Question: Homework #4 Economic consideration is being given for a proposal to build out a new business. All capital and operating costs are in thousands of

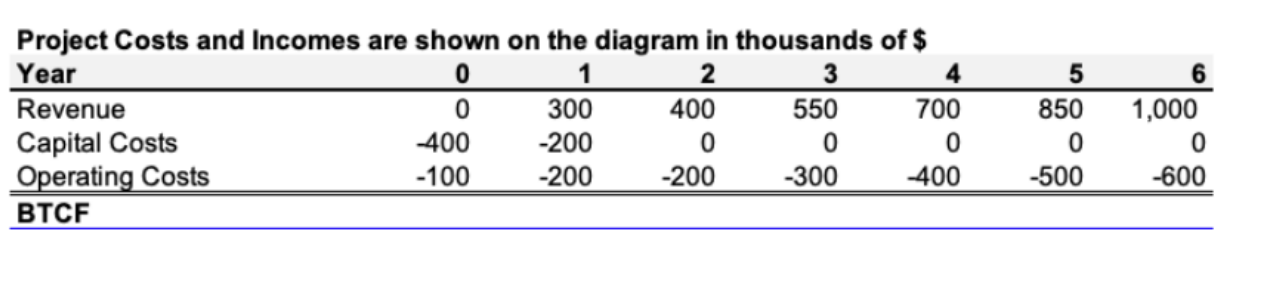

Homework #4 Economic consideration is being given for a proposal to build out a new business. All capital and operating costs are in thousands of dollars. Revenue is forecasted for six years and is also in thousands of dollars. Use a 15% minimum discount rate to evaluate the given proposal. Calculate the Net Present Value (NPV), Rate of Return (ROR), Growth Rate of Return (GROR), Present Value Ratio (PVR), and Benefit Cost Ratio (B/C Ratio). Please interpret all your findings. Finally, what time zero capital expense would give you exactly a 15% rate of return?

Project Costs and Incomes are shown on the diagram in thousands of $ \begin{tabular}{lrrrrrrr} Year & 0 & 1 & 2 & 3 & 4 & 5 & 6 \\ \hline Revenue & 0 & 300 & 400 & 550 & 700 & 850 & 1,000 \\ Capital Costs & -400 & -200 & 0 & 0 & 0 & 0 & 0 \\ Operating Costs & -100 & -200 & -200 & -300 & -400 & -500 & -600 \\ \hline \hline BTCF & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts