Question: a. Using value creation slides as an outline, walk through in detail exactly how your decision will change the inputs to valuation to demonstrate that

a. Using value creation slides as an outline, walk through in detail exactly how your decision will change the inputs to valuation to demonstrate that you understand exactly how overall firm value will change.

b. Walk through in detail exactly how your decision will change the overall risk of the firm. Be precise in answering.

c. Besides your own management area explain in detail exactly what other management areas of your firm either casually contribute to the value of your decision or will experience value implications from your decision. Answer precisely in context of Value and risk equations.

d. Explain in detail exactly how external factors affect both the valuation and risk of your firm.

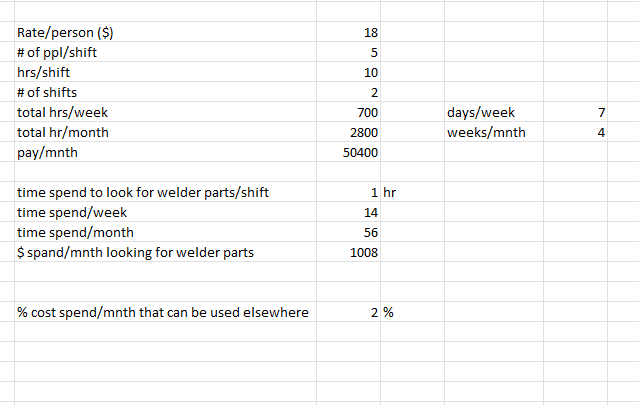

Using example of how I implemented a 5S initiative that minimized man hours used to find a piece of equipment, raw data given in slide picture.

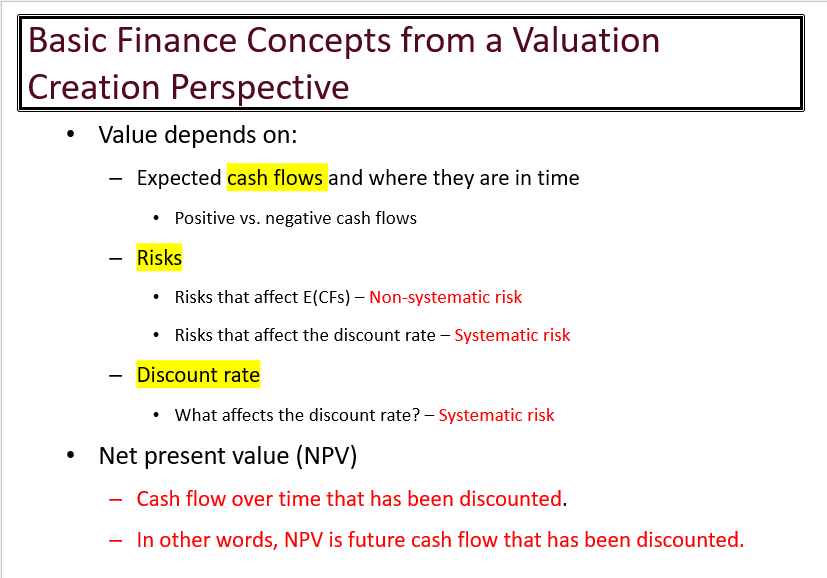

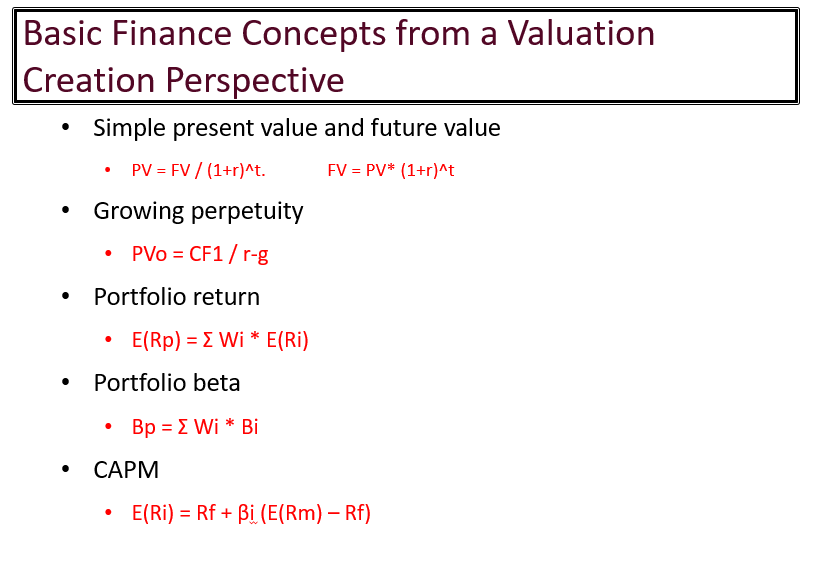

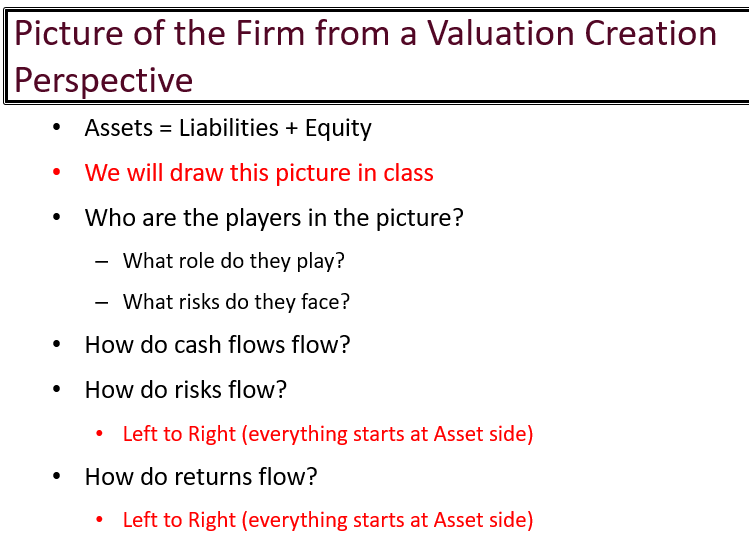

Basic Finance Concepts from a Valuation Creation Perspective - Value depends on: - Expected cash flows and where they are in time - Positive vs. negative cash flows - Risks that affect E(CFs) - Non-systematic risk - Risks that affect the discount rate - Systematic risk - What affects the discount rate? - Systematic risk - Net present value (NPV) - Cash flow over time that has been discounted. - In other words, NPV is future cash flow that has been discounted. Basic Finance Concepts from a Valuation Creation Perspective - Simple present value and future value - PV=FV/(1+r)t.FV=PV(1+r)t - Growing perpetuity - PVO=CF1/rg - Portfolio return - E(Rp)=WiE(Ri) - Portfolio beta - Bp=WiBi - CAPM - E(Ri)=Rf+i(E(Rm)Rf) Picture of the Firm from a Valuation Creation Perspective - Assets = Liabilities + Equity - We will draw this picture in class - Who are the players in the picture? - What role do they play? - What risks do they face? - How do cash flows flow? - How do risks flow? - Left to Right (everything starts at Asset side) - How do returns flow? - Left to Right (everything starts at Asset side) \begin{tabular}{|c|c|c|c|} \hline Rate/person (\$) & 18 & & \\ \hline \# of ppl/shift & 5 & & \\ \hline hrs/shift & 10 & & \\ \hline \# of shifts & 2 & & \\ \hline total hrs/week & 700 & days/week & 7 \\ \hline total hr/month & 2800 & weeks/mnth & 4 \\ \hline pay/mnth & 50400 & & \\ \hline time spend to look for welder parts/shift & 1hr & & \\ \hline time spend/week & 14 & & \\ \hline time spend/month & 56 & & \\ \hline \$ spand/mnth looking for welder parts & 1008 & & \\ \hline% cost spend/mnth that can be used elsewhere & 2% & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Basic Finance Concepts from a Valuation Creation Perspective - Value depends on: - Expected cash flows and where they are in time - Positive vs. negative cash flows - Risks that affect E(CFs) - Non-systematic risk - Risks that affect the discount rate - Systematic risk - What affects the discount rate? - Systematic risk - Net present value (NPV) - Cash flow over time that has been discounted. - In other words, NPV is future cash flow that has been discounted. Basic Finance Concepts from a Valuation Creation Perspective - Simple present value and future value - PV=FV/(1+r)t.FV=PV(1+r)t - Growing perpetuity - PVO=CF1/rg - Portfolio return - E(Rp)=WiE(Ri) - Portfolio beta - Bp=WiBi - CAPM - E(Ri)=Rf+i(E(Rm)Rf) Picture of the Firm from a Valuation Creation Perspective - Assets = Liabilities + Equity - We will draw this picture in class - Who are the players in the picture? - What role do they play? - What risks do they face? - How do cash flows flow? - How do risks flow? - Left to Right (everything starts at Asset side) - How do returns flow? - Left to Right (everything starts at Asset side) \begin{tabular}{|c|c|c|c|} \hline Rate/person (\$) & 18 & & \\ \hline \# of ppl/shift & 5 & & \\ \hline hrs/shift & 10 & & \\ \hline \# of shifts & 2 & & \\ \hline total hrs/week & 700 & days/week & 7 \\ \hline total hr/month & 2800 & weeks/mnth & 4 \\ \hline pay/mnth & 50400 & & \\ \hline time spend to look for welder parts/shift & 1hr & & \\ \hline time spend/week & 14 & & \\ \hline time spend/month & 56 & & \\ \hline \$ spand/mnth looking for welder parts & 1008 & & \\ \hline% cost spend/mnth that can be used elsewhere & 2% & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts