Question: ( EBIT - EPS analysis ) A group of retired college professors has decided to form a small manufacturing corporation that will produce a full

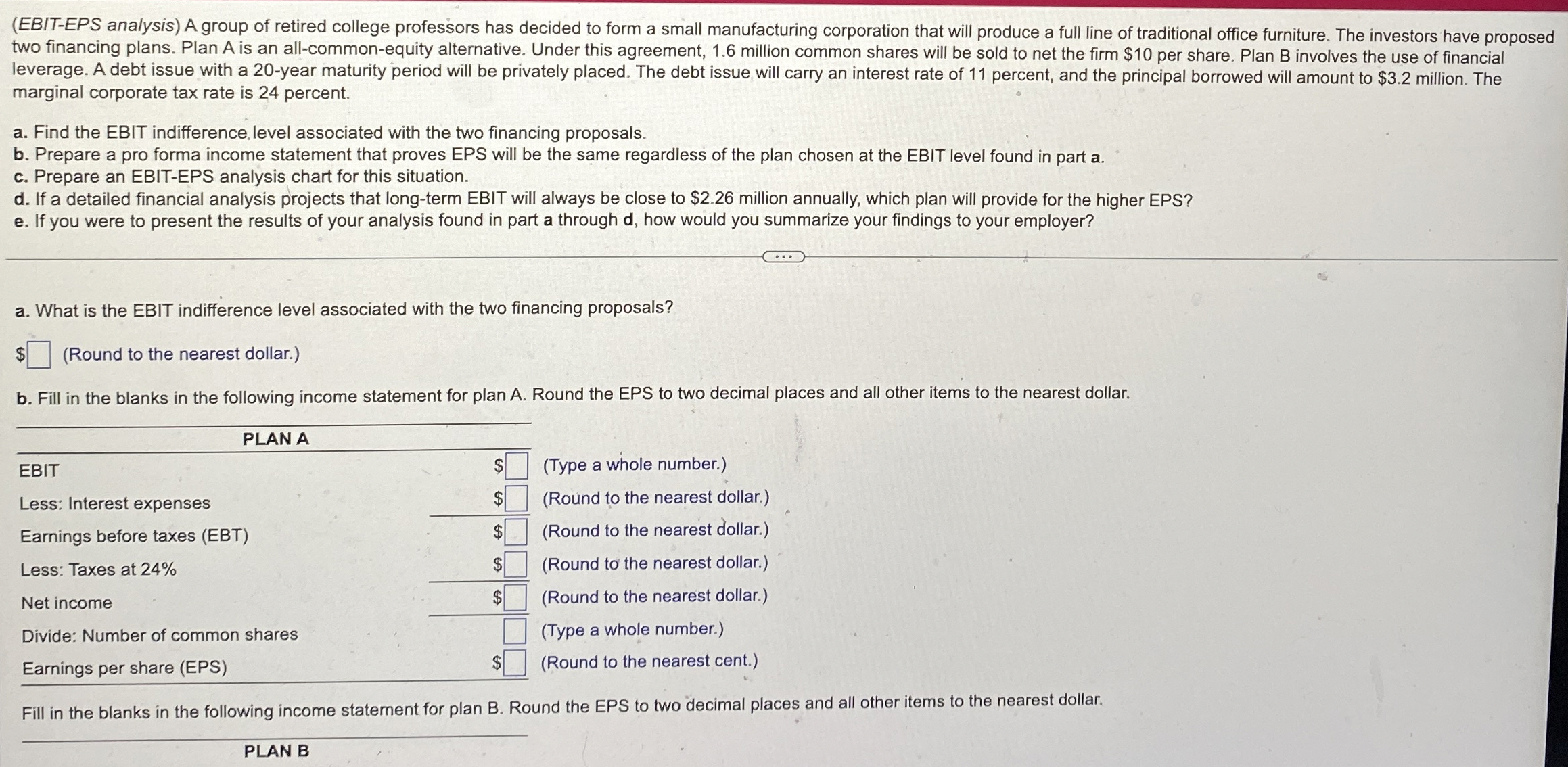

EBITEPS analysis A group of retired college professors has decided to form a small manufacturing corporation that will produce a full line of traditional office furniture. The investors have proposed two financing plans. Plan is an allcommonequity alternative. Under this agreement, million common shares will be sold to net the firm $ per share. Plan involves the use of financial leverage. A debt issue with a year maturity period will be privately placed. The debt issue will carry an interest rate of percent, and the principal borrowed will amount to $ million. The marginal corporate tax rate is percent.

a Find the EBIT indifference.level associated with the two financing proposals.

b Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at the EBIT level found in part a

c Prepare an EBITEPS analysis chart for this situation.

d If a detailed financial analysis projects that longterm EBIT will always be close to $ million annually, which plan will provide for the higher EPS?

e If you were to present the results of your analysis found in part a through d how would you summarize your findings to your employer?

a What is the EBIT indifference level associated with the two financing proposals?

Round to the nearest dollar.

b Fill in the blanks in the following income statement for plan A Round the EPS to two decimal places and all other items to the nearest dollar.

tablePLAN AEBIT$Type a whole number.Less: Interest expenses,$Round to the nearest dollar.Earnings before taxes EBT$Round to the nearest dollar.Less: Taxes at $Round to the nearest dollar.Net income,,Round to the nearest dollar.Divide: Number of common shares,,Type a whole number.Earnings per share EPS$Round to the nearest cent..

Fill in the blanks in the following income statement for plan B Round the EPS to two decimal places and all other items to the nearest dollar.

Fill in the blanks in the following income statement for plan B Round the EPS to two decimal places and all other items to the nearest dollar.

PLAN B

EBIT

$ Type a whole number.

Less: Interest expenses

$ Round to the nearest dollar.

Earnings before taxes EBT

Round to the nearest dollar.

Less: Taxes at

$ Round to the yzarest dollar.

Net income

Round to the nearest dollar.

Divide: Number of common shares

Type a whole number.

Earnings per share EPS

$

Round to the nearest cent.

c The following graph is an EBITEPS analysis chart for this situation. Using the Point Drawing Tool on the palette, show the EBITEPS indifference point computed in part a in the chart.

EBITEPS analysis A group of retired college professors has decided to form a small manufacturing corporation that will produce a full line of traditional office furniture. The investors have proposed two financing plans. Plan A is an allcommonequity alternative. Under this agreement, million common shares will be sold to net the firm $ per share. Plan B involves the use of financial leverage. A debt issue with a year maturity period will be privately placed. The debt issue will carry an interest rate of percent, and the principal borrowed will amount to $ million. The marginal corporate tax rate is percent.

a Find the EBIT indifference. level associated with the two financing proposals.

b Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at the EBIT level found in part a

c Prepare an EBITEPS analysis chart for this situation.

d If a detailed financial analysis projects that longterm EBIT will always be close to $ million annually, which plan will provide for the higher EPS?

e If you were to present the results of your analysis found in part a through d how would you summarize your findings to your employer?

a What is the EBIT indifference level associated with the two financing proposals?

$ Round to the nearest dollar.

b Fill in the blanks in the following income statement for plan A Round the EPS to two decimal places and all other items to the nearest dollar.

tablePLAN AEBIT$Type a whole number.Less: Inter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock