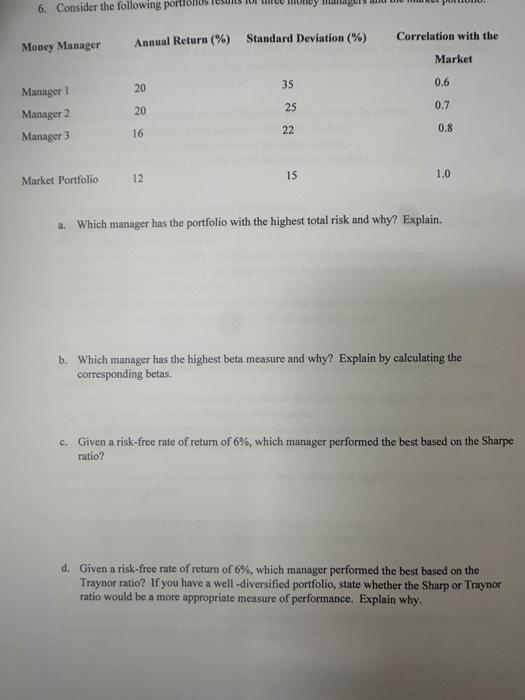

Question: a. Which manager has the portfolio with the highest total risk and why? Explain. b. Which manager has the highest beta measure and why? Explain

a. Which manager has the portfolio with the highest total risk and why? Explain. b. Which manager has the highest beta measure and why? Explain by calculating the corresponding betas. c. Given a risk-free rate of return of 6%, which manager performed the best based on the Sharpe ratio? d. Given a risk-free rate of retum of 6%, which manager performed the best based on the Traynor ratio? If you have a well-diversified portfolio, state whether the Sharp or Traynor ratio would be a more appropriate measure of performance. Explain why

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock