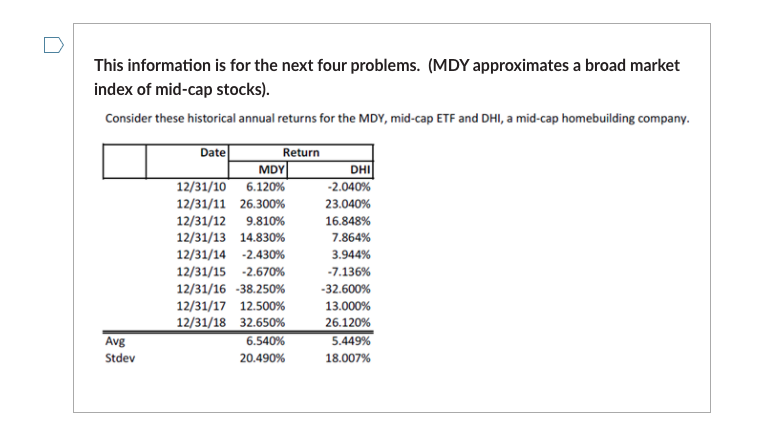

Question: This information is for the next four problems. (MDY approximates a broad market index of mid-cap stocks). Consider these historical annual returns for the MDY,

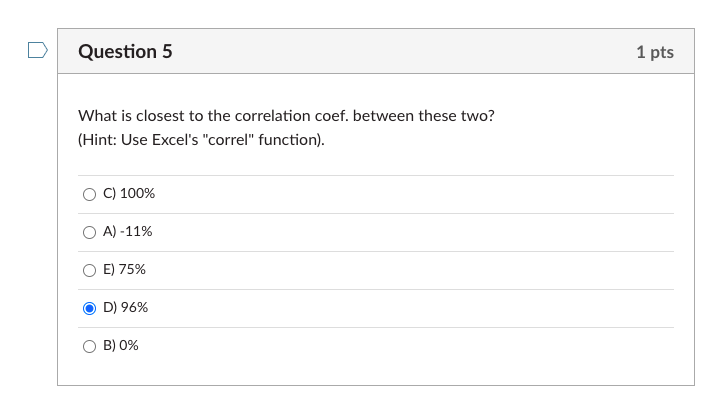

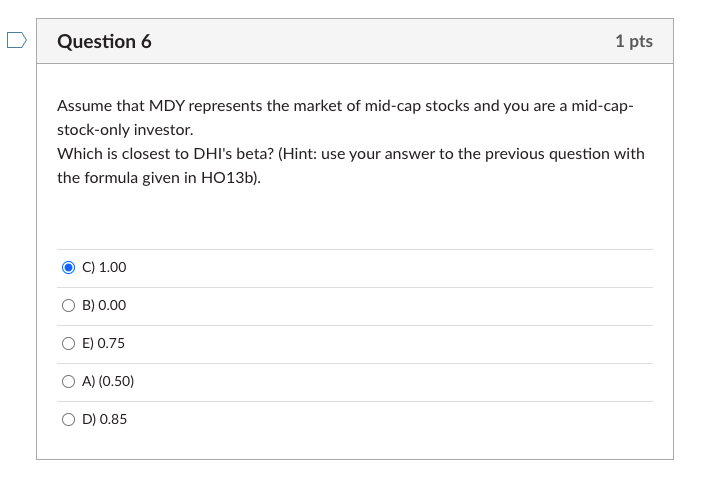

This information is for the next four problems. (MDY approximates a broad market index of mid-cap stocks). Consider these historical annual returns for the MDY, mid-cap ETF and DHI, a mid-cap homebuilding company. Date Return MDY DHI 12/31/106.120% -2.040% 12/31/11 26.300% 23.040% 12/31/12 9.810% 16.848% 12/31/13 14.830% 7.864% 12/31/14 -2.430% 3.944% 12/31/15 -2.670% -7.136% 12/31/16 -38.250% -32.600% 12/31/17 12.500% 13.000% 12/31/18 32.650% 26.120% Avg 6.540% 5.449% Stdev 20.490% 18.007% Question 5 1 pts What is closest to the correlation coef. between these two? (Hint: Use Excel's "correl" function). C) 100% OA) -11% E) 75% D) 96% B) 0% Question 6 1 pts Assume that MDY represents the market of mid-cap stocks and you are a mid-cap- stock-only investor. Which is closest to DHI's beta? (Hint: use your answer to the previous question with the formula given in H013b). C) 1.00 B) 0.00 E) 0.75 OA) (0.50) OD) 0.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts