Question: A3-6 Economic consideration is being given for a proposal to drill a natu- ral gas well. All capital and operating costs are in thousands of

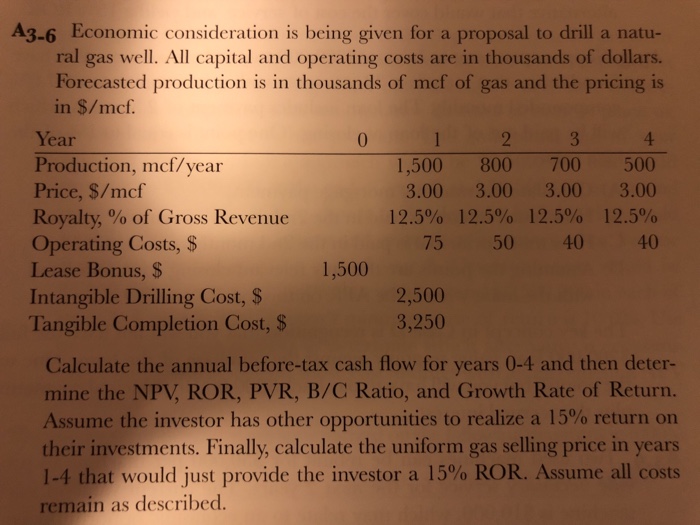

A3-6 Economic consideration is being given for a proposal to drill a natu- ral gas well. All capital and operating costs are in thousands of dollars. Forecasted production is in thousands of mcf of gas and the pricing is in $/mcf. Year Production, mcf/year Price, S/mcf Royalty, % of Gross Revenue Operating Costs, $ Lease Bonus, S Intangible Drilling Cost, $ Tangible Completion Cost, S 4 1,500 800 700 500 3.00 3.00 3.00 3.00 12.5% 12.5% 12.5% 12.5% 0 75 50 40 40 1,500 2,500 3,250 Calculate the annual before-tax cash flow for years 0-4 and then deter- mine the NPV, ROR, PVR, B/C Ratio, and Growth Rate of Return. Assume the investor has other opportunities to realize a 15% return on their investments. Finally, calculate the uniform gas selling price in years 1-4 that would just provide the investor a 15% ROR. Assume all costs remain as described

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts