Question: A. What is the correlation coef. between these two? B. Assume that MDY represents the market of mid-cap stocks and you are a mid-cap-stock-only investor.

A. What is the correlation coef. between these two?

A. What is the correlation coef. between these two?

B. Assume that MDY represents the market of mid-cap stocks and you are a mid-cap-stock-only investor. Which is the DHI's beta?

C. Historically, has DHI been more or less volatile than the mid-cap stock market, as approximated by MDY?

D. For the purpose of this question (irrespective of your prior answers) assume DHI is less volatile than the mid-cap market. What best explains this?

--------a) The absolute value of DHI's beta is less than 1, and its standard deviation is less than MDY's.

------b) DHI works in a staid, steady-state industry, and should therefore should be expected to be less volatile than the entire mid-cap market.

--------c) The absolute value of DHI's beta is greater than 1, and its standard deviation is less than MDY's.

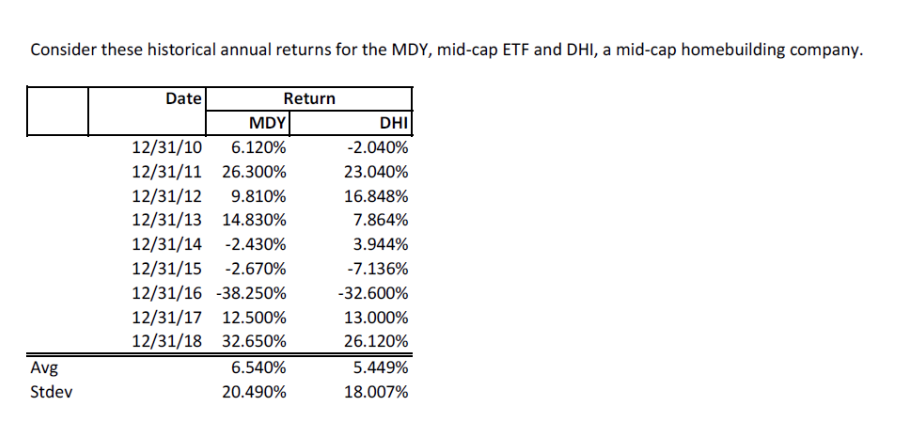

Consider these historical annual returns for the MDY, mid-cap ETF and DHI, a mid-cap homebuilding company. Date Return MDY DHI 12/31/106.120% -2.040% 12/31/11 26.300% 23.040% 12/31/12 9.810% 16.848% 12/31/13 14.830% 7.864% 12/31/14 -2.430% 3.944% 12/31/15 -2.670% -7.136% 12/31/16 -38.250% -32.600% 12/31/17 12.500% 13.000% 12/31/18 32.650% 26.120% 6.540% 5.449% 20.490% 18.007% Avg Stdev

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts