Question: A) You wish to create a Delta-neutral position with two different calls but without any shares of the underlying assets. The market premiums of these

A) You wish to create a Delta-neutral position with two different calls but without any shares of the underlying assets. The market premiums of these calls are: c1 and c2 .

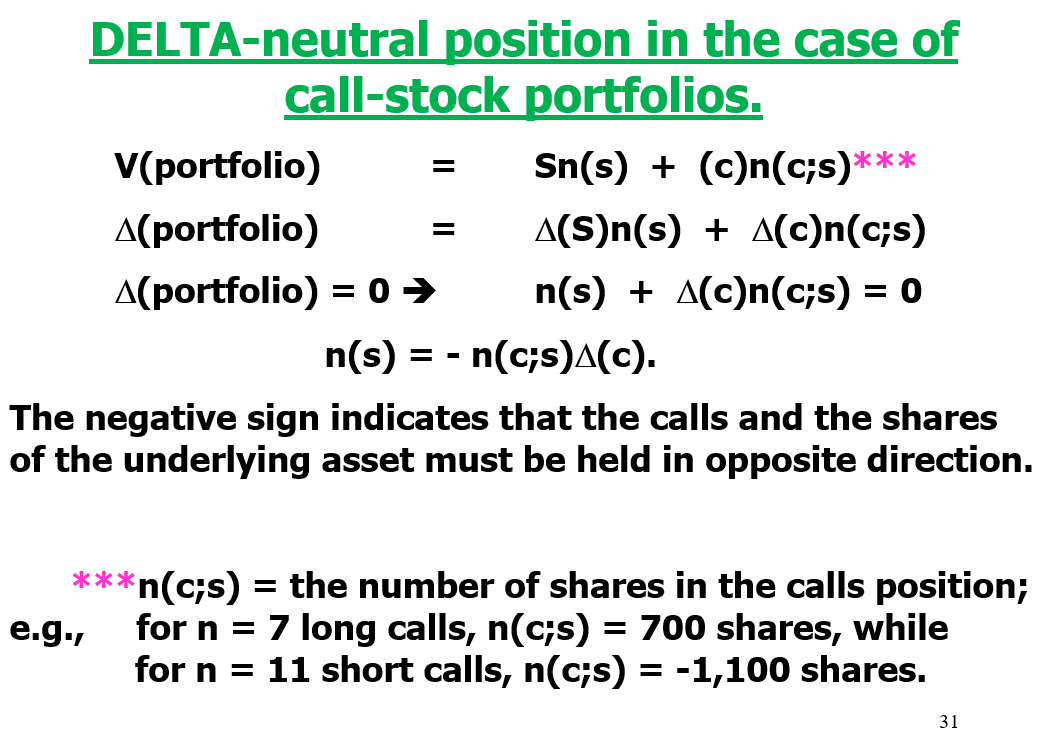

The value of this portfolio is: V = (c1)n(c1,s) + (c2)n(c2,s).

Derive the formula for the relationship between the two calls so as to create a Delta-neutral position. Use the same method that I used on slide 31 CH. 17 but with only the two calls; no stock shares.

B) A financial institution just sold 1,000 CBOE of the 170, AUG calls. Use the formula you derived in Q6. to explain what position will be taken in the OCT 165 call to create a Delta-neutral portfolio, using no shares of the underlying asset.

DELTA-neutral position in the case of call-stock portfolios. v(portfolio)(portfolio)(portfolio)=0n(s)===n(s)+(c)n(c;s)=0n(c;s)(c).Sn(s)+(c)n(c;s)(S)n(s)+(c)n(c;s) The negative sign indicates that the calls and the shares of the underlying asset must be held in opposite direction. n(c;s)= the number of shares in the calls position; e.g., for n=7 long calls, n(c;s)=700 shares, while for n=11 short calls, n(c;s)=1,100 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts