Question: a) Your favourite topic when studying Derivatives was swaps, and as such you have decided to start acting as an intermediary in currency and interest

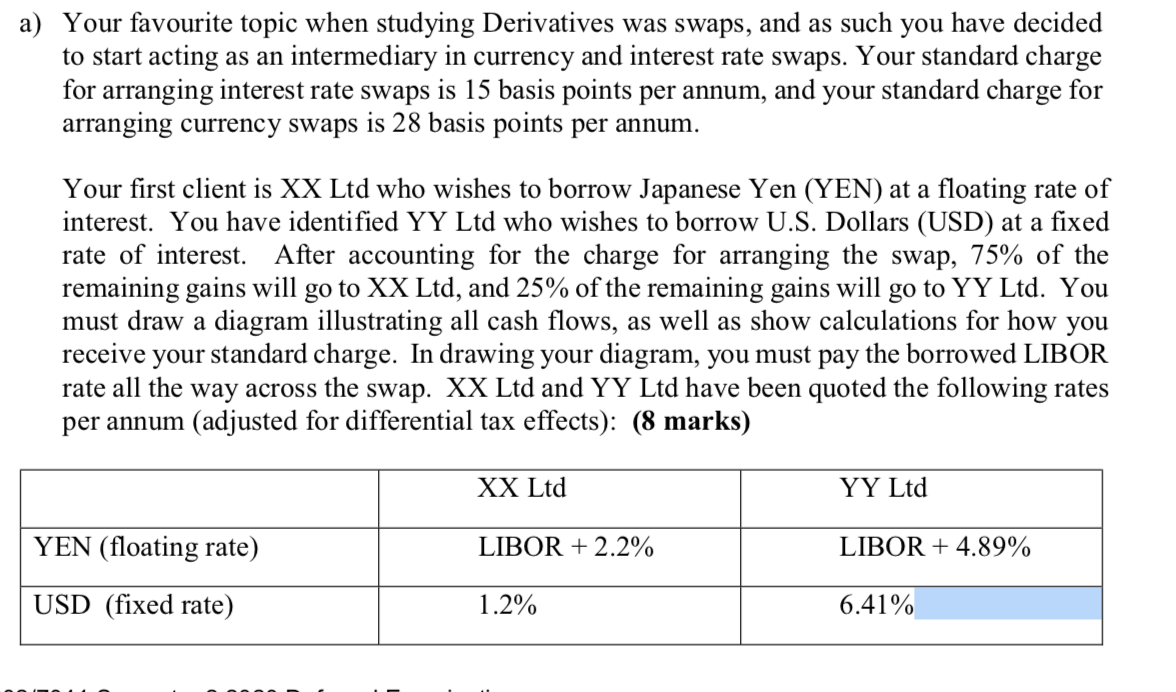

a) Your favourite topic when studying Derivatives was swaps, and as such you have decided to start acting as an intermediary in currency and interest rate swaps. Your standard charge for arranging interest rate swaps is 15 basis points per annum, and your standard charge for arranging currency swaps is 28 basis points per annum. Your first client is XX Ltd who wishes to borrow Japanese Yen (YEN) at a floating rate of interest. You have identified YY Ltd who wishes to borrow U.S. Dollars (USD) at a fixed rate of interest. After accounting for the charge for arranging the swap, 75% of the remaining gains will go to XX Ltd, and 25% of the remaining gains will go to YY Ltd. You must draw a diagram illustrating all cash flows, as well as show calculations for how you receive your standard charge. In drawing your diagram, you must pay the borrowed LIBOR rate all the way across the swap. XX Ltd and YY Ltd have been quoted the following rates per annum (adjusted for differential tax effects): (8 marks) XX Ltd YY Ltd YEN (floating rate) LIBOR + 2.2% LIBOR + 4.89% USD (fixed rate) 1.2% 6.41% a) Your favourite topic when studying Derivatives was swaps, and as such you have decided to start acting as an intermediary in currency and interest rate swaps. Your standard charge for arranging interest rate swaps is 15 basis points per annum, and your standard charge for arranging currency swaps is 28 basis points per annum. Your first client is XX Ltd who wishes to borrow Japanese Yen (YEN) at a floating rate of interest. You have identified YY Ltd who wishes to borrow U.S. Dollars (USD) at a fixed rate of interest. After accounting for the charge for arranging the swap, 75% of the remaining gains will go to XX Ltd, and 25% of the remaining gains will go to YY Ltd. You must draw a diagram illustrating all cash flows, as well as show calculations for how you receive your standard charge. In drawing your diagram, you must pay the borrowed LIBOR rate all the way across the swap. XX Ltd and YY Ltd have been quoted the following rates per annum (adjusted for differential tax effects): (8 marks) XX Ltd YY Ltd YEN (floating rate) LIBOR + 2.2% LIBOR + 4.89% USD (fixed rate) 1.2% 6.41%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts