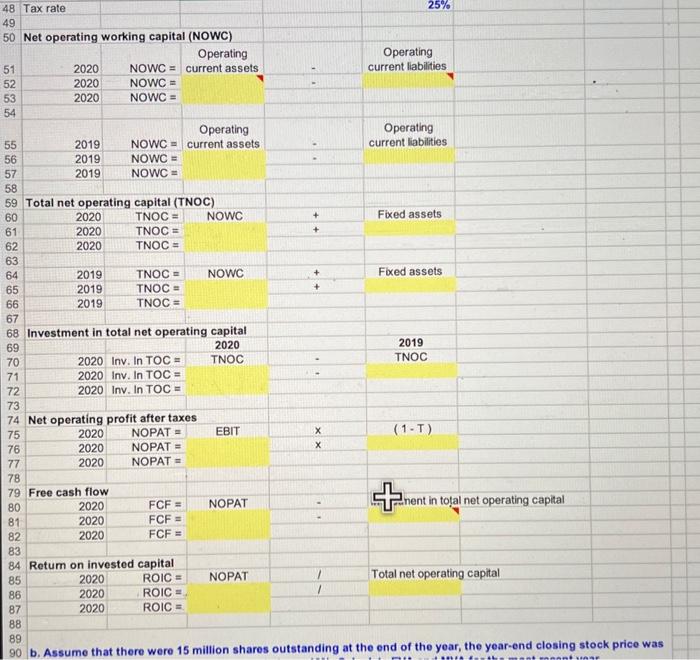

a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and retum on invested capital for the most recent year. The federalplus-state tax rate is 25%. Lan \& Chen Technologies: Income Statements for Year Ending December 31 4 Lan \& Chen Technologies: December 31 Balance Sheets (Millions of Dollars) Liabilities and equity 6 Accounts payable 7 Accruals 8 Notes payable 9 Total current liabilities 0 Long-term debt Total liabilities \begin{tabular}{|rr|} \hline$94,500 & $90,000 \\ \hline 47,250 & 45,000 \\ \hline 17,400 & 9,000 \\ \hline$159,150 & $144,000 \\ \hline 90,000 & 90,000 \\ \hline$249,150 & $234,000 \\ \hline \end{tabular} Build a Model + 48 Tax rate 50 Net operating working capital (NOWC) Operating current liabilities 54 Total net operating capital (TNOC) Investment in total net operating capital Net operating profit after taxes 202020202020NOPAT=NOPAT=EBITxx(1T) 2020 NOPAT = Free cash flow ashflow20202020FCF=FCF=FCF= NOPAT . Retum on invested capital 20202020ROICNotalnetoperatingcapital=NOPAT12020ROIC= b. Assume that there were 15 million shares outstanding at the end of the year, the year-end closing stock price was a. Using the financial statements shown below, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and retum on invested capital for the most recent year. The federalplus-state tax rate is 25%. Lan \& Chen Technologies: Income Statements for Year Ending December 31 4 Lan \& Chen Technologies: December 31 Balance Sheets (Millions of Dollars) Liabilities and equity 6 Accounts payable 7 Accruals 8 Notes payable 9 Total current liabilities 0 Long-term debt Total liabilities \begin{tabular}{|rr|} \hline$94,500 & $90,000 \\ \hline 47,250 & 45,000 \\ \hline 17,400 & 9,000 \\ \hline$159,150 & $144,000 \\ \hline 90,000 & 90,000 \\ \hline$249,150 & $234,000 \\ \hline \end{tabular} Build a Model + 48 Tax rate 50 Net operating working capital (NOWC) Operating current liabilities 54 Total net operating capital (TNOC) Investment in total net operating capital Net operating profit after taxes 202020202020NOPAT=NOPAT=EBITxx(1T) 2020 NOPAT = Free cash flow ashflow20202020FCF=FCF=FCF= NOPAT . Retum on invested capital 20202020ROICNotalnetoperatingcapital=NOPAT12020ROIC= b. Assume that there were 15 million shares outstanding at the end of the year, the year-end closing stock price was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts