Question: Answer 4 questions. All questions are worth 25 marks. (a) Write out and interpret the formula for the Single Index Model (SIM) equation. What does

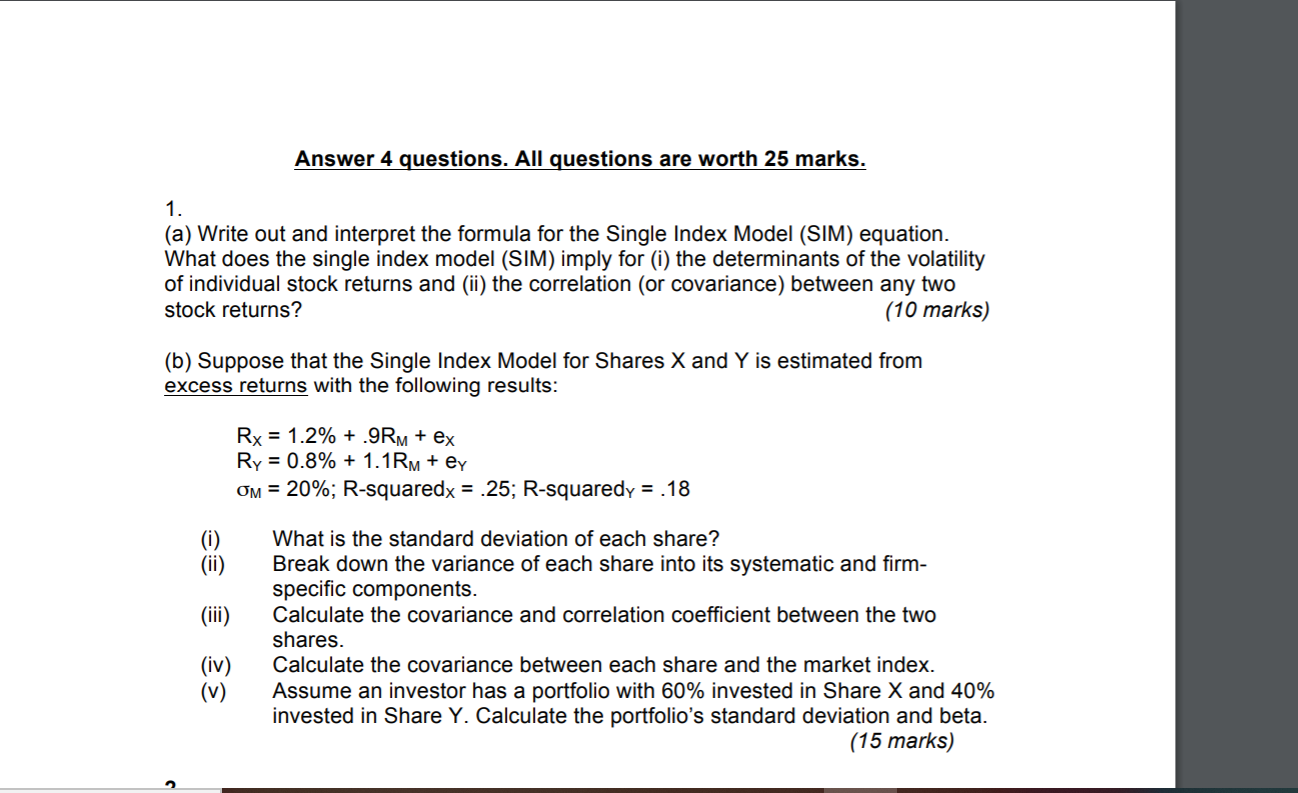

Answer 4 questions. All questions are worth 25 marks. (a) Write out and interpret the formula for the Single Index Model (SIM) equation. What does the single index model (SIM) imply for (i) the determinants of the volatility of individual stock returns and (ii) the correlation (or covariance) between any two stock returns? (10 marks) (b) Suppose that the Single Index Model for Shares X and Y is estimated from excess returns with the following results: Rx = 1.2% + .9RM + ex Ry = 0.8% + 1.1RM + ey OM = 20%; R-squaredx = -25; R-squaredy = .18 (0) WH (iii) What is the standard deviation of each share? Break down the variance of each share into its systematic and firm- specific components. Calculate the covariance and correlation coefficient between the two shares. Calculate the covariance between each share and the market index. Assume an investor has a portfolio with 60% invested in Share X and 40% invested in Share Y. Calculate the portfolio's standard deviation and beta. (15 marks) Answer 4 questions. All questions are worth 25 marks. (a) Write out and interpret the formula for the Single Index Model (SIM) equation. What does the single index model (SIM) imply for (i) the determinants of the volatility of individual stock returns and (ii) the correlation (or covariance) between any two stock returns? (10 marks) (b) Suppose that the Single Index Model for Shares X and Y is estimated from excess returns with the following results: Rx = 1.2% + .9RM + ex Ry = 0.8% + 1.1RM + ey OM = 20%; R-squaredx = -25; R-squaredy = .18 (0) WH (iii) What is the standard deviation of each share? Break down the variance of each share into its systematic and firm- specific components. Calculate the covariance and correlation coefficient between the two shares. Calculate the covariance between each share and the market index. Assume an investor has a portfolio with 60% invested in Share X and 40% invested in Share Y. Calculate the portfolio's standard deviation and beta. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts