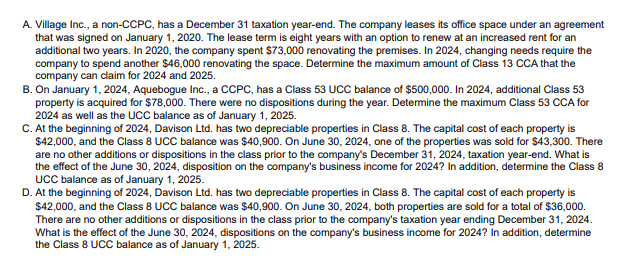

Question: A . Village Inc., a non - CCPC , has a December 3 1 taxation year - end. The company leases its office space under

A Village Inc., a nonCCPC has a December taxation yearend. The company leases its office space under an agreement that was signed on January The lease term is eight years with an option to renew at an increased rent for an additional two years. In the company spent $ renovating the premises. In changing needs require the company to spend another $ renovating the space. Determine the maximum amount of Class CCA that the company can claim for and B On January Aquebogue Inc., a CCPC has a Class UCC balance of $ In additional Class property is acquired for $ There were no dispositions during the year. Determine the maximum Class CCA for as well as the UCC balance as of January C At the beginning of Davison Ltd has two depreciable properties in Class The capital cost of each property is $ and the Class UCC balance was $ On June one of the properties was sold for $ There are no other additions or dispositions in the class prior to the company's December taxation yearend. What is the effect of the June disposition on the company's business income for In addition, determine the Class UCC balance as of January D At the beginning of Davison Ltd has two depreciable properties in Class The capital cost of each property is $ and the Class UCC balance was $ On June both properties are sold for a total of $ There are no other additions or dispositions in the class prior to the company's taxation year ending December What is the effect of the June dispositions on the company's business income for In addition, determine the Class UCC balance as of January The required CCA calculation for would be as follows. On Improvements On Improvements Maximum CCA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock