Question: a. What is the EBIT indifference level associated with the two financing proposals? $______ (Round to the nearest dollar.) b. Fill in the blanks in

a. What is the EBIT indifference level associated with the two financing proposals?

$______ (Round to the nearest dollar.)

b. Fill in the blanks in the following income statement for plan A. Round the EPS to two decimal places and all other items to the nearest dollar.

b.

| Plan A | |||

| EBIT | $ _____ | ||

| Less: Interest Expense | $ _____ | ||

| Earnings before taxes (EBT) | $ _____ | ||

| Less: Taxes at 21% | $ _____ | ||

| $ _____ | ||

| Divide: Number of common shares | $ _____ | ||

| Earnings per share (EPS) | $ _____ |

Fill in the blanks in the following income statement for plan B. Round the EPS to two decimal places and all other items to the nearest dollar.

| Plan B | |||

| EBIT | $ _____ | ||

| Less: Interest Expense | $ _____ | ||

| Earnings before taxes (EBT) | $ _____ | ||

| Less: Taxes at 21% | $ _____ | ||

| $ _____ | ||

| Divide: Number of common shares | $ _____ | ||

| Earnings per share (EPS) | $ _____ |

c. The following graph is an EBIT-EPS analysis chart for this situation. Using the Point Drawing Tool on the palette, show the EBIT-EPS indifference point computed in part a in the chart.

d. If a detailed financial analysis projects that long-term EBIT will always be close to $2.7 million annually, which plan will provide for the higher EPS?(Select the best choice below.)

A. Plan A

B. Plan B

e. If you were to present the results of your analysis found in part a through d, how would you summarize your findings to your employer?

"EBIT-EPS indifference point identifies the EBIT level at which the EPS will be the same regardless of the financing plan chosen by the financial manager. To prove that the EBIT computed in part a is the indifference point, we can compute the earnings per share EPS for the two plans. In addition, from the EBIT-EPS analysis chart displayed in part c, the EPS of the two plans at various level of EBIT can be easily compared. According to the EBIT-EPS analysis chart in part c, if the EBIT is greater than the indifference point plan B will result in a higher EPS. On the other hand, if the EBIT is less than the indifference point, then plan A will have a higher EPS."

The statement above is____ . TRUE/FALSE (Select from the drop-down menu.)

Please solve step by step all the sections that need to be answered in the question. Answer all parts A, B, C, D and E given in the question.

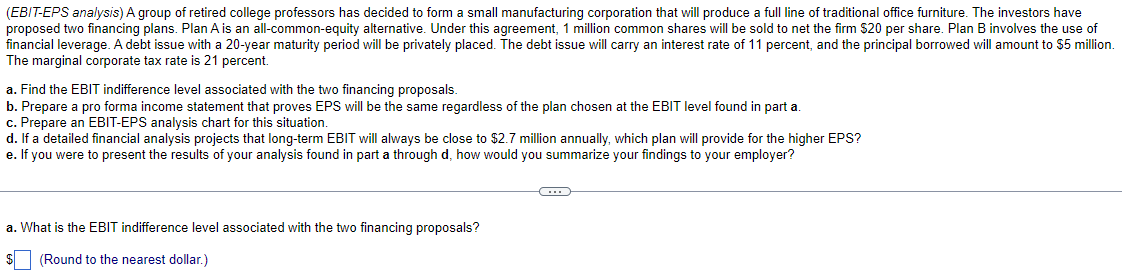

(EBIT-EPS analysis) A group of retired college professors has decided to form a small manufacturing corporation that will produce a full line of traditional office furniture. The investors have proposed two financing plans. Plan A is an all-common-equity alternative. Under this agreement, 1 million common shares will be sold to net the firm $20 per share. Plan B involves the use of financial leverage. A debt issue with a 20-year maturity period will be privately placed. The debt issue will carry an interest rate of 11 percent, and the principal borrowed will amount to $5 million. The marginal corporate tax rate is 21 percent. a. Find the EBIT indifference level associated with the two financing proposals. b. Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at the EBIT level found in part a. c. Prepare an EBIT-EPS analysis chart for this situation. d. If a detailed financial analysis projects that long-term EBIT will always be close to $2.7 million annually, which plan will provide for the higher EPS? e. If you were to present the results of your analysis found in part a through d, how would you summarize your findings to your employer? a. What is the EBIT indifference level associated with the two financing proposals? $ (Round to the nearest dollar.) (EBIT-EPS analysis) A group of retired college professors has decided to form a small manufacturing corporation that will produce a full line of traditional office furniture. The investors have proposed two financing plans. Plan A is an all-common-equity alternative. Under this agreement, 1 million common shares will be sold to net the firm $20 per share. Plan B involves the use of financial leverage. A debt issue with a 20-year maturity period will be privately placed. The debt issue will carry an interest rate of 11 percent, and the principal borrowed will amount to $5 million. The marginal corporate tax rate is 21 percent. a. Find the EBIT indifference level associated with the two financing proposals. b. Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at the EBIT level found in part a. c. Prepare an EBIT-EPS analysis chart for this situation. d. If a detailed financial analysis projects that long-term EBIT will always be close to $2.7 million annually, which plan will provide for the higher EPS? e. If you were to present the results of your analysis found in part a through d, how would you summarize your findings to your employer? a. What is the EBIT indifference level associated with the two financing proposals? $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts