Question: (a) Write out and interpret the formula for the Single Index Model (SIM) equation What does the SIM assume about the sources of risk for

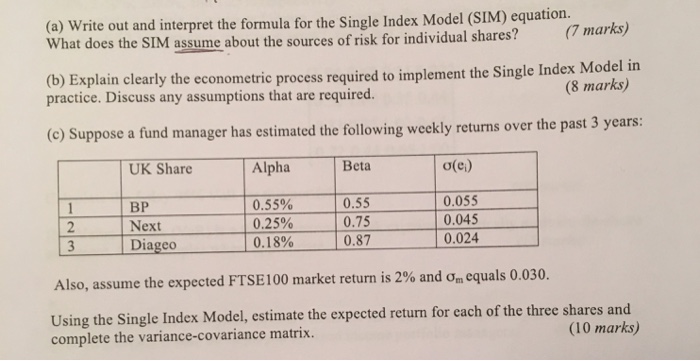

(a) Write out and interpret the formula for the Single Index Model (SIM) equation What does the SIM assume about the sources of risk for individual shares? (7marks) (b) Explain clearly the econometric process practice. Discuss any assumptions that are required. required to implement the Single Index Model in (8 marks) (e) Suppose a fund manager has estimated the following weekly returns over the past 3 years: UK Share Alpha Beta o(e) BP 2 Next Diageo 0.55% 0.25% 0.18% 0.55 0.75 0.87 0.024 0.055 0.045 Also, assume the expected FTSE 100 market return is 2% and om equals 0.030. Using the Single Index Model, estimate the expected return for each of the three share complete the variance-covariance matrix. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts