Question: a) Using the NPV analysis, advise Gustav whether he should purchase the new machine. b) Using the IRR analysis, advise Gustav whether he should purchase

a) Using the NPV analysis, advise Gustav whether he should purchase the new machine.

b) Using the IRR analysis, advise Gustav whether he should purchase the new machine. Do you reach the same conclusion?

c) Are there any other factors Gustav should consider when making his decision? Think about strategic, qualitative, and other non-financial factors. Find at least 3

d) Give a short recommendation for Gustav. Be specific on how you reached your conclusion.

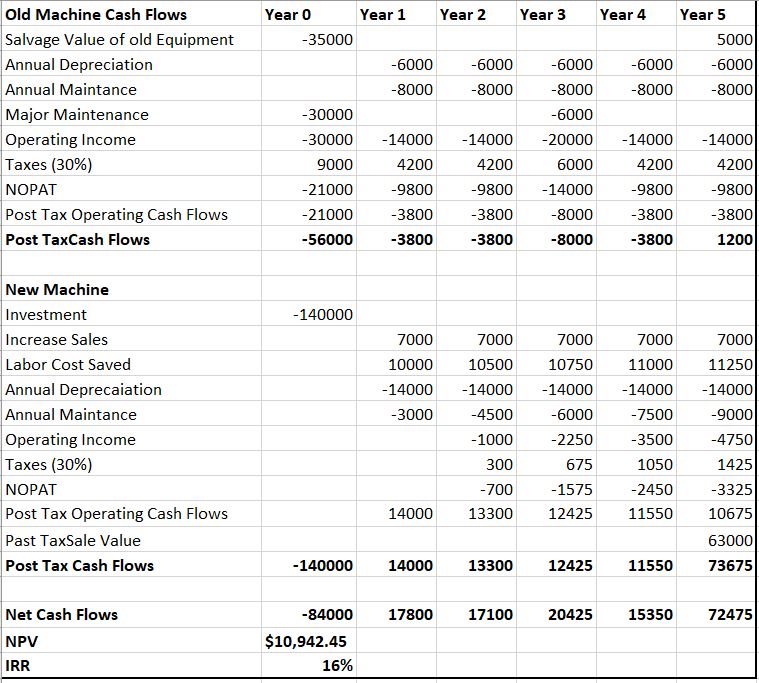

Old Machine Cash Flows Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Salvage Value of old Equipment -35000 5000 Annual Depreciation -6000 -6000 -6000 -6000 -6000 Annual Maintance -8000 -8000 -8000 -8000 -8000 Major Maintenance -30000 -6000 Operating Income -30000 -14000 -14000 -20000 -14000 -14000 Taxes (30%) 9000 4200 4200 6000 4200 4200 NOPAT -21000 -9800 -9800 -14000 -9800 -9800 Post Tax Operating Cash Flows -21000 -3800 -3800 -8000 -3800 -3800 Post TaxCash Flows -56000 -3800 -3800 -8000 -3800 1200 New Machine Investment Increase Sales Labor Cost Saved Annual Deprecaiation Annual Maintance Operating Income Taxes (30%) NOPAT Post Tax Operating Cash Flows Past TaxSale Value Post Tax Cash Flows Net Cash Flows NPV IRR -140000 7000 7000 7000 7000 7000 10000 10500 10750 11000 11250 -14000 -14000 -14000 -14000 -14000 -3000 -4500 -6000 -7500 -9000 -1000 -2250 -3500 -4750 300 675 1050 1425 -700 -1575 -2450 -3325 14000 13300 12425 11550 10675 63000 -140000 14000 13300 12425 11550 73675 -84000 17800 17100 20425 15350 72475 $10,942.45 16%

Step by Step Solution

There are 3 Steps involved in it

To evaluate the decision to replace the old machine with a new one we can use the net present value NPV method We will discount the cash flows at the ... View full answer

Get step-by-step solutions from verified subject matter experts