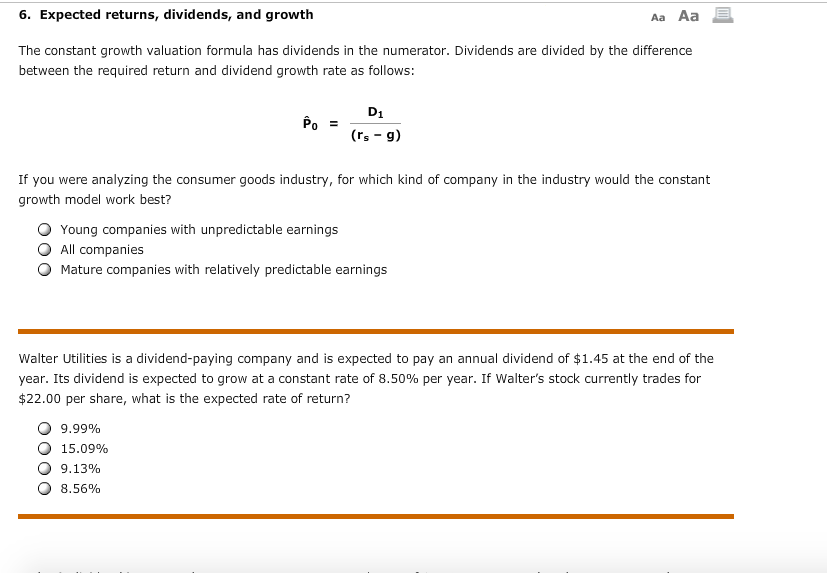

Question: Aa Aa E. 6. Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference

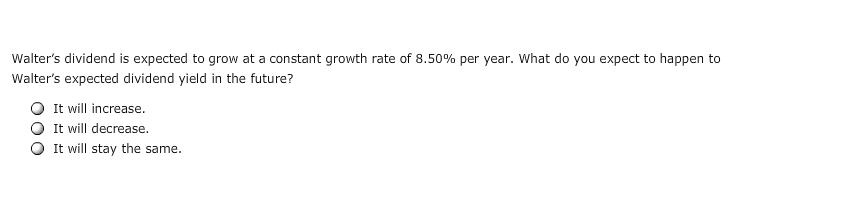

Aa Aa E. 6. Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return and dividend growth rate as follows: D1 (rs g) If you were analyzing the consumer goods industry, for which kind of company in the industry would the constant growth model work best? O Young companies with unpredictable earnings O All companies O Mature companies with relatively predictable earnings Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $1.45 at the end of the year. Its dividend is expected to grow at a constant rate of 8.50% per year. If Walter's stock currently trades for $22.00 per share, what is the expected rate of return? O 9.99% 15.09% O 9.13% O 8.56%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts