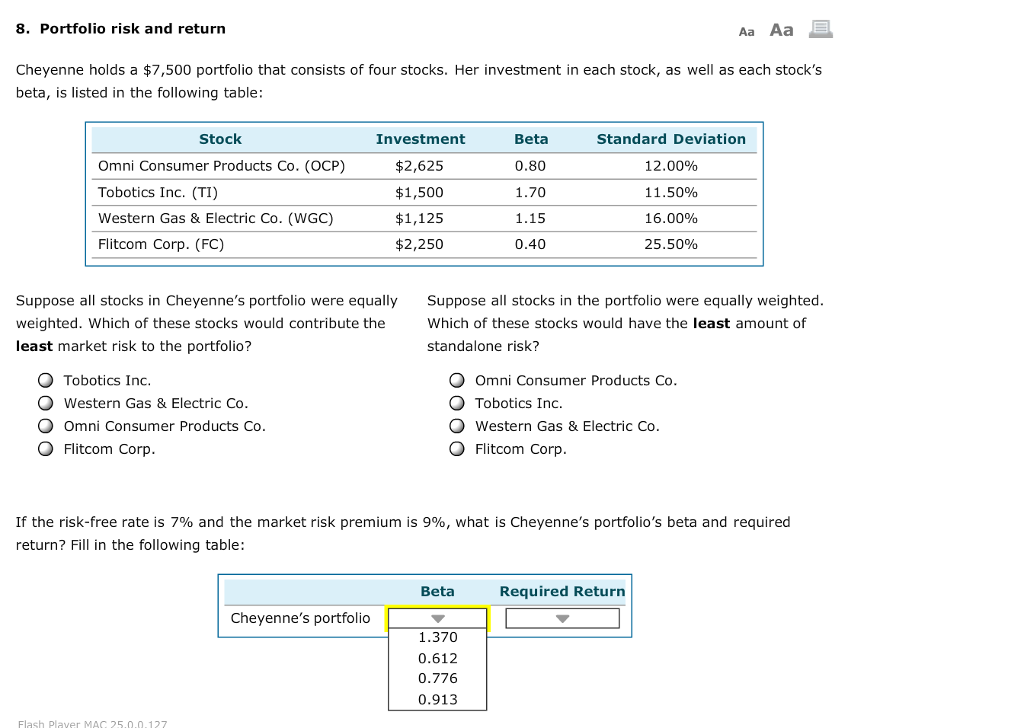

Question: Aa Aa E. 8. Portfolio risk and return Cheyenne holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well

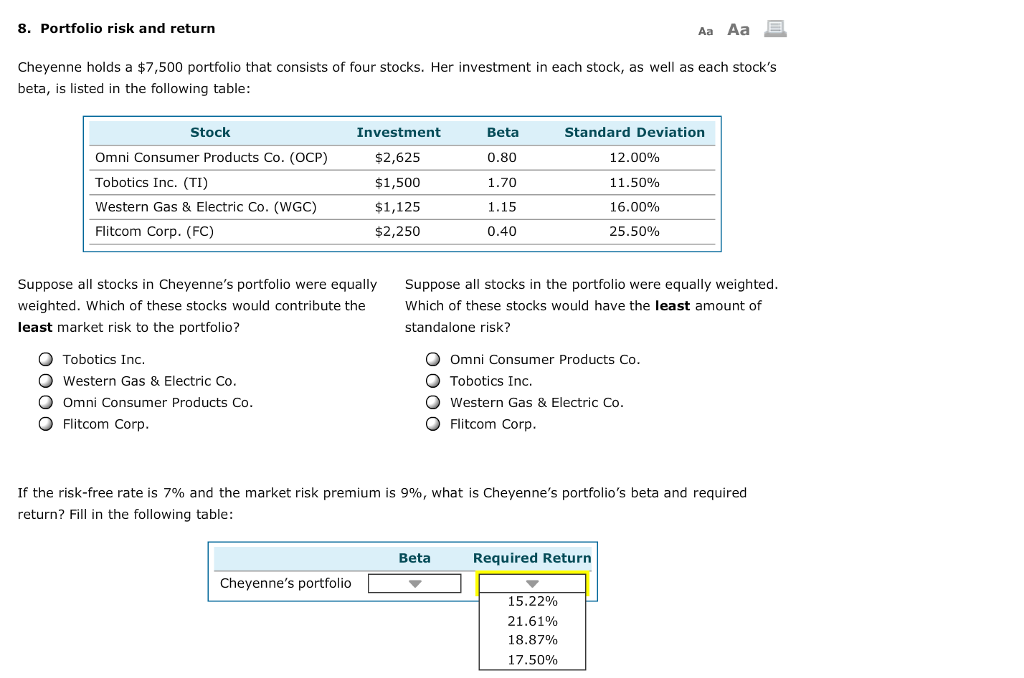

Aa Aa E. 8. Portfolio risk and return Cheyenne holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Standard Deviation Investment Beta 12.00% $2,625 Omni Consumer Products Co. (OCP 0.80 Tobotics Inc. (TI) $1,500 11.50% 1.70 Western Gas & Electric Co. (WGC) $1,125 16.00% 1.15 Flit com Corp. (FC) $2,250 0.40 25.50% Suppose all stocks in Cheyenne's portfolio were equally Suppose all stocks in the portfolio were equally weighted weighted. Which of these stocks would contribute the Which of these stocks would have the least amount of least market risk to the portfolio? standalone risk? O Tobotics Inc. O Omni Consumer Products Co. O Tobotics Inc. O Western Gas & Electric Co. O Omni Consumer Products Co. O Western Gas & Electric Co. O Flitcom Corp. O Flitcom Corp. If the risk-free rate is 7% and the market risk premium is 9%, what is Cheyenne's portfolio's beta and required return? Fill in the following table Beta Required Return Cheyenne's portfolio 1.370 0.612 0.776 0.913 Flash player MAC 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts