Question: A:1 A:2 B:1 B:2 c:1 c:2 please help to answer this question. thank you! Prepare the worksheet consolidation entries needed on December 31,202, to remove

A:1

A:2

B:1

B:2

c:1

c:2 please help to answer this question. thank you!

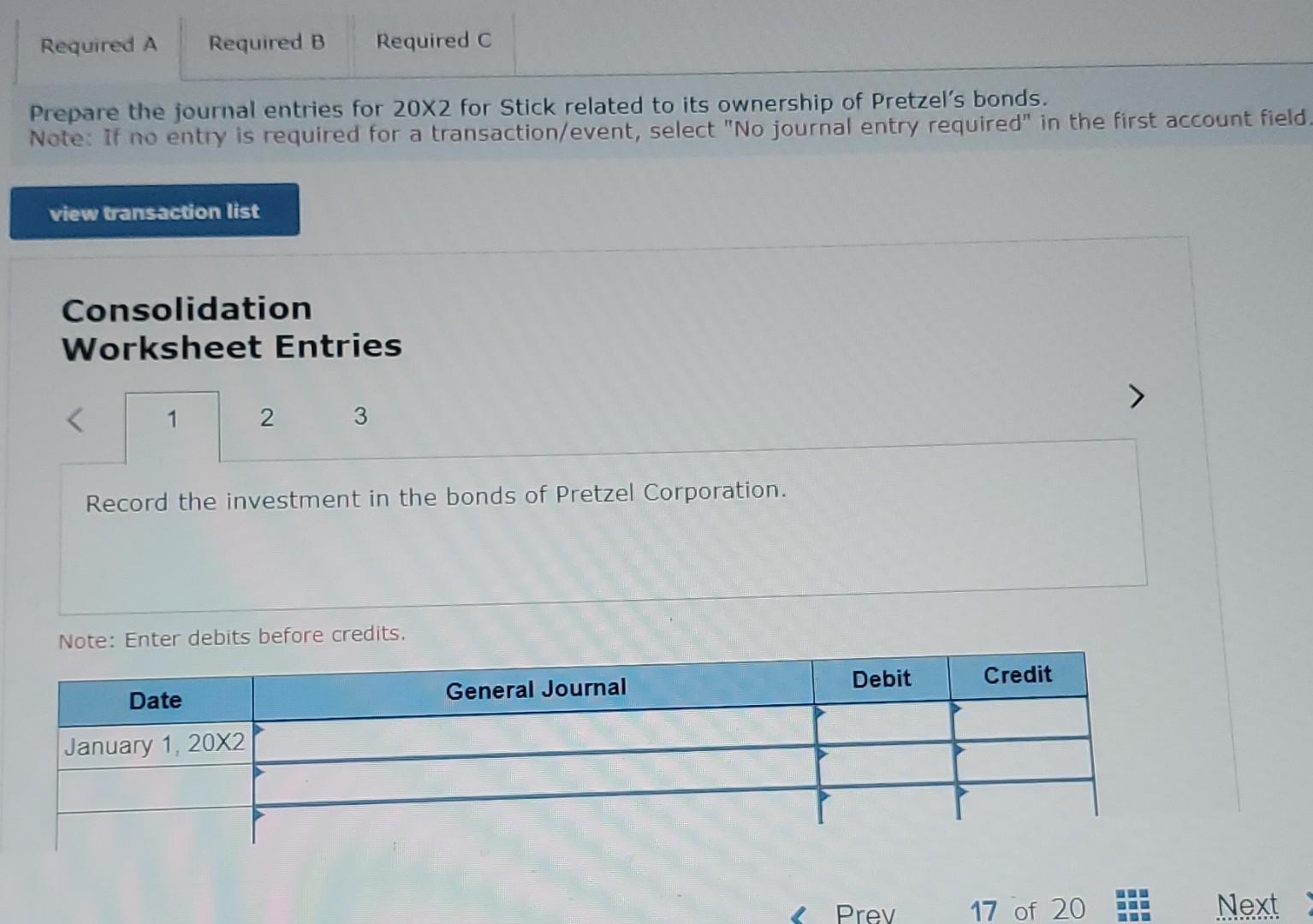

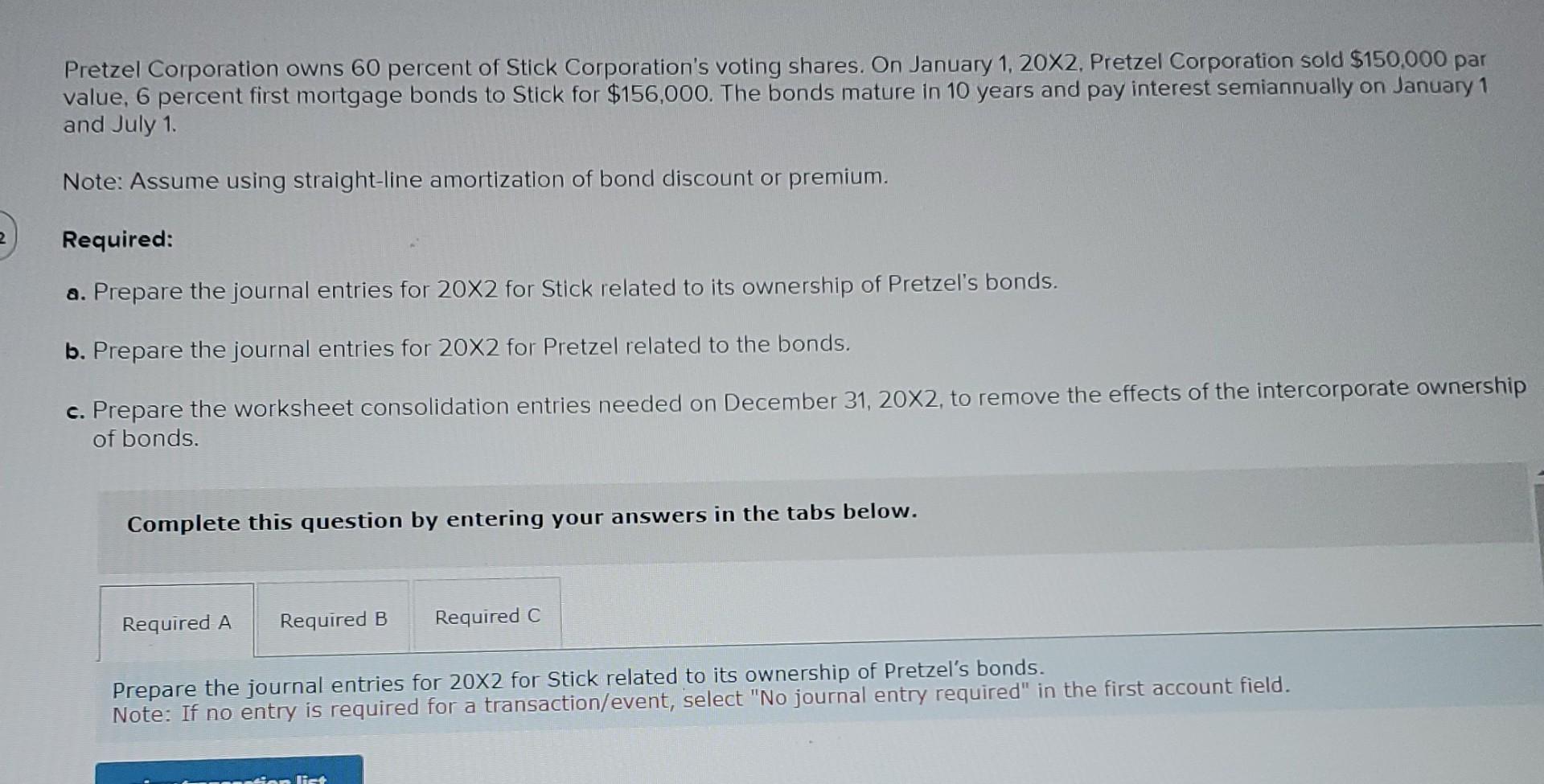

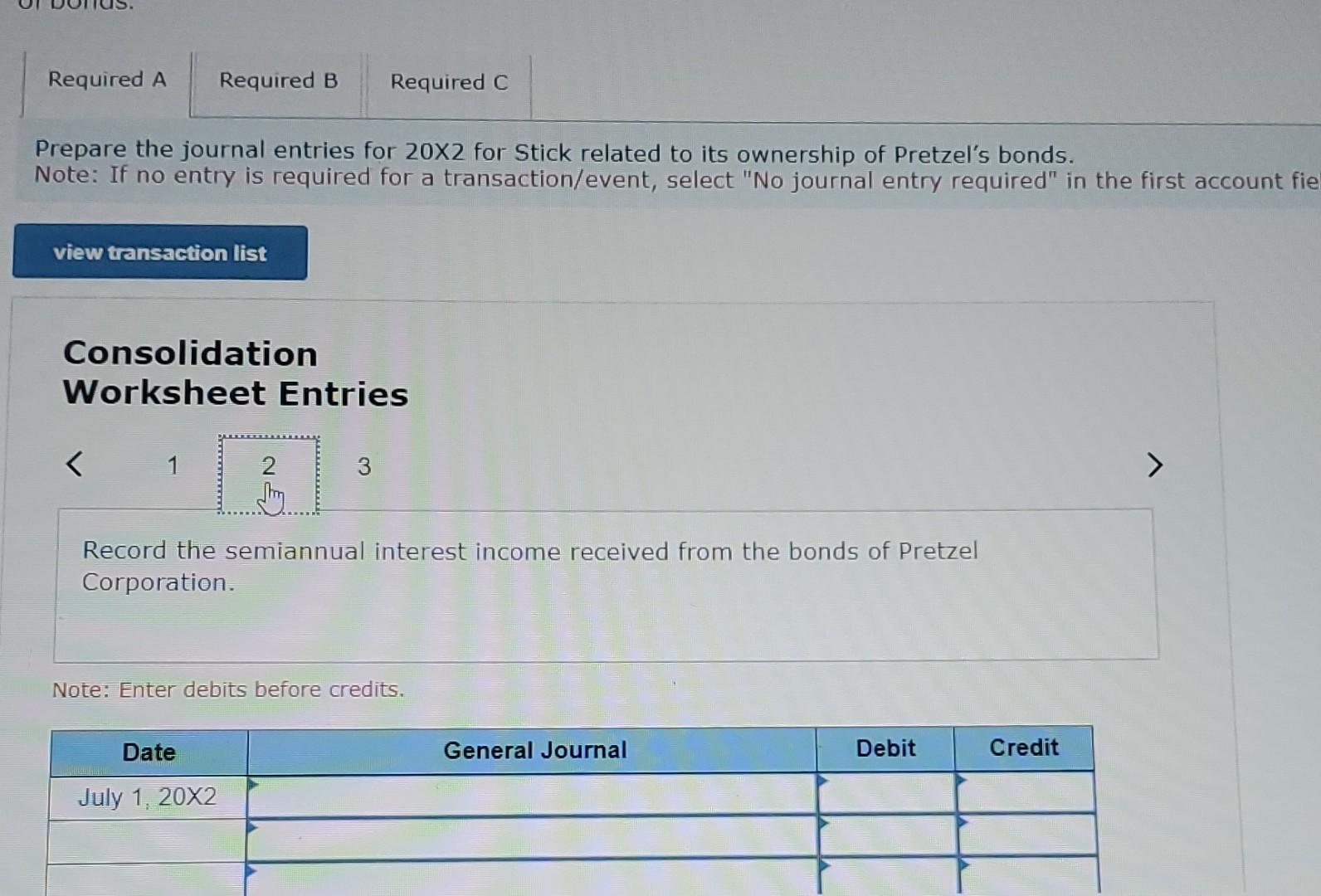

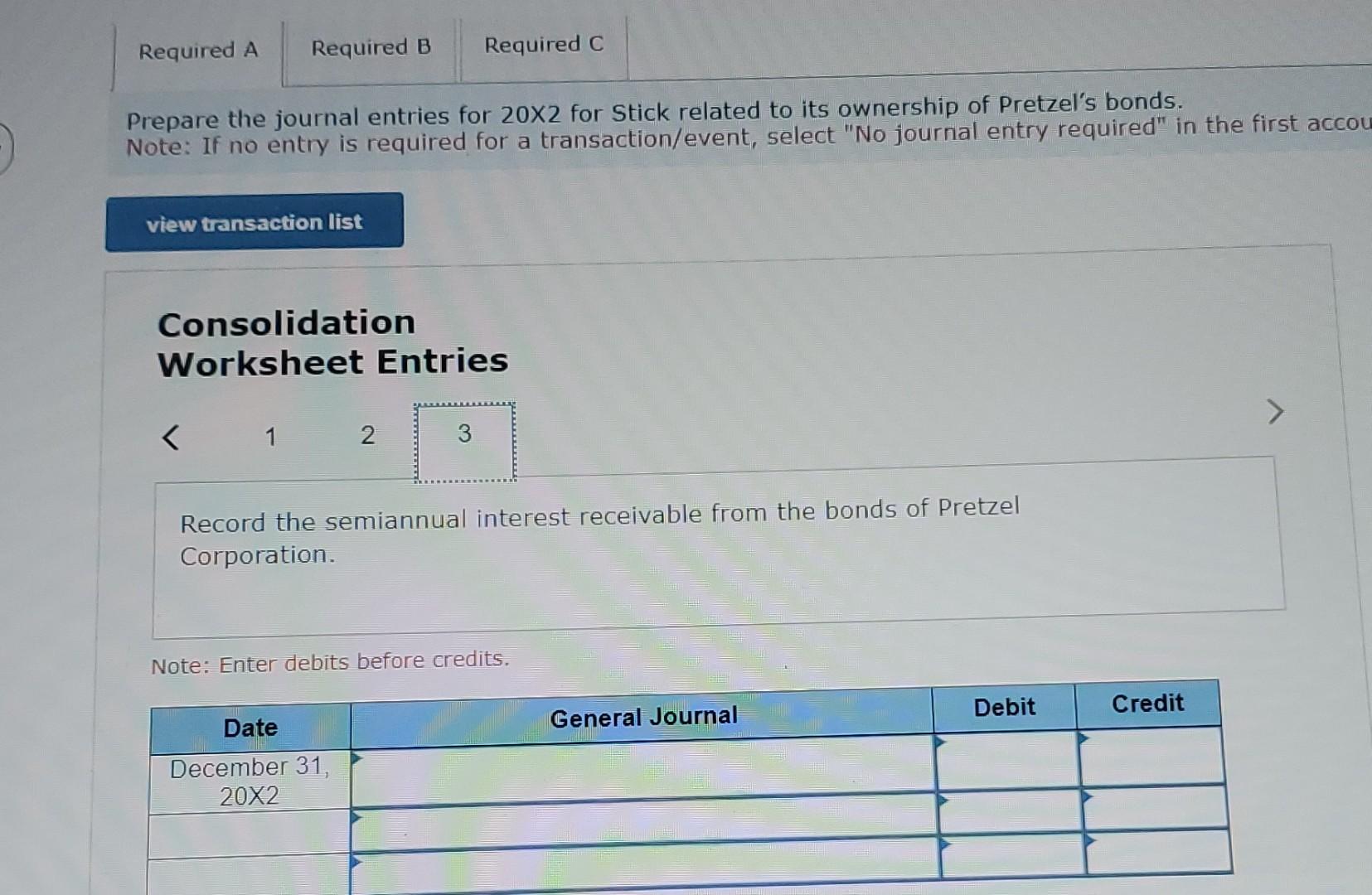

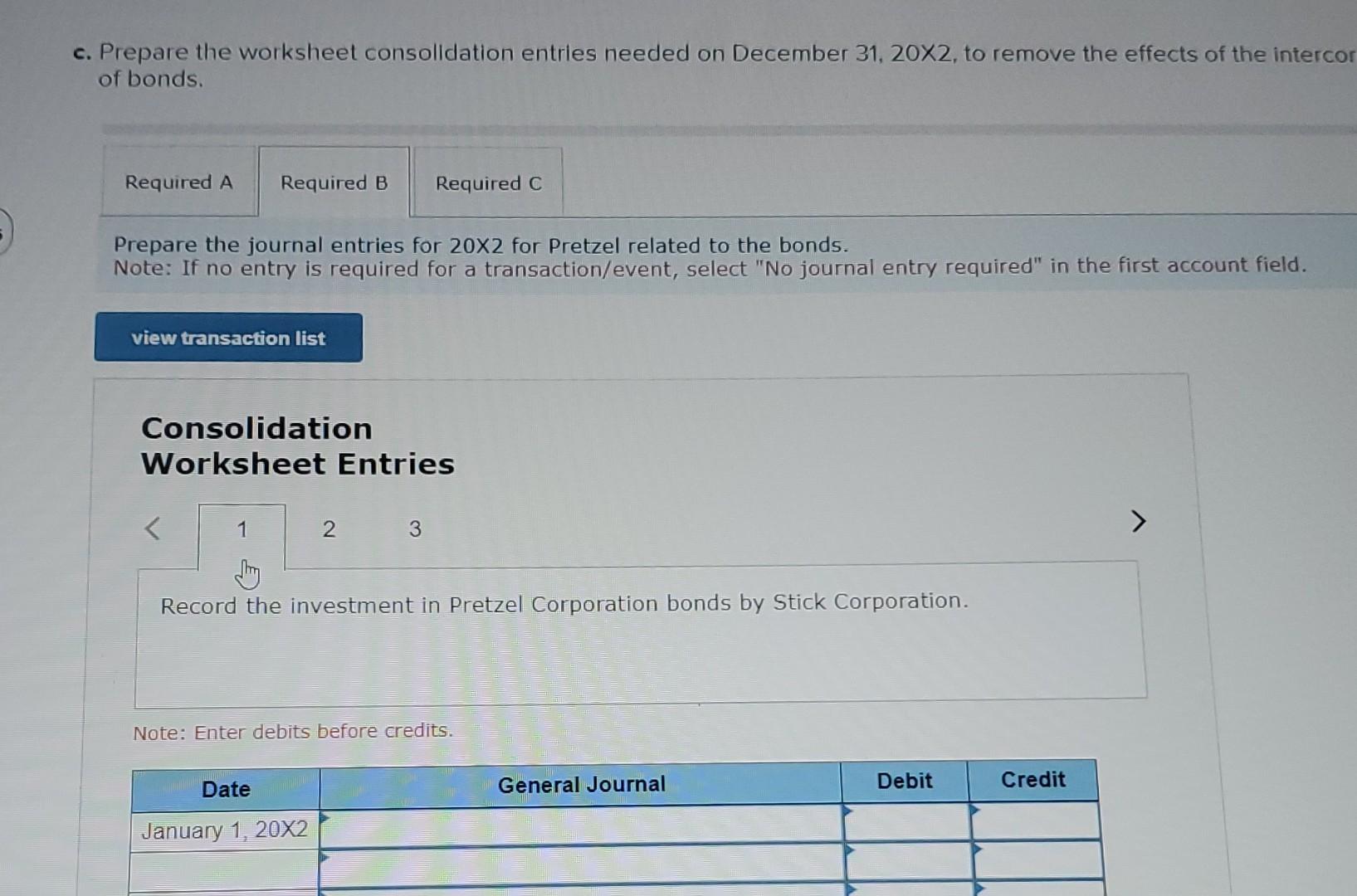

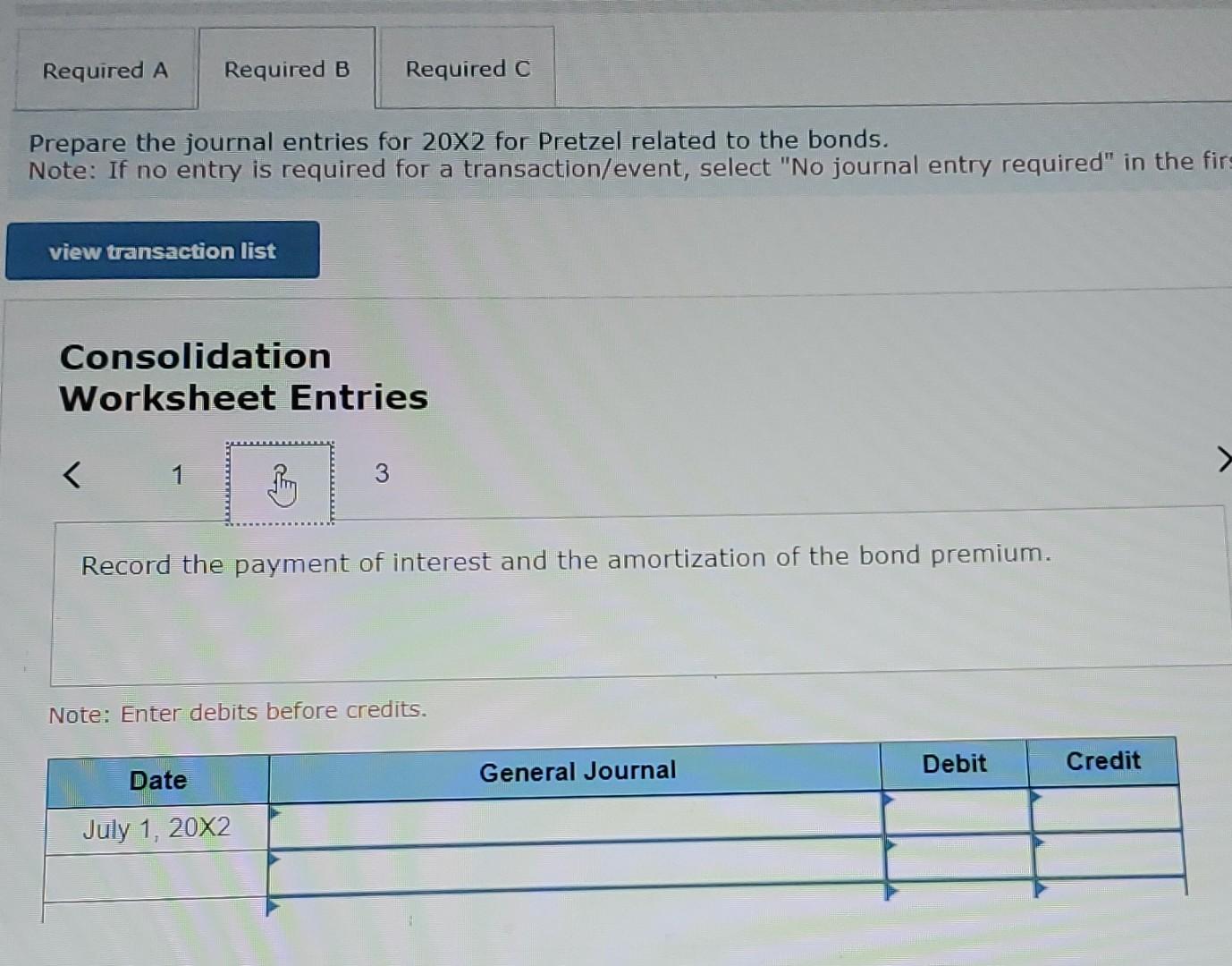

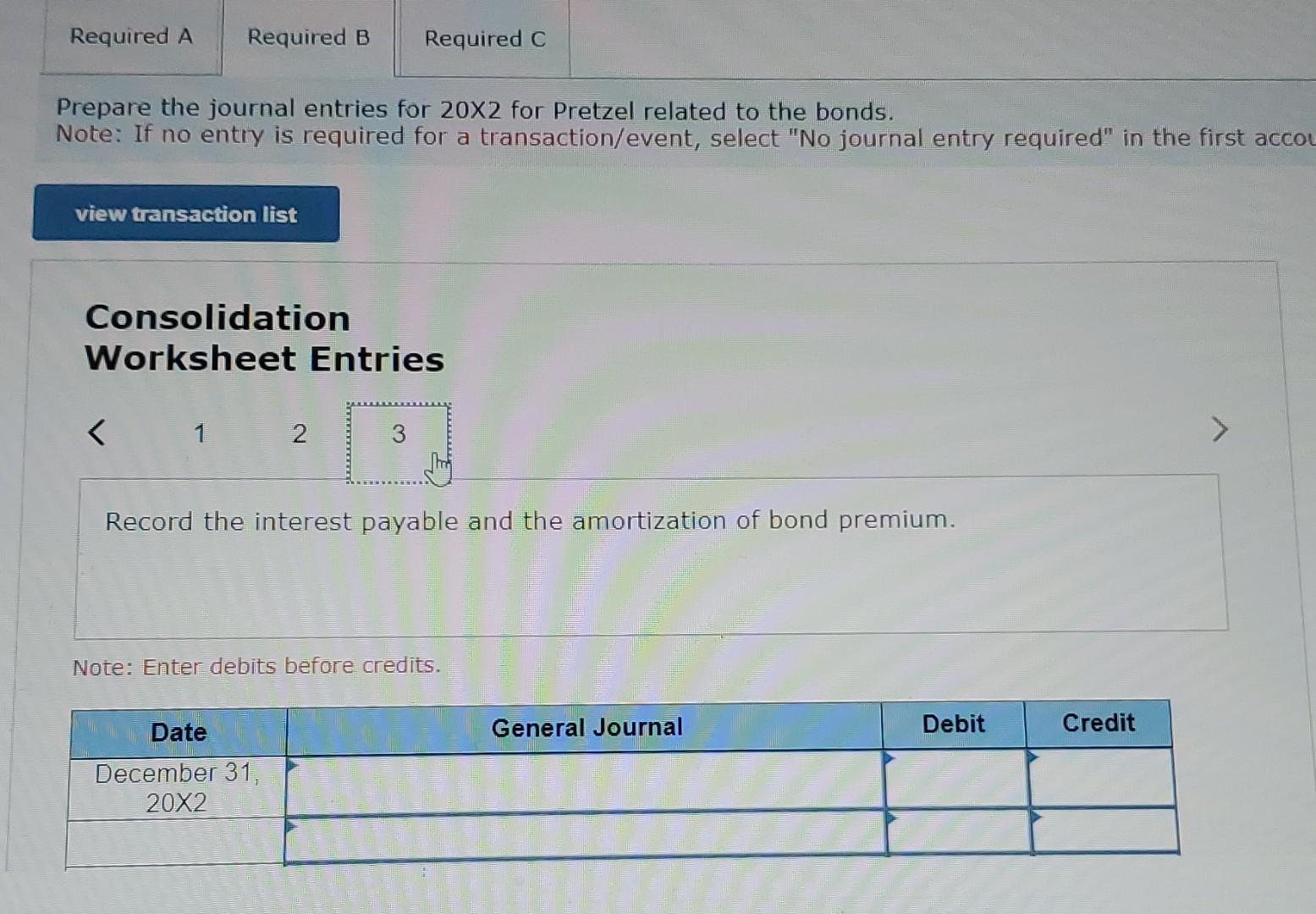

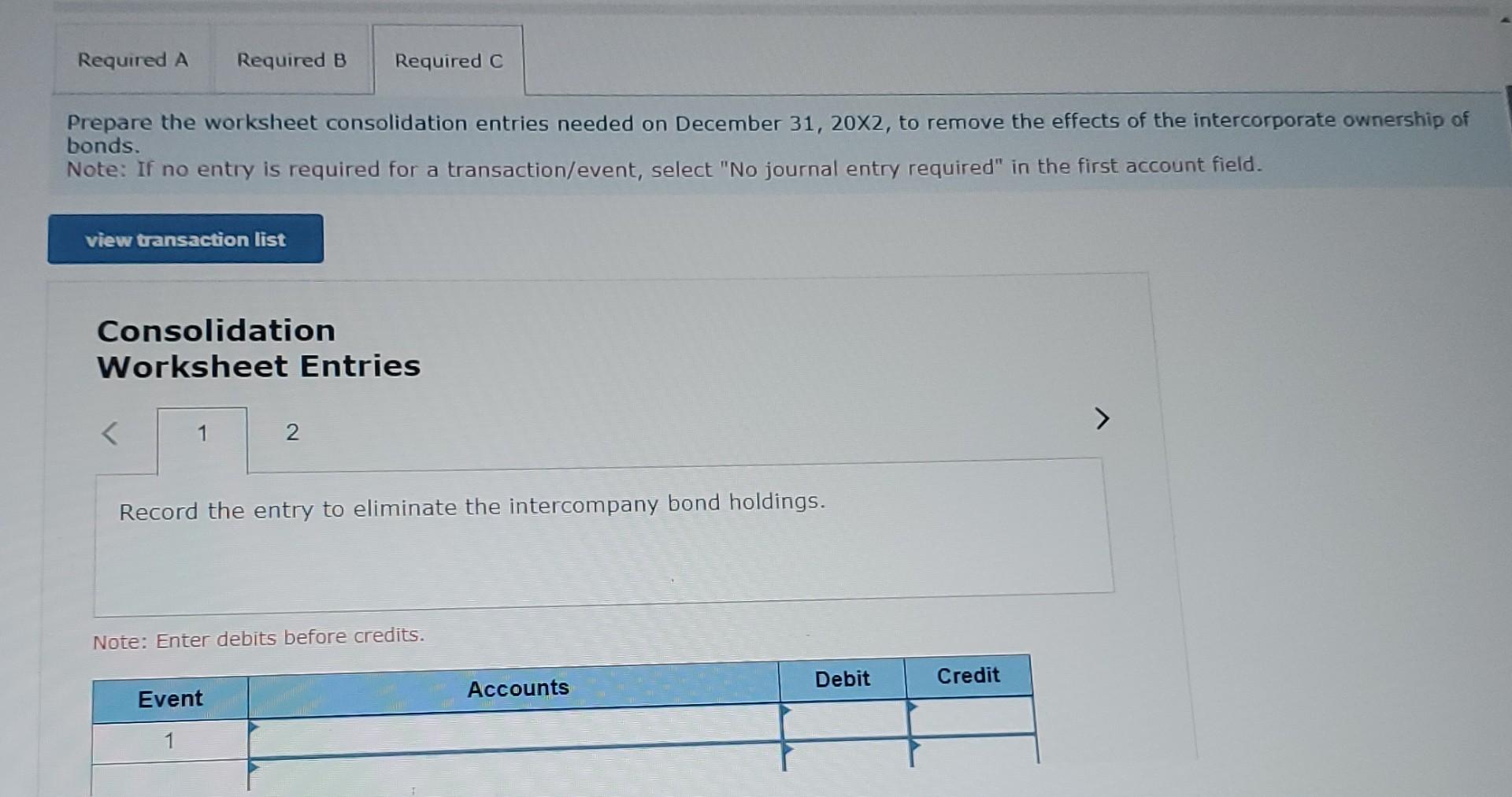

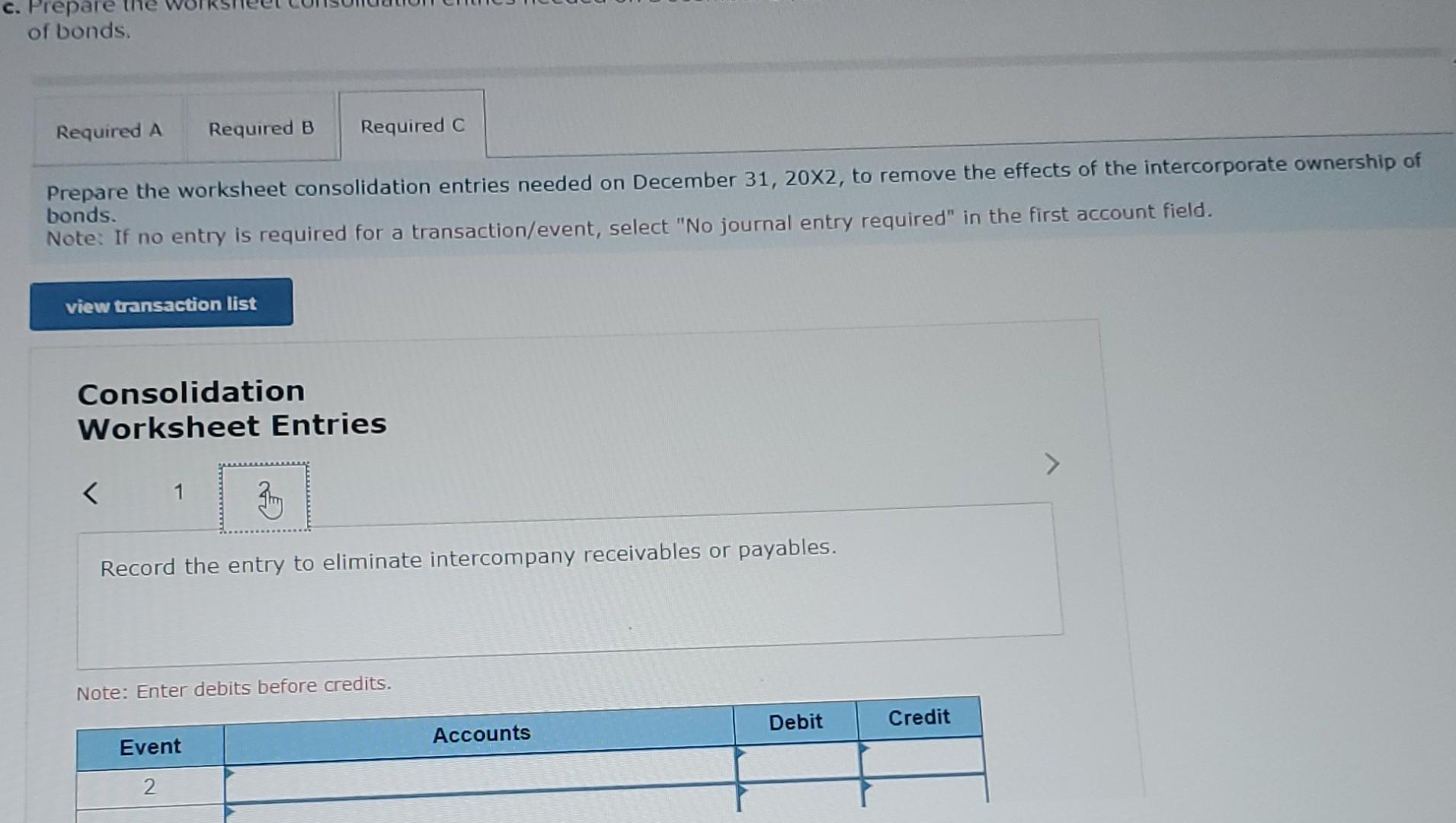

Prepare the worksheet consolidation entries needed on December 31,202, to remove the effects of the intercorporate ownership of bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the entry to eliminate the intercompany bond holdings. Note: Enter debits before credits. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first acco Consolidation Worksheet Entries Record the semiannual interest receivable from the bonds of Pretzel Corporation. Note: Enter debits before credits. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account f Consolidation Worksheet Entries Record the semiannual interest income received from the bonds of Pretzel Corporation. Note: Enter debits before credits. Prepare the worksheet consolidation entries needed on December 31,202, to remove the effects of the intercorporate ownership of bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the entry to eliminate intercompany receivables or payables. Note: Enter debits before credits. Pretzel Corporation owns 60 percent of Stick Corporation's voting shares. On January 1, 20X2. Pretzel Corporation sold $150,000 par value, 6 percent first mortgage bonds to Stick for $156,000. The bonds mature in 10 years and pay interest semiannually on January 1 and July 1. Note: Assume using straight-line amortization of bond discount or premium. Required: a. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. b. Prepare the journal entries for 202 for Pretzel related to the bonds. c. Prepare the worksheet consolidation entries needed on December 31, 20X2, to remove the effects of the intercorporate ownership of bonds. Complete this question by entering your answers in the tabs below. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare the journal entries for 202 for Pretzel related to the bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the Consolidation Worksheet Entries Record the payment of interest and the amortization of the bond premium. Note: Enter debits before credits. E. Prepare the worksheet consolldation entrles needed on December 31,202, to remove the effects of the interco of bonds. Prepare the journal entries for 202 for Pretzel related to the bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the investment in Pretzel Corporation bonds by Stick Corporation. Note: Enter debits before credits. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field Consolidation Worksheet Entries Record the investment in the bonds of Pretzel Corporation. Note: Enter debits before credits. Prepare the journal entries for 202 for Pretzel related to the bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first acco Consolidation Worksheet Entries Record the interest payable and the amortization of bond premium. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts