Question: Q No 5 (7 Marks) What is cash flow statement? why we use indirect method to prepare cash flow statement? Briefly explain operating, investing, and

Q No 5 (7 Marks)

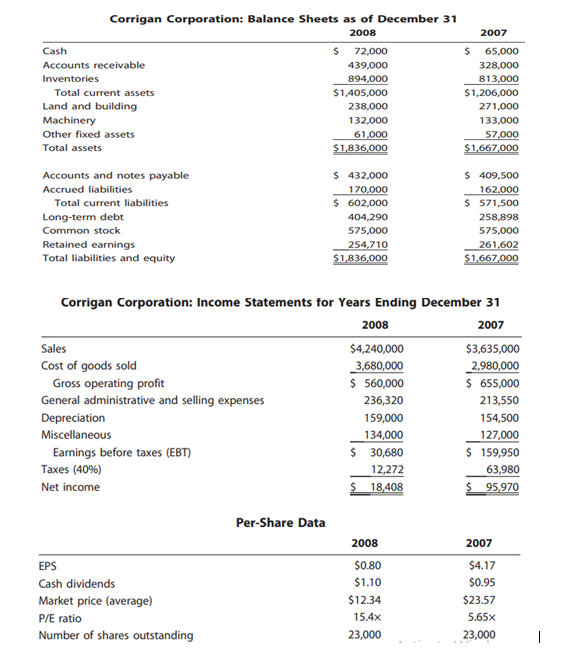

- What is cash flow statement? why we use indirect method to prepare cash flow statement? Briefly explain operating, investing, and financing activities? (03)

- Prepare cash flow statement for Dec 31, 2008 using indirect method (04)

2007 Corrigan Corporation: Balance Sheets as of December 31 2008 Cash $ 72,000 Accounts receivable 439,000 Inventories 894,000 Total current assets $1,405,000 Land and building 238,000 Machinery 132,000 Other fixed assets 61,000 Total assets $1,836,000 Accounts and notes payable $ 432,000 Accrued liabilities 170,000 Total current liabilities $ 602,000 Long-term debt 404,290 Common stock 575,000 Retained earnings 254.710 Total liabilities and equity $1,836,000 $ 65,000 328,000 813,000 $1,206,000 271.000 133,000 57,000 $1,667,000 $ 409,500 162.000 $ 571,500 258,898 575,000 261,602 $1,667,000 Corrigan Corporation: Income Statements for Years Ending December 31 2008 2007 Sales $4,240,000 $3,635,000 Cost of goods sold _3,680,000 _2,980,000 Gross operating profit $ 560,000 $ 655,000 General administrative and selling expenses 236,320 213,550 Depreciation 159,000 154,500 Miscellaneous 134,000 127,000 Earnings before taxes (EBT) $ 30,680 $ 159,950 Taxes (40%) 12,272 63,980 Net income $ 18,408 $ 95,970 Per-Share Data EPS Cash dividends Market price (average) P/E ratio Number of shares outstanding 2008 $0.80 $1.10 $12.34 15.4x 23,000 2007 $4.17 $0.95 $23.57 5.65x 23,000 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts