Question: a) What is commercial paper, and how does Apple use it? What is the value of the outstanding commercial paper on September 25, 2021? Use

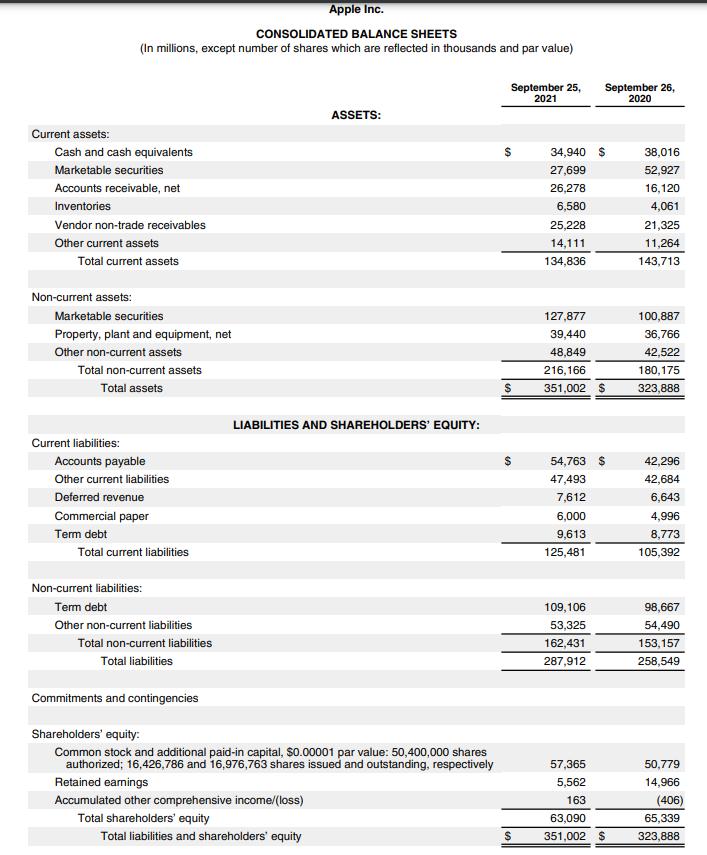

a) What is commercial paper, and how does Apple use it? What is the value of the outstanding commercial paper on September 25, 2021? Use the balance sheet (statement of financial position) to confirm this. What is the cost (interest rate paid by Apple) of this form of financing?

b) How much new ‘term debt’ did Apple borrow in fiscal 2021? When will this new debt be repaid? Does this new debt pay fixed or variable rates of interest? What is the financing cost (interest rate) of the new ‘term debt’ added in fiscal 2021?

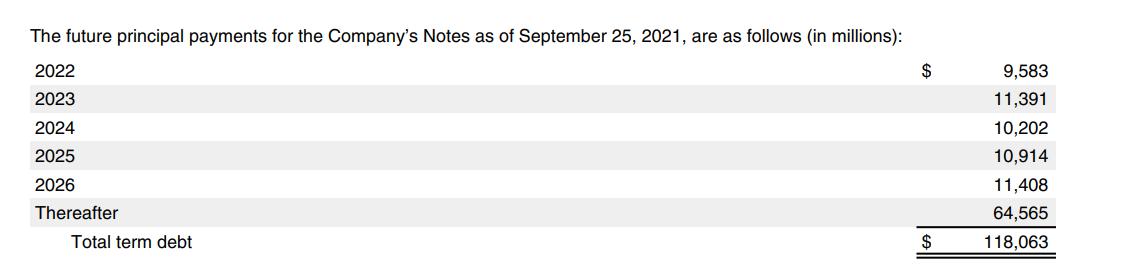

c) What is the total term debt outstanding on the balance sheet (statement of financial position) on September 25, 2021? Why is the term debt shown this way? Find the table of future principal repayments in Note 7. What is the purpose of this table?

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 25, 2021 September 26, 2020 ASSETS: Current assets: Cash and cash equivalents 34,940 $ 38,016 Marketable securities 27,699 52,927 Accounts receivable, net 26,278 16,120 Inventories 6,580 4,061 Vendor non-trade receivables 25,228 21,325 Other current assets 14,111 11,264 Total current assets 134,836 143,713 Non-current assets: Marketable securities 127,877 100,887 Property, plant and equipment, net 39,440 36,766 Other non-current assets 48,849 42,522 Total non-current assets 216,166 180,175 Total assets $ 351,002 $ 323,888 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable 54,763 $ 42,296 Other current liabilities 47,493 42,684 Deferred revenue 7,612 6,643 Commercial paper 6,000 4,996 Term debt 9,613 8,773 Total current liabilities 125,481 105,392 Non-current liabilities: Term debt 109,106 98,667 Other non-current liabilities 53,325 54,490 Total non-current liabilities 53,157 Total liabilities 287,912 258,549 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, S0.00001 par value: 50,400,000 shares authorized; 16,426,786 and 16,976,763 shares issued and outstanding, respectively 57,365 50,779 Retained eamings 5,562 14,966 Accumulated other comprehensive income/(loss) 163 (406) Total shareholders' equity 63,090 65,339 Total liabilities and shareholders' equity 351,002 $ 323,888

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Answer According to the given Conditions Explanation a Commercial Paper CP is an unsecured money mar... View full answer

Get step-by-step solutions from verified subject matter experts