Question: this is all information i got here GOPM 540 Quantitative Decision Modeling Assignment #3 Due April 12. 2021 Refer to the last page for a

this is all information i got here

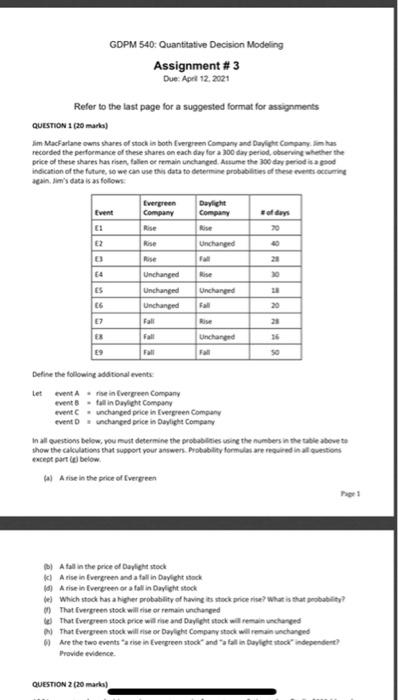

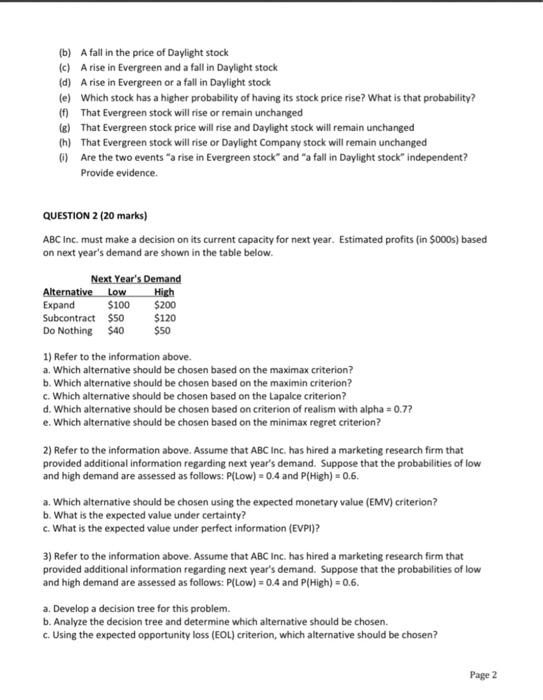

GOPM 540 Quantitative Decision Modeling Assignment #3 Due April 12. 2021 Refer to the last page for a suggested format for assignments QUESTION 1 (20 marks) im MacFarlane owns shares of stock is both Evergreen Company and Day Company has recorded the performance of these shares on each day for a 100 day period observing whether the price of these shares hasilor remain unchanged. Assume the 100 day period indication of the future, so we can use this data to determine probabilities of these events curring again im's data is as follows Company Daylight Company of days Rise Unchanged Rise Unchanged Unchanged Unchanged Fall Unchanged Fall 16 20 E7 Rise Unchanged 30 ES Define the following additional events Let event in Evergreen Company event - fall in Daylight Company event. unchanged price in Evergreen Company eventDanchanged price in Daylight Company In all questions below, you must determine the probabilities using the numbers in the title above te show the calculations that support your answers. Probability formulare real estions except art below Arise in the price of Evergreen D) A tal in the price of Daylight stock tl Arise in Evergreen and a tall in Daylight stack Atise in Evergreen or fall in Daylight stock es which stock has a hiere probability of havine is stuck price rise? What is that probability? ) That Evergreen stock will rise or remain unchanged That twergreen stock price will rise and Daylight stock will remain unchanged That Evergreen stock will raight Company stock will remain unchanged Are the two events are in Evergreen stock and fall in Daylig stock independent Provide evidence QUESTION 2 (20 marks) (b) A fall in the price of Daylight stock (c) A rise in Evergreen and a fall in Daylight stock (d) A rise in Evergreen or a fall in Daylight stock le) Which stock has a higher probability of having its stock price rise? What is that probability? (f) That Evergreen stock will rise or remain unchanged (g) That Evergreen stock price will rise and Daylight stock will remain unchanged th) That Evergreen stock will rise or Daylight Company stock will remain unchanged Are the two events a rise in Evergreen stock" and "a fall in Daylight stock" independent? Provide evidence QUESTION 2 (20 marks) ABC Inc. must make a decision on its current capacity for next year. Estimated profits (in $000s) based on next year's demand are shown in the table below. Next Year's Demand Alternative Low High Expand $100 $200 Subcontract $50 $120 Do Nothing $40 $50 1) Refer to the information above. a. Which alternative should be chosen based on the maximax criterion? b. Which alternative should be chosen based on the maximin criterion? c. Which alternative should be chosen based on the Lapalce criterion? d. Which alternative should be chosen based on criterion of realism with alpha=0.7? e. Which alternative should be chosen based on the minimax regret criterion? 2) Refer to the information above. Assume that ABC Inc. has hired a marketing research firm that provided additional information regarding next year's demand. Suppose that the probabilities of low and high demand are assessed as follows: P(Low) = 0.4 and P(High) = 0.6. a. Which alternative should be chosen using the expected monetary value (EMV) criterion? b. What is the expected value under certainty? c. What is the expected value under perfect information (EVPI)? 3) Refer to the information above. Assume that ABC Inc. has hired a marketing research firm that provided additional information regarding next year's demand. Suppose that the probabilities of low and high demand are assessed as follows: P(Low) = 0.4 and P(High) = 0.6. a Develop a decision tree for this problem. b. Analyze the decision tree and determine which alternative should be chosen. c. Using the expected opportunity loss (EOL) criterion, which alternative should be chosen? Page 2 GOPM 540 Quantitative Decision Modeling Assignment #3 Due April 12. 2021 Refer to the last page for a suggested format for assignments QUESTION 1 (20 marks) im MacFarlane owns shares of stock is both Evergreen Company and Day Company has recorded the performance of these shares on each day for a 100 day period observing whether the price of these shares hasilor remain unchanged. Assume the 100 day period indication of the future, so we can use this data to determine probabilities of these events curring again im's data is as follows Company Daylight Company of days Rise Unchanged Rise Unchanged Unchanged Unchanged Fall Unchanged Fall 16 20 E7 Rise Unchanged 30 ES Define the following additional events Let event in Evergreen Company event - fall in Daylight Company event. unchanged price in Evergreen Company eventDanchanged price in Daylight Company In all questions below, you must determine the probabilities using the numbers in the title above te show the calculations that support your answers. Probability formulare real estions except art below Arise in the price of Evergreen D) A tal in the price of Daylight stock tl Arise in Evergreen and a tall in Daylight stack Atise in Evergreen or fall in Daylight stock es which stock has a hiere probability of havine is stuck price rise? What is that probability? ) That Evergreen stock will rise or remain unchanged That twergreen stock price will rise and Daylight stock will remain unchanged That Evergreen stock will raight Company stock will remain unchanged Are the two events are in Evergreen stock and fall in Daylig stock independent Provide evidence QUESTION 2 (20 marks) (b) A fall in the price of Daylight stock (c) A rise in Evergreen and a fall in Daylight stock (d) A rise in Evergreen or a fall in Daylight stock le) Which stock has a higher probability of having its stock price rise? What is that probability? (f) That Evergreen stock will rise or remain unchanged (g) That Evergreen stock price will rise and Daylight stock will remain unchanged th) That Evergreen stock will rise or Daylight Company stock will remain unchanged Are the two events a rise in Evergreen stock" and "a fall in Daylight stock" independent? Provide evidence QUESTION 2 (20 marks) ABC Inc. must make a decision on its current capacity for next year. Estimated profits (in $000s) based on next year's demand are shown in the table below. Next Year's Demand Alternative Low High Expand $100 $200 Subcontract $50 $120 Do Nothing $40 $50 1) Refer to the information above. a. Which alternative should be chosen based on the maximax criterion? b. Which alternative should be chosen based on the maximin criterion? c. Which alternative should be chosen based on the Lapalce criterion? d. Which alternative should be chosen based on criterion of realism with alpha=0.7? e. Which alternative should be chosen based on the minimax regret criterion? 2) Refer to the information above. Assume that ABC Inc. has hired a marketing research firm that provided additional information regarding next year's demand. Suppose that the probabilities of low and high demand are assessed as follows: P(Low) = 0.4 and P(High) = 0.6. a. Which alternative should be chosen using the expected monetary value (EMV) criterion? b. What is the expected value under certainty? c. What is the expected value under perfect information (EVPI)? 3) Refer to the information above. Assume that ABC Inc. has hired a marketing research firm that provided additional information regarding next year's demand. Suppose that the probabilities of low and high demand are assessed as follows: P(Low) = 0.4 and P(High) = 0.6. a Develop a decision tree for this problem. b. Analyze the decision tree and determine which alternative should be chosen. c. Using the expected opportunity loss (EOL) criterion, which alternative should be chosen? Page 2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock