Question: A1 v : XV fx v B C D E F G H M N 0 P R S U 1. On Jan 1, Margo

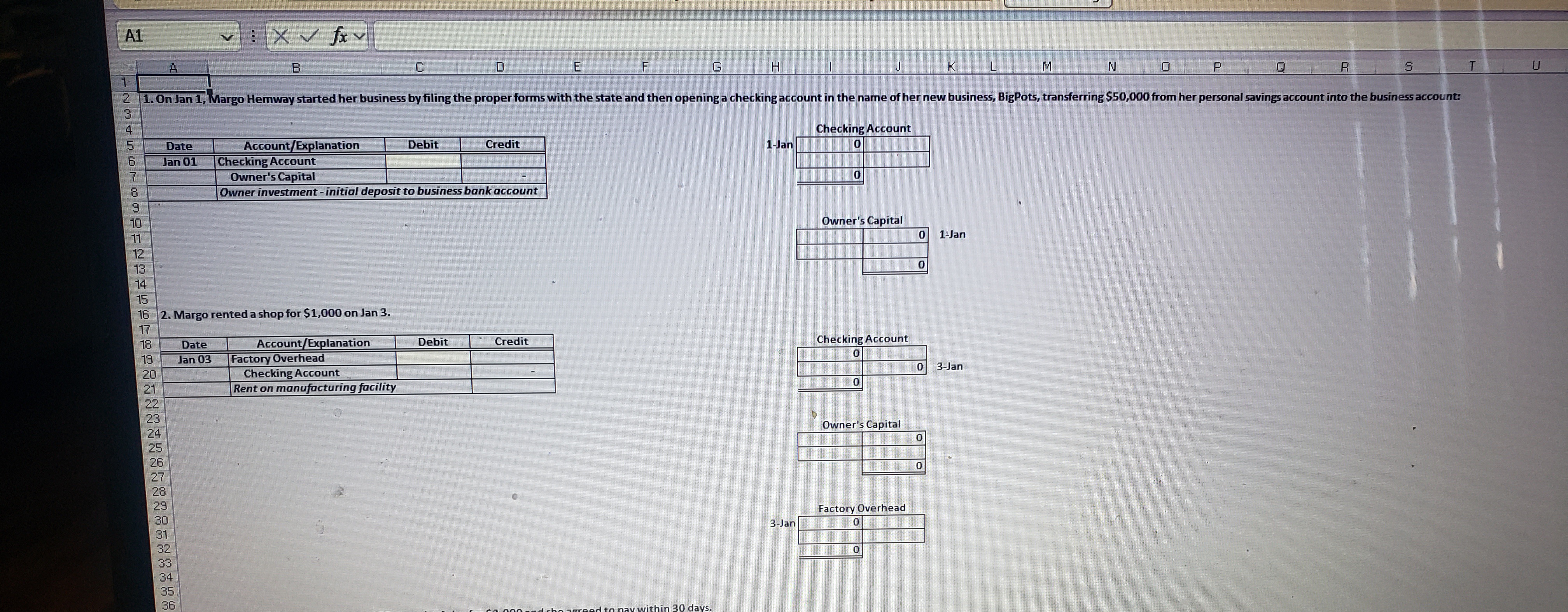

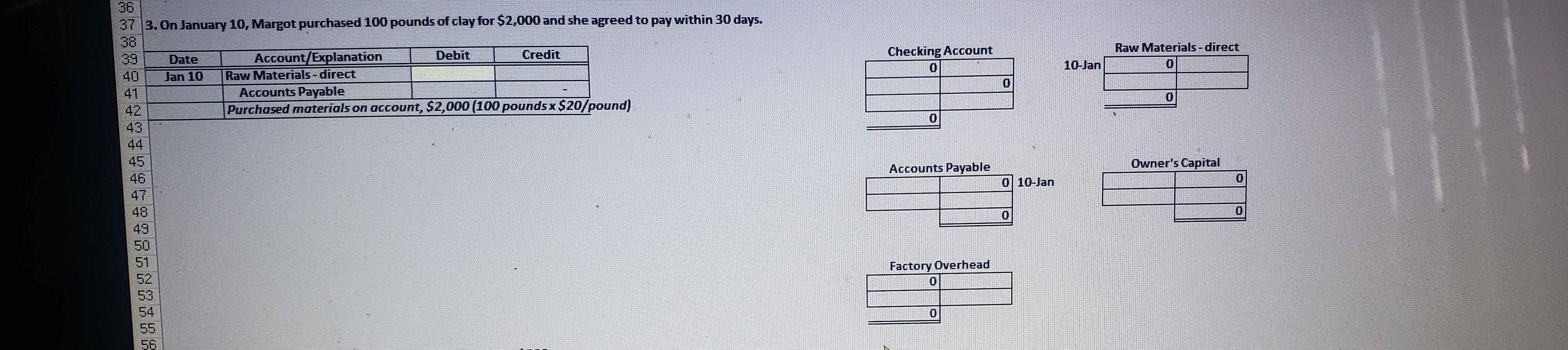

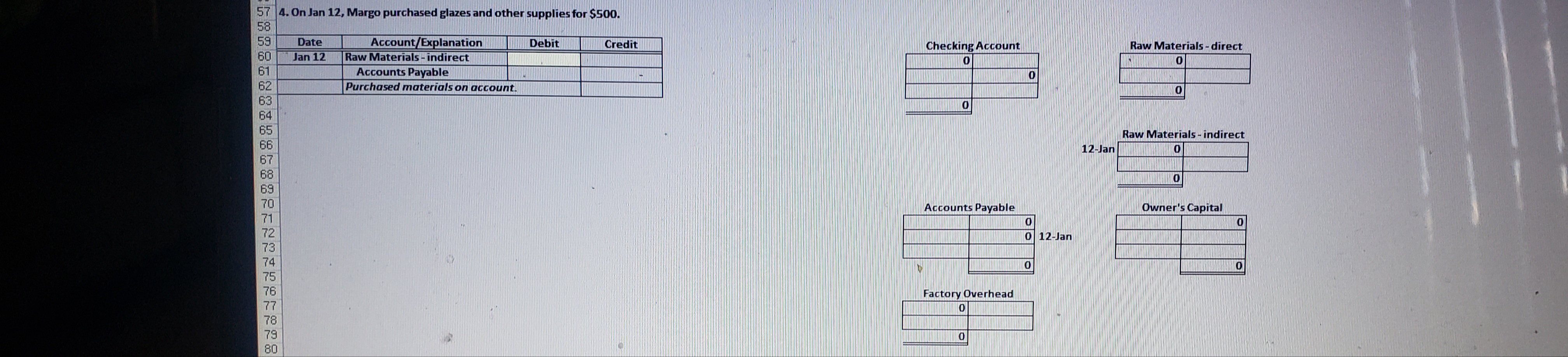

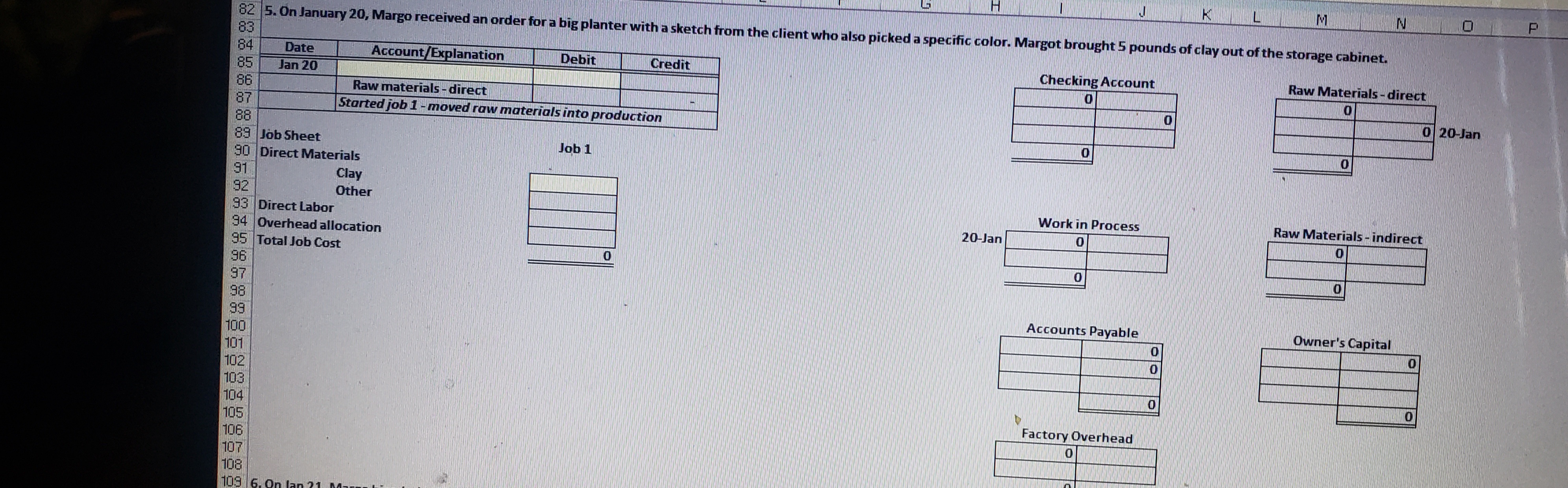

A1 v : XV fx v B C D E F G H M N 0 P R S U 1. On Jan 1, Margo Hemway started her business by filing the proper forms with the state and then opening a checking account in the name of her new business, BigPots, transferring $50,000 from her personal savings account into the business account: DJDueON Checking Account Date Account/Explanation Debit Credit L-Jan Jan 01 Checking Account Owner's Capital Owner investment - initial deposit to business bank account 11 Owner's Capital 12 0 1 Jan 13 0 14 15 16 2. Margo rented a shop for $1,000 on Jan 3. Date Account Explanation Debit Credit Checking Account 19 Jan 03 Factory Overhead 20 Checking Account 0 3-Jan 21 Rent on manufacturing facility O 22 23 24 Owner's Capital O O Factory Overhead 3-Jan36 37 3. On January 10, Margot purchased 100 pounds of clay for $2,000 and she agreed to pay within 30 days. 38 39 Date Account/Explanation Debit Credit Checking Account Raw Materials - direct 40 Jan 10 Raw Materials - direct O 10-Jan O 41 Accounts Payable 42 Purchased materials on account, $2,000 (100 pounds x $20/pound) 43 44 45 46 Accounts Payable Owner's Capital 47 0 10-Jan 48 49 O 50 51 52 Factory Overhead 53 O 54 55 o57 4. On Jan 12, Margo purchased glazes and other supplies for $500. 59 Date Account/Explanation Debit Credit 60 Checking Account Raw Materials - direct Jan 12 Raw Materials - indirect O O 61 Accounts Payable 62 Purchased materials on account. 63 O 64 Raw Materials - indirect 12-Jan O Accounts Payable Owner's Capital O SO Bad38 88989 0 12-Jan O Factory Overhead o ON P 82 5. On January 20, Margo received an order for a big planter with a sketch from the client who also picked a specific color. Margot brought 5 pounds of clay out of the storage cabinet. 83 84 Date Account Explanation Debit Credit Checking Account Raw Materials - direct 85 Jan 20 86 Raw materials - direct 0 20-Jan 87 Started job 1 - moved raw materials into production 88 O 89 Job Sheet Job 1 30 Direct Materials 91 Clay 92 Other Work in Process Raw Materials - indirect 93 Direct Labor 20-Jan O 34 Overhead allocation 95 Total Job Cost 96 97 98 Accounts Payable Owner's Capital 93 100 101 102 0 103 104 Factory Overhead 105 106 107 108 108109 6. On Jan 21, Margo hired a local college student to throw the pot on a wheel and paid her haase and metal handles for $100. She paid for both from the checking account. 110 111 Date Account/Explanation Debit Credit 112 Jan 21 Checking Account Raw Materials - direct 113 Checking Account 114 Checking Account 115 Labor for Job #1 ($250) and accessories ($100) 0 21-Jan 116 0 21 Jan 117 Job Sheet Job 1 116 Direct Materials 119 Clay 120 Other Work in Process 121 Direct Labor 122 Overhead allocation 21 Jan 123 Total Job Cost 124 125 126 Accounts Payable 127 128 129 130 131 132 Factory Overhead 133 134134 135 136 7. On January 22nd, Margo started a large pot according to her own idea with 10 pounds of clay. 137 138 Date Account Explanation Debit Credit Checking Account Raw Materials - direct 139 Jan 22 O 140 Raw materials - direct 0 0 141 Job #2 started 0 22-Jan 142 O 143 Job Sheet Job 1 Job 2 Total WIP O 144 Direct Materials 145 Clay O Work in Process Raw Materials - indirect 146 Other 147 Direct Labor 148 Overhead allocation 22-Jan 149 Total Job Cost O O O 150 151 152 Accounts Payable Owner's Capital 153 154 155 156 157 158 Factory Overhead 159 160163 164 8. On the 25th, Margo pays her college student intern $300 for throwing her giant patio planter pot. She also buys decorative appliques for the project for $20. 165 166 Date Account Explanation Debit Credit Checking Account Raw Materials - direct 167 Jan 25 168 Checking Account 169 Checking Account 170 Labor for Job #2 ($300) and appliques ($20) 17 0 25-Jan 172 0 25-Jan 173 O 174 Job Sheet Job 1 Job 2 Total WIP 175 Direct Materials Work in Process Raw Materials - indirect 176 Clay 0 O 177 Other 0 O 178 Direct Labor 0 179 Overhead allocation 0 25-Jan 180 Total Job Cost 0 0 0 181 182 183 Accounts Payable Owner's Capital 184 185 186 187 188 Factory Overhead 189 190 191104 9. On the 29th, Margo gets another order for a big pot with a diagram and detailed specifications. She takes 1 pound of clay out of storage. 195 196 Date Account Explanation Debit Credit Checking Account Raw Materials - direct 187 Jan 29 O 198 Raw materials - direct O 198 Job #3 started 200 0 29-Jan 201 202 O 203 204 O 0 205 206 Job Sheet Job 1 Job 2 Job 3 WIP Work in Process Raw Materials - indirect 207 Direct Materials 208 Clay O O O O Other O o o 210 Direct Labor 0 O o O 211 Overhead allocation O 29-Jan O 212 Total Job Cost 0 O 0 O 213 214 215 Accounts Payable Owner's Capital 216 217 218 O 219 220 Factory Overhead O 222 223 224A B C E F G ZZT 10. On the 30th, Margo receives payment on Job 1 in the amount of $1000 and she delivers the completed project to the customer. 228 229 Date Account Explanation Debit Credit 230 Jan 30 Checking Account Checking Account Raw Materials - direct 231 Sales Revenue O 232 Payment on Job 1 0 0 233 0 234 O 235 O 236 237 Jan 30 238 239 240 Job Sheet Job 1 Job 2 Job 3 WIP Work in Process Raw Materials - indirect 241 Direct Materials 242 Clay O 243 Other 0 O 244 Direct Labor O O 245 Overhead allocation O 246 Total Job Cost 10 0 247 248 249 Accounts Payable Owner's Capital 0 250 251 252 253 254 Factory Overhead Sales Revenue 255 0 Jan 30 256 257 O 258260 261 11. Margo allocates Factory Overhead to Work In Process based on a plant-wide rate of $2 per direct labor dollar. 262 263 Date Account/Explanation Debit Credit Checking Account Raw Materials - direct 264 Jan 31 265 Factory Overhead 266 To allocate factory overhead to jobs. 267 268 O 269 270 271 O 272 273 Work in Process Raw Materials - indirect 274 Job Sheet Job 1 Job 2 Job 3 WIP O O 275 Direct Materials 276 Clay O O O 277 Other 0 O O 278 Direct Labor 0 O O 279 Overhead allocation O 31-Jan O 280 Total Job Cost 0 0 O O O 281 282 283 Accounts Payable Owner's Capital 284 285 286 287 O 28 283 Factory Overhead Sales Revenue 290 O O 291 0 31-Jan OB 1294 E F G H K P 295 12. At the end of the month, Margo assesses by physical observation the amount and cost of indirect materials left and determines it to be $300. 297 Date Account Explanation Debit Credit 298 Jul 31 299 Raw Materials - Indirect Checking Account Raw Materials - direct 300 To adjust indirect materials to actual on hand. 301 0 302 303 304 305 306 307 308 309 Job Sheet Work in Process Raw Materials - indirect Job 1 Job 2 Job 3 WIP 310 Direct Materials 311 0 31-Jul Clay O 312 Other 313 Direct Labor 314 Overhead allocation 315 Total Job Cost 0 316 317 318 Accounts Payable Owner's Capital 319 0 320 321 322 323 324 Factory Overhead Sales Revenue 325 O 326 327 31-Jul 328 330 13. At the end of the month, Jackie assesses by physical observation the amount and cost of Work In Process and confirms it to be $20. 331 332 Date Account/Explanation Debit Credit Checking Account Raw Materials - direct ENTERANSWERS Ready Q Search a WA1 v : XV jxy A B C E 330 13. At the end of the month, Jackie assesses by physical observation the amount and cost of Work In Process and confirms it to be $20. 331 332 Date Account Explanation Debit Credit Checking Account Raw Materials - direct 333 Jan 3 334 Work in Process 335 To move Jobs 1 and 2 to Finished Goods 336 337 338 339 340 341 342 Job Sheet Job 3 WIP Work in Process Raw Materials - indirect 343 Direct Materials O O 344 Clay 0 345 Other 346 Direct Labor O 347 Overhead allocation 348 Total Job Cost 349 0 31-Jan 350 Job Sheet Job 1 Job 2 FG 351 Direct Materials Finished Goods 352 Clay 31-Jan 353 Other 354 Direct Labor 355 Overhead allocation O 356 Total Job Cost O 357 Accounts Payable Owner's Capital 358 359 360 361 362 363 Factory Overhead Sales Revenue 364 O 365 366 367 368 ENTERANSWERS + W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts