Question: a. What does return on equity (ROE) measure? Why is it important to consider ROE and not just net income in dollar terms? b. How

a. What does return on equity (ROE) measure? Why is it important to consider ROE and not just net income in dollar terms?

b. How do return on equity (ROE) and return on net operating assets (RNOA) differ? Explain in your own words what the non-operating portion of ROE represents.

c. In general, what is a company's "marginal" tax rate? What is meant by the term -tax shield"? Explain the importance of considering the tax shield that arises from debt.

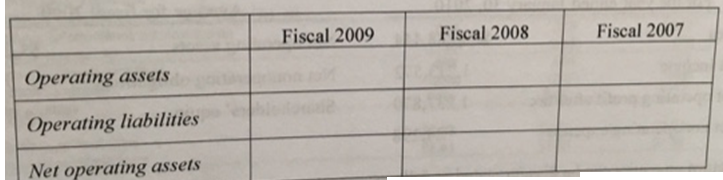

d. Refer to Nordstrom's balance sheets for fiscal 2007 through 2009. Calculate net operating assets for fiscal years 2009, 2008, and 2007 using the chart below. Assume that Other assets. Other current liabilities, Deferred property incentives, and Other liabilities are operating items.

e. Refer to Nordstrom?s statement of earnings for fiscal 2009 and 2008. Calculate net operating profit after tax (NOPAT) for fiscal 2009 and 2008. Assume that the company?s marginal tax rate (as estimated by the combined federal and state statutory tax rates) is 38.5% for both year. What is the dollar amount of Nordstrom?s tax shield from non-operating activities in fiscal 2009?

Operating assets Operating liabilities Net operating assets Fiscal 2009 Fiscal 2008 Fiscal 2007

Step by Step Solution

3.57 Rating (161 Votes )

There are 3 Steps involved in it

To address your questions Ill break down the explanations and calculations step by step a Return on Equity ROE What does ROE measure ROE is a measure ... View full answer

Get step-by-step solutions from verified subject matter experts