Question: a) Using the information provided under analytical procedures', identify three key factors that suggest PEST Limited may have a going concern problem. b) Given your

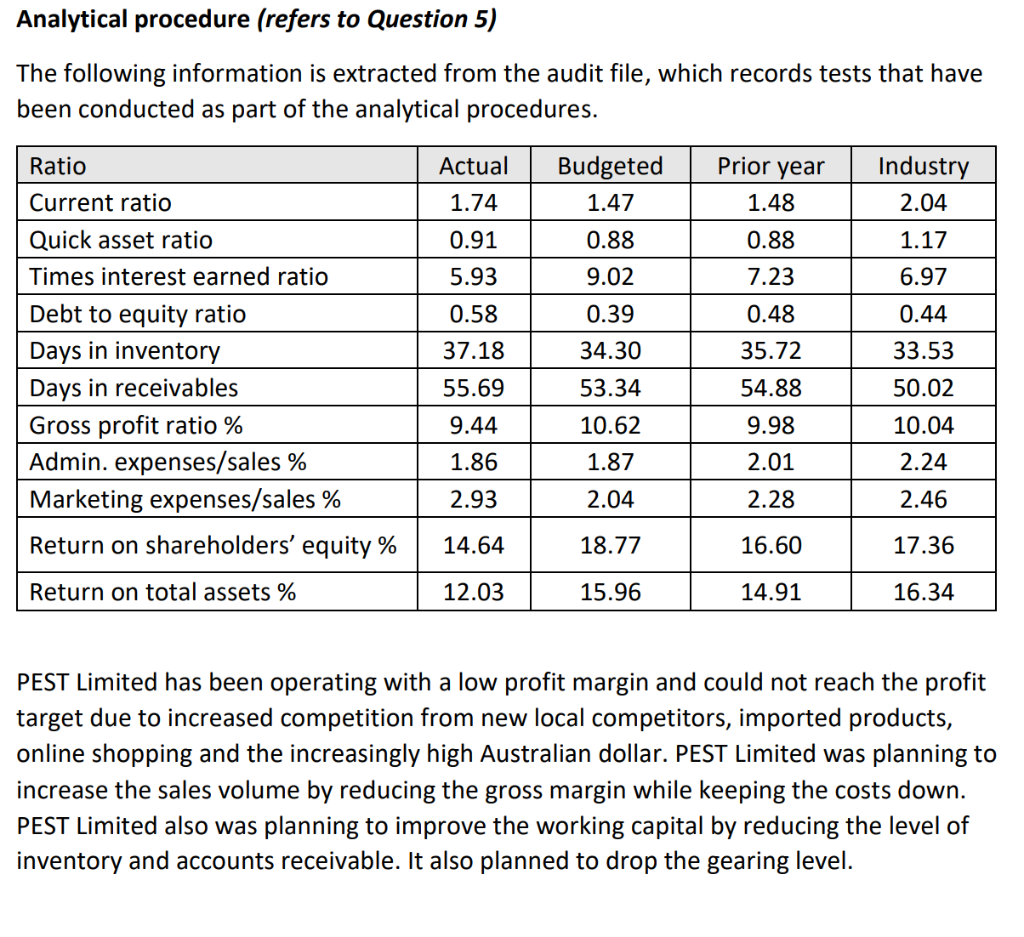

a) Using the information provided under analytical procedures', identify three key factors that suggest PEST Limited may have a going concern problem. b) Given your answer to (a), identify three audit procedures that you would conduct to assess the appropriateness of management's use of the going concern assumption in the preparation of the financial report. Analytical procedure (refers to Question 5) The following information is extracted from the audit file, which records tests that have been conducted as part of the analytical procedures. Ratio Actual Budgeted Prior year Industry 2.04 Current ratio 1.74 1.47 1.48 Quick asset ratio 0.91 0.88 0.88 1.17 Times interest earned ratio 5.93 9.02 7.23 6.97 0.58 0.39 0.48 0.44 37.18 34.30 35.72 33.53 55.69 53.34 54.88 50.02 Debt to equity ratio Days in inventory Days in receivables Gross profit ratio % Admin. expenses/ % Marketing expenses/sales % 9.44 10.62 9.98 10.04 1.86 1.87 2.01 2.24 2.93 2.04 2.28 2.46 Return on shareholders' equity % 14.64 18.77 16.60 17.36 Return on total assets % 12.03 15.96 14.91 16.34 PEST Limited has been operating with a low profit margin and could not reach the profit target due to increased competition from new local competitors, imported products, online shopping and the increasingly high Australian dollar. PEST Limited was planning to increase the sales volume by reducing the gross margin while keeping the costs down. PEST Limited also was planning to improve the working capital by reducing the level of inventory and accounts receivable. It also planned to drop the gearing level. a) Using the information provided under analytical procedures', identify three key factors that suggest PEST Limited may have a going concern problem. b) Given your answer to (a), identify three audit procedures that you would conduct to assess the appropriateness of management's use of the going concern assumption in the preparation of the financial report. Analytical procedure (refers to Question 5) The following information is extracted from the audit file, which records tests that have been conducted as part of the analytical procedures. Ratio Actual Budgeted Prior year Industry 2.04 Current ratio 1.74 1.47 1.48 Quick asset ratio 0.91 0.88 0.88 1.17 Times interest earned ratio 5.93 9.02 7.23 6.97 0.58 0.39 0.48 0.44 37.18 34.30 35.72 33.53 55.69 53.34 54.88 50.02 Debt to equity ratio Days in inventory Days in receivables Gross profit ratio % Admin. expenses/ % Marketing expenses/sales % 9.44 10.62 9.98 10.04 1.86 1.87 2.01 2.24 2.93 2.04 2.28 2.46 Return on shareholders' equity % 14.64 18.77 16.60 17.36 Return on total assets % 12.03 15.96 14.91 16.34 PEST Limited has been operating with a low profit margin and could not reach the profit target due to increased competition from new local competitors, imported products, online shopping and the increasingly high Australian dollar. PEST Limited was planning to increase the sales volume by reducing the gross margin while keeping the costs down. PEST Limited also was planning to improve the working capital by reducing the level of inventory and accounts receivable. It also planned to drop the gearing level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts