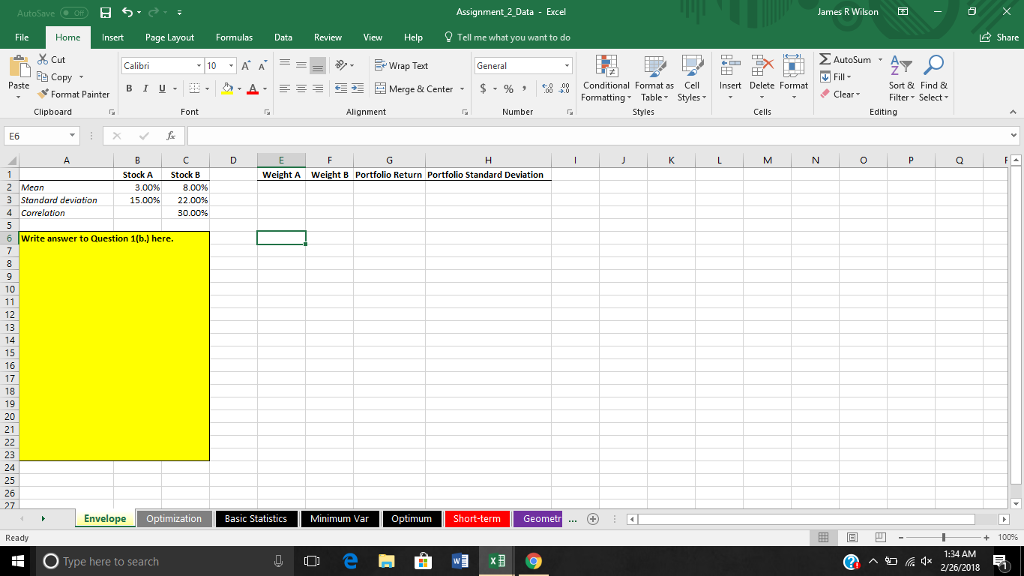

Question: (a.) you are given data on two stocks. Plot the Markowitz bullet for these two stocks. To do so, calculate the expected stock return and

(a.) you are given data on two stocks. Plot the Markowitz bullet for these two stocks. To do so, calculate the expected stock return and standard deviation for a portfolio comprised of the stocks with different weights on each asset. Remember that weights must add up to one. (Show Formulas)

(b.) What do you notice happens to the Markowitz bullet if the correlation between the two assets is -1? Does this make sense? Briefly explain.

Assignment 2 Data Excel James R Wilson Insert Page Layout FormulasData Review View Help Tell me what you want to do Share AutoSum . A Cut Copy Fonmat Painter 9- Wrap Text General | Paste Merge & Center. $. % , 8: Conditional Fonmat as Cell Insert Delete Format Formatting Table. Styles Sort & Find & Filter Select B 1 u . , , ,Clear Clipboard Font Alignment Number Cells Editing Stock A Stock B Weight A Weight B Portfolio Return Portfolio Standard Deviation 2 Mean 3 Standard deviation 4 Correlotion 3.00% 15.00% 8.00% 22.00% 30.00% 6 Write answer to Question 1(b.) here. 13 17 19 20 21 23 24 25 26 Envelope Optimization Basic Statistics Minimum Var Optimum Short-term Geomet + 100% 1:34 AM x 2/26/2018 Type here to search ^

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts