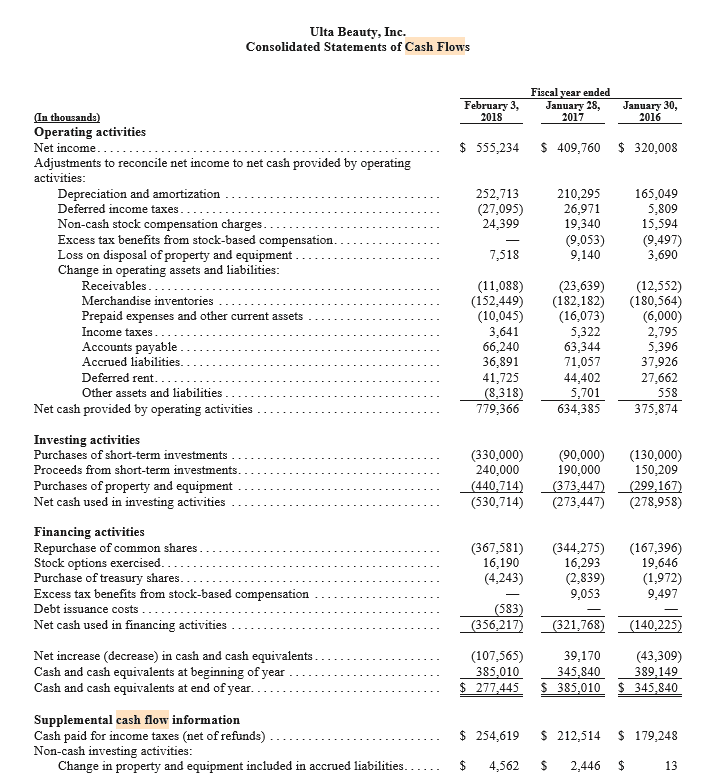

Question: a. Which method is used, direct or indirect, is used in this statement? b. List the principle sources and uses of cashe for this firm.

a. Which method is used, direct or indirect, is used in this statement?

b. List the principle sources and uses of cashe for this firm.

c. Evaluate the change in cash. Has the firm generated most of its cash requirements from operations, or has it borrowed extensively? Has the firm's uses of cash balanced between investments and dividends?

.d. Have there been significant treasury stock transactions?

e. Has the cash balance been increasing or decreasing? What seem to be the implications for this pattern of dividends?

Ulta Beauty, Inc. Consolidated Statements of Cash Flows Fiscal year ended February 3,January 28,January 2016 In thousands Operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities 2018 2017 555,234 S 409,760 320,008 252,713 (27,095) 24,399 Depreciation and amortization Deferred income taxes.. Non-cash stock compensation charges Excess tax benefits from stock-based Loss on disposal of property and equipment Change in operating assets and liabilities 210,295 26,971 19,340 (9,053) 165,049 5,809 15,594 compensation 7,518 3,690 Receivables Merchandise inventories Prepaid expenses and other current assets 11,08) (23,639 (12,552) (152,449) 182,182) 180,564) (1 0,045) (16,073) 66,240 36,891 (8,318) 779,366 (6,000) . Accounts payable Accrued liabilities Deferred rent Other assets and liabilities 2,795 37,926 558 634,385 375A 5,322 63,344 71,057 44,402 5.701 Net cash provided by operating activities Investing activities Purchases of short-term investments Proceeds from short-term investments Purchases of property and equipment Net cash used in investing activities (330,000) 90,000) (130,000) 190,000 150,209 299167 240,000 (440,714 (373.44 (530,714) (273,447) (278,958) Financing activities Repurchase of common shares Stock options exercised Purchase of treasury s Excess tax benefits from stock-based Debt issuance costs Net cash used in financing activities (367,581) (344,275) (167,396) 19,646 (1,972) 9,497 16,190 (4,243) 16,293 compensation 9,053 583 356.217 856212 621763) (140225) (321,768) (140,225) 65)34510 Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning ofyear Cash an 385010345,840. $ 277,445 39,170(43,309) 389,149 d cash equivalents at end of year 385,010 345,840 Supplemental cash flow information Cash paid for income taxes (net of refunds) Non-cash investing $254,619 212,514 S 179,248 activities Change in property and equipment included in accrued liabilities $ 4,562 S 2,446 S$ 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts