Question: a. What is cash flow statement? why we use indirect method to prepare cash flow statement? Briefly explain operating, investing, and financing activities? (03) b.

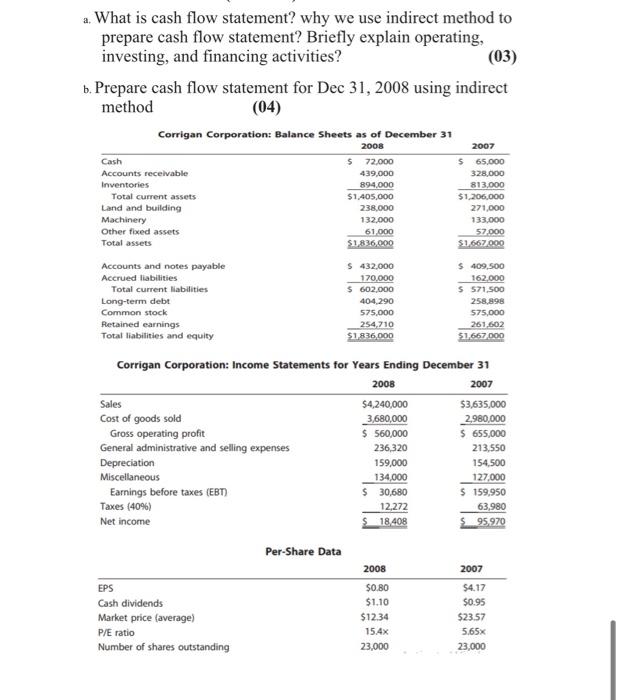

a. What is cash flow statement? why we use indirect method to prepare cash flow statement? Briefly explain operating, investing, and financing activities? (03) b. Prepare cash flow statement for Dec 31, 2008 using indirect method (04) Corrigan Corporation: Balance Sheets as of December 31 Cash Accounts receivable Inventories Total current assets Land and building Machinery Other fixed assets Total assets 2008 $ 72,000 439,000 894,000 $1,405,000 238,000 132.000 61.000 51,836,000 2007 $65.000 328,000 813,000 $1,206,000 271,000 133.000 57.000 51.667000 Accounts and notes payable Accrued liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $ 432,000 170,000 $ 602,000 404.290 575.000 254.710 $1.836.000 $ 409,500 162.000 S 571.500 258.898 575,000 261,602 51.667.000 Corrigan Corporation: Income Statements for Years Ending December 31 2008 2007 Sales $4,240,000 $3,635,000 Cost of goods sold 3,680,000 2,980,000 Gross operating profit $ 560,000 $ 655,000 General administrative and selling expenses 236,320 213,550 Depreciation 159,000 154,500 Miscellaneous 134,000 127.000 Earnings before taxes (EBT $ 30,680 $ 159,950 Taxes (40%) 12,272 63.980 Net income 18.408 95.970 Per-Share Data 2008 2007 EPS 54.17 Cash dividends $1.10 $0.95 Market price (average) $12.34 $23.57 P/E ratio 15.4 5.65% Number of shares outstanding 23,000 23,000 $0.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts