Question: a z gh 8. Compute the weights for AAP's equity and debt based on the market value of equity (Market Capitalization) and AAP's market value

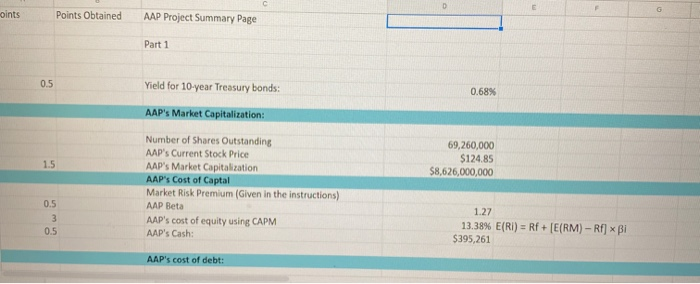

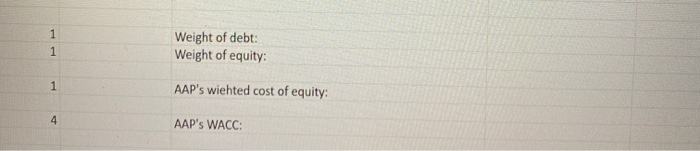

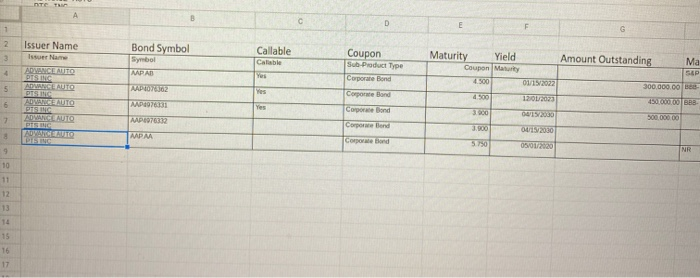

8. Compute the weights for AAP's equity and debt based on the market value of equity (Market Capitalization) and AAP's market value of debt, computed in step 5. 9. Assuming that AAP has a tax rate of 20%, calculate its effective cost of debt capital. 10. Calculate AAP's WACC. oints Points obtained AAP Project Summary Page Part 1 Yield for 10-year Treasury bonds: 0.68% AAP's Market Capitalization: 69,260,000 $124.85 $8,626,000,000 Number of Shares Outstanding AAP's Current Stock Price AAP's Market Capitalization AAP's Cost of Captal Market Risk Premium (Given in the instructions) AAP Beta AAP's cost of equity using CAPM AAP's Cash: 1.27 13.38% E(RI) = Rf + [E(RM) - Rf] x Bi $395,261 AAP's cost of debt: Weight of debt: Weight of equity: AAP's wiehted cost of equity: AAP's WACC: 8. Compute the weights for AAP's equity and debt based on the market value of equity (Market Capitalization) and AAP's market value of debt, computed in step 5. 9. Assuming that AAP has a tax rate of 20%, calculate its effective cost of debt capital. 10. Calculate AAP's WACC. oints Points obtained AAP Project Summary Page Part 1 Yield for 10-year Treasury bonds: 0.68% AAP's Market Capitalization: 69,260,000 $124.85 $8,626,000,000 Number of Shares Outstanding AAP's Current Stock Price AAP's Market Capitalization AAP's Cost of Captal Market Risk Premium (Given in the instructions) AAP Beta AAP's cost of equity using CAPM AAP's Cash: 1.27 13.38% E(RI) = Rf + [E(RM) - Rf] x Bi $395,261 AAP's cost of debt: Weight of debt: Weight of equity: AAP's wiehted cost of equity: AAP's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts