Question: A verbal analysis or expression is expected to support your numerical answer. a. Which alternative should be chosen under the maximax criterion? b. Which alternative

A verbal analysis or expression is expected to support your numerical answer.

a. Which alternative should be chosen under the maximax criterion? b. Which alternative should be chosen under the maximin criterion? c. Which alternative should be chosen under the maximum likelihood criterion? d. Construct and solve a decision tree for this problem.

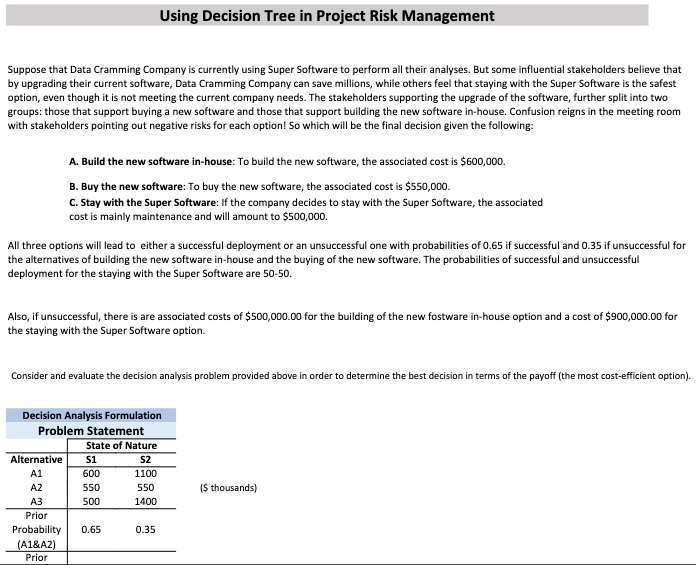

Using Decision Tree in Project Risk Management Suppose that Data Cramming Company is currently using Super Software to perform all their analyses. But some influential stakeholders believe that by upgrading their current software, Data Cramming Company can save millions, while others feel that staying with the Super Software is the safest option, even though it is not meeting the current company needs. The stakeholders supporting the upgrade of the software, further split into two groups: those that support buying a new software and those that support building the new software in-house. Confusion reigns in the meeting room with stakeholders pointing out negative risks for each option! So which will be the final decision given the following: A. Build the new software in-house: To build the new software, the associated cost is $600,000. B. Buy the new software: To buy the new software, the associated cost is $550,000. C. Stay with the Super Software: If the company decides to stay with the Super Software, the associated cost is mainly maintenance and will amount to $500,000. All three options will lead to either a successful deployment or an unsuccessful one with probabilities of 0.65 if successful and 0.35 if unsuccessful for the alternatives of building the new software in-house and the buying of the new software. The probabilities of successful and unsuccessful deployment for the staying with the Super Software are 50-50. Also, if unsuccessful, there is are associated costs of $500,000.00 for the building of the new fostware in-house option and a cost of $900,000.00 for the staying with the Super Software option. Consider and evaluate the decision analysis problem provided above in order to determine the best decision in terms of the payoff (the most cost-efficient option). Decision Analysis Formulation Problem Statement State of Nature Alternative S1 S2 A1 600 1100 A2 550 550 A3 500 1400 Prior Probability 0.65 0.35 (A1&A2) Prior (5 thousands)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts