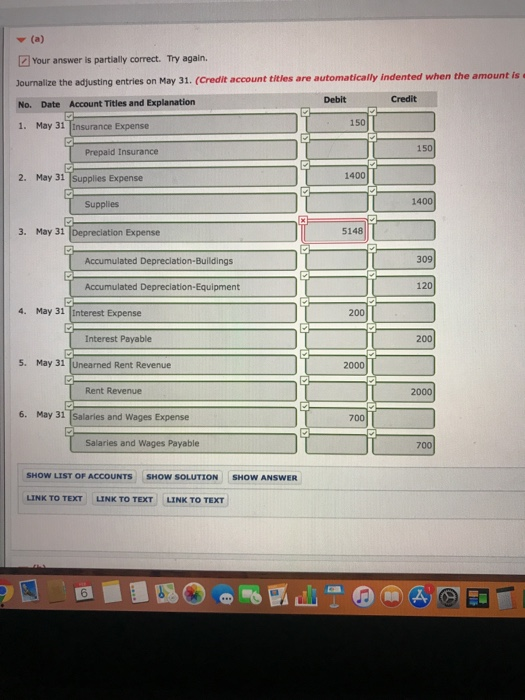

Question: (a) Your answer is partially correct. Try again. Journalize the adjusting entries on May 31. (Credit account titles are automatically indented when the amount is

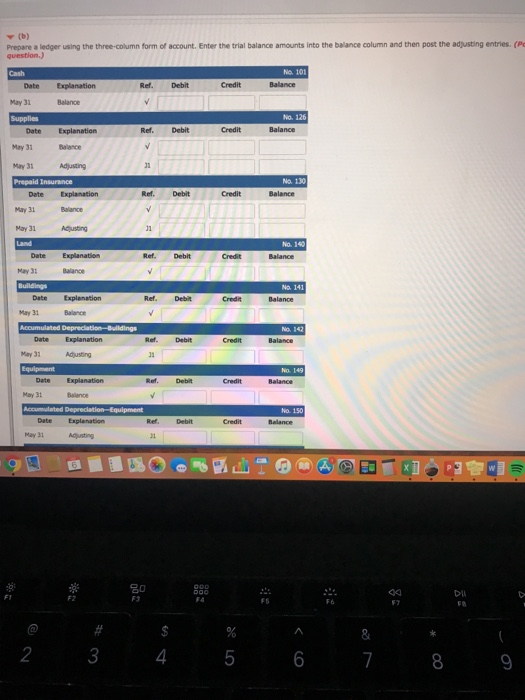

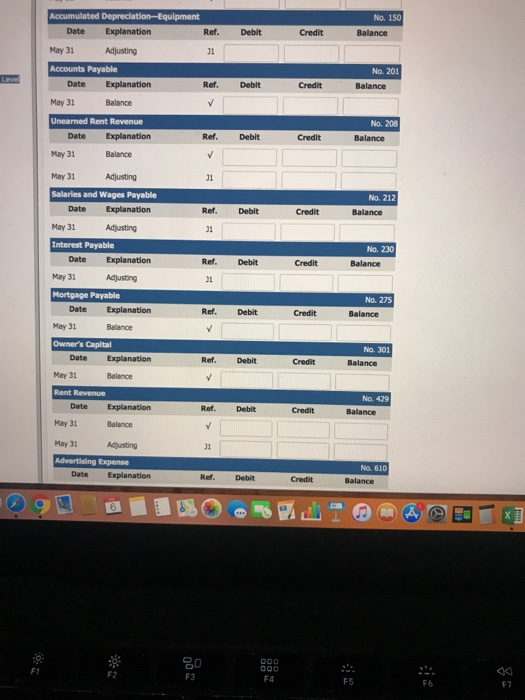

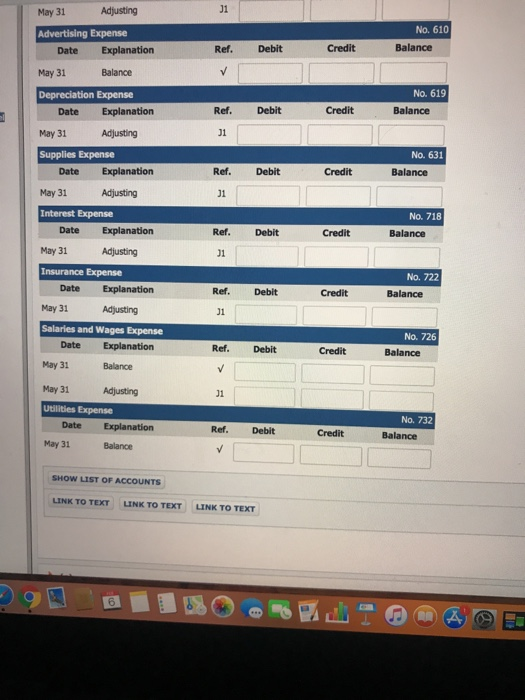

(a) Your answer is partially correct. Try again. Journalize the adjusting entries on May 31. (Credit account titles are automatically indented when the amount is Debit Credit Date Account Titles and Explanation 150 1. May 31 insurance Expense 150 Prepaid Insurance 2. May 31 Supplies Expense 1400 Supplies 1400 3. May 31 Expense 5148 Accumulated Depreclation-Buildings 309 Accumulated Depreciation-Equipment 120 4. May 31 [interest Expense 200 Interest Payable 200 5. May 31 Unearned Rent Revenue 2000 Rent Revenue 2000 6. May 31 Salaries and Wages Expense 700 Salaries and Wages Payable 700 Show LIST OF ACCOUNTS SHOW SOLUTON SHow ANswER LINK TO TEXT LINK TO TEXT LINK TO TEXT 6 Prepare a ledger using the three-column form of account. Enter the trial balance amounts into the balance column and then post the adjusting entries. (P No. 101 Ref. Debit May 31 Ref. Debit May 31 May 31 Adjusting 31 No. 130 Ref. Debit May 31 Ref. Debit May 31 May 31 May 33 May 31 May 31 2 4K DI F2 2 4 No. 150 Date Explanation Ref. Debit Credit Balance May 31 Adjusting No. 201 Accounts Payable Ref. Debit Credit Balance Date Explanation May 31 Unearned Rent Revenue No. 206 Ref. Debit Credit Date Explanation May 31 May 31 Salaries and Wages Payable No. 212 Date Explanation Ref. Debit Credit May 31 No. 230 Interest Payable Date Explanation Ref. Debit Credit May 31Adjusting No. 275 Credit Date Explanation May 31 Owners Capital Ref. Debit No. 301 Date Explanation Ref. Debit May 31 No. 429 Date Explanation Ref. Debit Credit May 31 May 31 J1 No. 610 Date Explanation Debit F1 F2 F3 F4 F5 F6 F7 J1 May 31 No. 610 Advertising Expense Balance Ref. Debit Credit Date Explanation May 31 No. 619 Ref. Debit Credit Balance Date Explanation May 31 Supplies Expense No. 631 Ref. Debit Credit Balance Date Explanation May 31 Interest Expense J1 No. 718 Balance Date Explanation May 31 Insurance Expense Ref. Debit J1 No. 722 Credit Balance Date Explanation May 31 Salaries and Wages Expense Ref. Debit 01 No. 726 Ref. Debit Credit Balance May 31 May 31 Utilities Expense No. 732 Date Explanation Ref. Debit Credit Balance May 31 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT (a) Your answer is partially correct. Try again. Journalize the adjusting entries on May 31. (Credit account titles are automatically indented when the amount is Debit Credit Date Account Titles and Explanation 150 1. May 31 insurance Expense 150 Prepaid Insurance 2. May 31 Supplies Expense 1400 Supplies 1400 3. May 31 Expense 5148 Accumulated Depreclation-Buildings 309 Accumulated Depreciation-Equipment 120 4. May 31 [interest Expense 200 Interest Payable 200 5. May 31 Unearned Rent Revenue 2000 Rent Revenue 2000 6. May 31 Salaries and Wages Expense 700 Salaries and Wages Payable 700 Show LIST OF ACCOUNTS SHOW SOLUTON SHow ANswER LINK TO TEXT LINK TO TEXT LINK TO TEXT 6 Prepare a ledger using the three-column form of account. Enter the trial balance amounts into the balance column and then post the adjusting entries. (P No. 101 Ref. Debit May 31 Ref. Debit May 31 May 31 Adjusting 31 No. 130 Ref. Debit May 31 Ref. Debit May 31 May 31 May 33 May 31 May 31 2 4K DI F2 2 4 No. 150 Date Explanation Ref. Debit Credit Balance May 31 Adjusting No. 201 Accounts Payable Ref. Debit Credit Balance Date Explanation May 31 Unearned Rent Revenue No. 206 Ref. Debit Credit Date Explanation May 31 May 31 Salaries and Wages Payable No. 212 Date Explanation Ref. Debit Credit May 31 No. 230 Interest Payable Date Explanation Ref. Debit Credit May 31Adjusting No. 275 Credit Date Explanation May 31 Owners Capital Ref. Debit No. 301 Date Explanation Ref. Debit May 31 No. 429 Date Explanation Ref. Debit Credit May 31 May 31 J1 No. 610 Date Explanation Debit F1 F2 F3 F4 F5 F6 F7 J1 May 31 No. 610 Advertising Expense Balance Ref. Debit Credit Date Explanation May 31 No. 619 Ref. Debit Credit Balance Date Explanation May 31 Supplies Expense No. 631 Ref. Debit Credit Balance Date Explanation May 31 Interest Expense J1 No. 718 Balance Date Explanation May 31 Insurance Expense Ref. Debit J1 No. 722 Credit Balance Date Explanation May 31 Salaries and Wages Expense Ref. Debit 01 No. 726 Ref. Debit Credit Balance May 31 May 31 Utilities Expense No. 732 Date Explanation Ref. Debit Credit Balance May 31 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts