Question: (a) Where will the following projects plot in relation to the security market line if the risk-free rate is 6% and the market risk premium

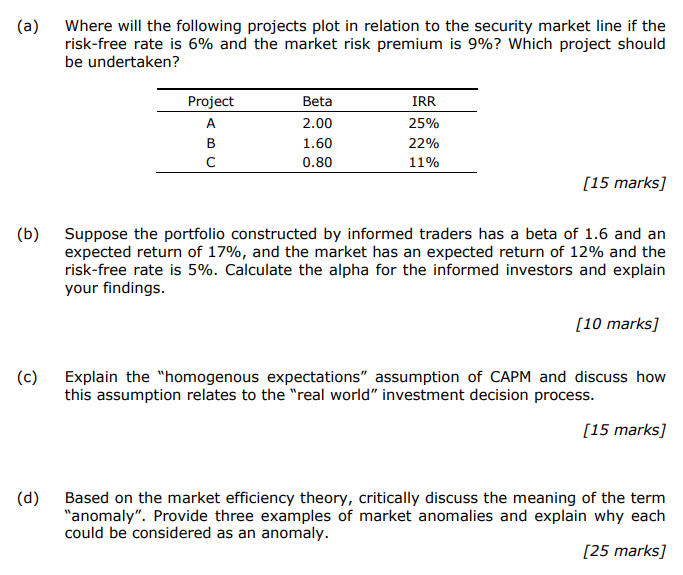

(a) Where will the following projects plot in relation to the security market line if the risk-free rate is 6% and the market risk premium is 9% ? Which project should be undertaken? [15 marks] (b) Suppose the portfolio constructed by informed traders has a beta of 1.6 and an expected return of 17%, and the market has an expected return of 12% and the risk-free rate is 5%. Calculate the alpha for the informed investors and explain your findings. [10 marks] (c) Explain the "homogenous expectations" assumption of CAPM and discuss how this assumption relates to the "real world" investment decision process. [15 marks] (d) Based on the market efficiency theory, critically discuss the meaning of the term "anomaly". Provide three examples of market anomalies and explain why each could be considered as an anomaly. [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts