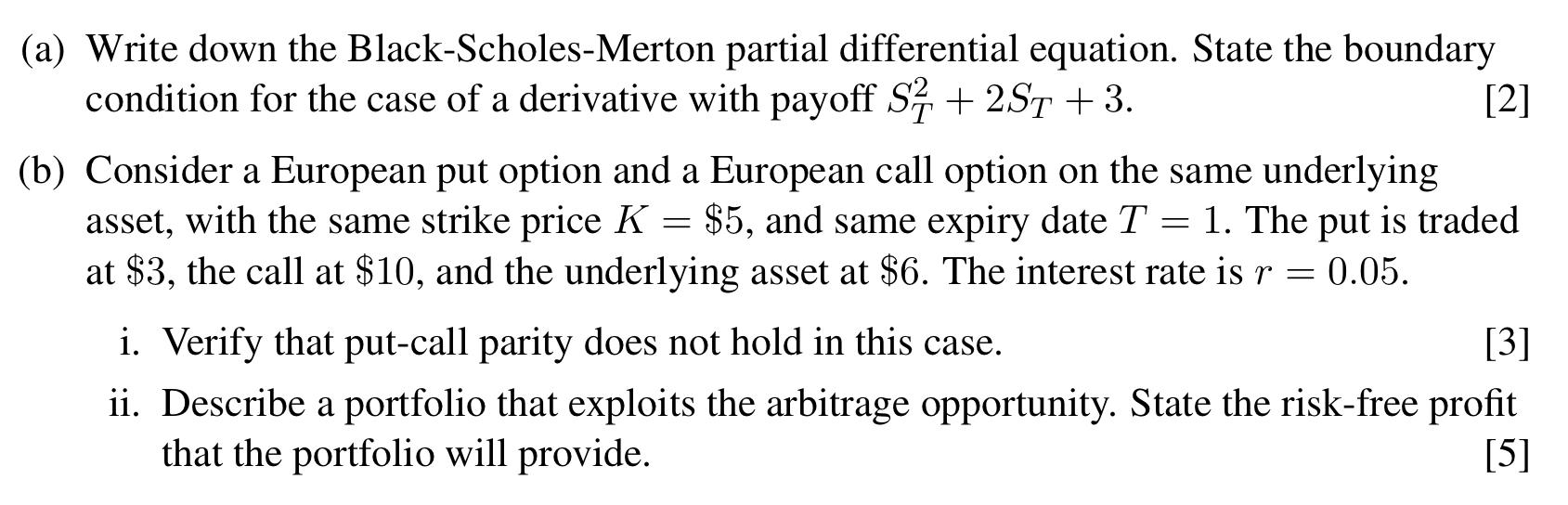

Question: (a) Write down the Black-Scholes-Merton partial differential equation. State the boundary condition for the case of a derivative with payoff S2 +251 +3. [2] (b)

(a) Write down the Black-Scholes-Merton partial differential equation. State the boundary condition for the case of a derivative with payoff S2 +251 +3. [2] (b) Consider a European put option and a European call option on the same underlying asset, with the same strike price K = $5, and same expiry date T = 1. The put is traded at $3, the call at $10, and the underlying asset at $6. The interest rate is r = 0.05. i. Verify that put-call parity does not hold in this case. [3] ii. Describe a portfolio that exploits the arbitrage opportunity. State the risk-free profit that the portfolio will provide. [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts