Question: just a) & b) part ii) please not i) (a) The Black-Scholes formulae for the price c of a European call option and the price

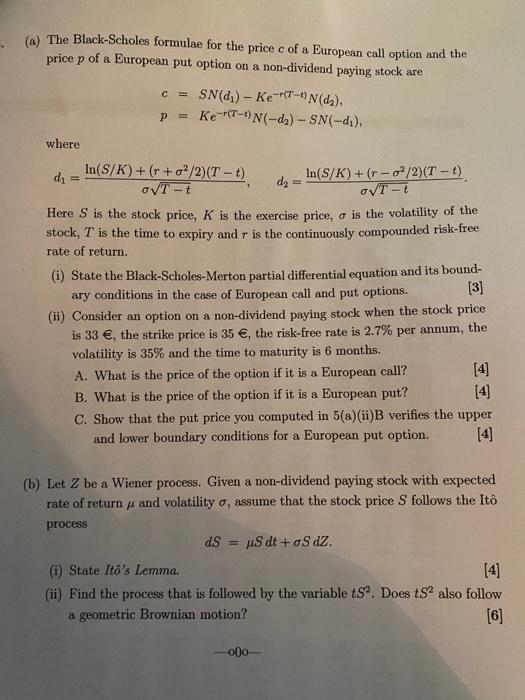

(a) The Black-Scholes formulae for the price c of a European call option and the price p of a European put option on a non-dividend paying stock are SN(di) - Kert-N(da), p = Ker(T-N(-da) - SN(-d), C = where di In(S/K) + (r +o/2)(T t) OVT-t In(S/K)+ (r-/2)(T - t) dz OVT-t Here is the stock price, K is the exercise price, a is the volatility of the stock, T is the time to expiry and r is the continuously compounded risk-free rate of return. (i) State the Black-Scholes-Merton partial differential equation and its bound- ary conditions in the case of European call and put options. [3] (ii) Consider an option on a non-dividend paying stock when the stock price is 33 , the strike price is 35 , the risk-free rate is 2.7% per annum, the volatility is 35% and the time to maturity is 6 months. A. What is the price of the option if it is a European call? B. What is the price of the option if it is a European put? [4] C. Show that the put price you computed in 5(a)(ii)B verifies the upper and lower boundary conditions for a European put option. [4] (b) Let 2 be a Wiener process. Given a non-dividend paying stock with expected rate of return p and volatility o, assume that the stock price s follows the It process dS = S dt+oS dz. (i) State Ito's Lemma. [4] (ii) Find the process that is followed by the variable ts. Does ts also follow a geometric Brownian motion? [6] -000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts