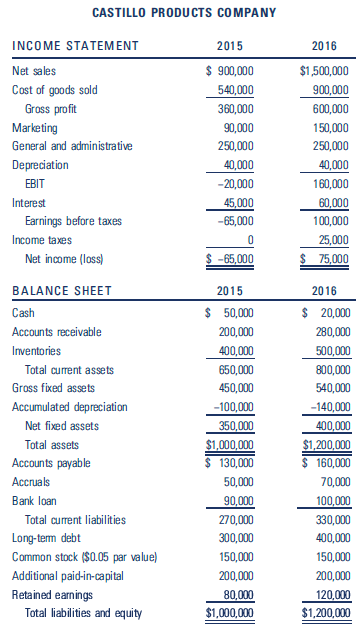

The Castillo Products Company was started in 2014. The company manufactures components for personal digital assistant (PDA)

Question:

A. Calculate the net profit margin, total-sales-to-total-assets ratio, the equity multiplier, and the return on equity for both 2015 and 2016 for the Castillo Products Corporation. Describe what happened in terms of financial performance between the two years.

B. Estimate the cost of short-term bank loans, long-term debt, and common equity capital for the Castillo Products Corporation.

C. Although, Castillo Products paid a low effective tax rate in 2016, a 30 percent income tax rate is considered more appropriate when looking to the future. Estimate the after-tax cost of short-term bank loans, long-term debt, and the venture€™s common equity.

D. Estimate the weighted average cost of capital (WACC) for the Castillo Products Corporation using the book values of interest-bearing debt and stockholders€™ equity capital at the end of 2016.

E. Cindy and Rob estimate that the market value of the common equity in the venture is $900,000 at the end of 2016. The market values of interest-bearing debt are judged to be the same as the recorded book values at the end of 2016. Estimate the market value-based weighted average cost of capital for Castillo Products.

F. Would you recommend to Cindy and Rob that they use the book value€“based WACC estimate or the market value€“ based WACC estimate for planning purposes? Why?

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Entrepreneurial Finance

ISBN: 978-1305968356

6th edition

Authors: J. Chris Leach, Ronald W. Melicher