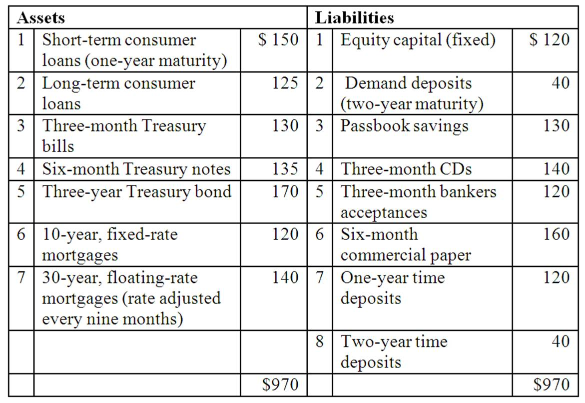

Question: a) What is the total one year Rate Sensitive Assets? b) What is the total one year Rate Sensitive Liability? c) What is the cumulative

a) What is the total one year Rate Sensitive Assets?

b) What is the total one year Rate Sensitive Liability?

c) What is the cumulative one year repricing gap (CGAP)

d) What is the Gap ratio?

e) Suppose interest rates rises by 2% on both RSAs and RLAs. What is the expected annual change in net interest income of the bank?

Liabilities $ 150 1 Equity capital (fixed) $ 120 40 Assets 1 Short-term consumer loans (one-year maturity) 2 Long-term consumer loans 3 Three-month Treasury bills 4 Six-month Treasury notes 5 Three-year Treasury bond 125 2 Demand deposits (two-year maturity) 1303 Passbook savings 130 140 120 1354 Three-month CDs 1705 Three-month bankers acceptances 1206 Six-month commercial paper 1407 One-year time deposits 6 10-year, fixed-rate mortgages 7 30-year, floating-rate mortgages (rate adjusted every nine months) 160 120 40 8 Two-year time deposits $970 $970

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts