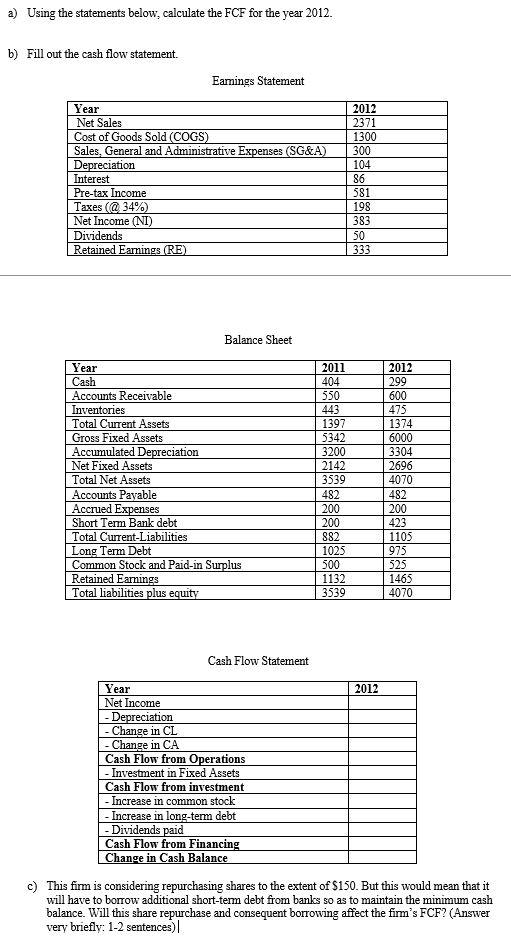

Question: a) Using the statements below, calculate the FCF for the year 2012. b) Fill out the cash flow statement. Eamings Statement Year Net Sales Cost

a) Using the statements below, calculate the FCF for the year 2012. b) Fill out the cash flow statement. Eamings Statement Year Net Sales Cost of Goods Sold (COGS) Sales. General and Administrative Expenses (SG&A) Depreciation Interest Pre-tax Income Taxes (@34% Net Income (NI) Dividends Retained Earnings (RE) 2012 2371 1300 300 104 86 581 198 383 50 333 bloolen Balance Sheet Year Cash Accounts Receivable Inventories Total Current Assets Gross Fix Assets Accumulated Depreciation Net Fixed Assets Total Net Assets Accounts Payable Accrued Expenses Short Term Bank debt Total Current-Liabilities Long Term Debt Common Stock and Paid-in Surplus Retained Earnings Total liabilities plus equity 2011 404 550 443 1397 5342 3200 2142 3539 482 200 200 882 1025 500 1132 3539 2012 299 600 475 1374 6000 3304 2696 4070 482 200 423 1105 975 525 1465 4070 Cash Flow Statement 2012 Year Net Income - Depreciation - Change in CL - Change in CA Cash Flow from Operations - Investment in Fixed Assets Cash Flow from investment - Increase in common stock - Increase in long-term debt Dividends paid Cash Flow from Financing Change in Cash Balance c) This firm is considering repurchasing shares to the extent of $150. But this would mean that it will have to borrow additional short-term debt from banks so as to maintain the minimum cash balance. Will this share repurchase and consequent borrowing affect the firm's FCF? (Answer very briefly: 1-2 sentences)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts