Question: Aa EES. E+ 4 AaBbccdd Aabbccdd AaBbc AaBbcc AaB AabCD ABCD Aalbices Mate 1 Normal 1 No Spac.. Heading 1 Heading 2 Title Subtitle Subtle

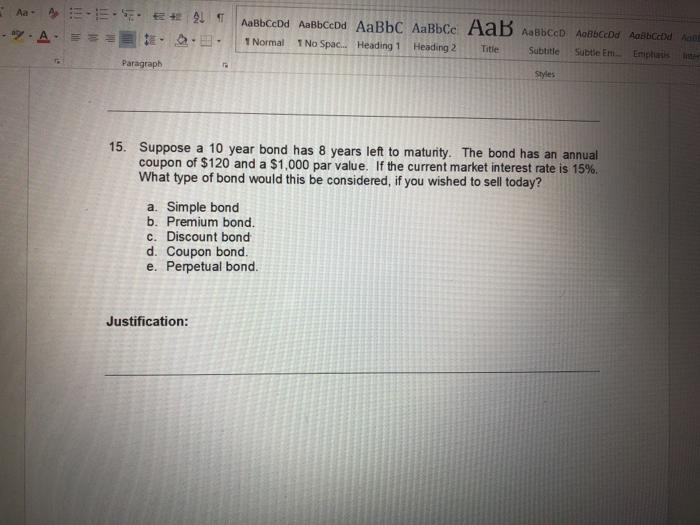

Aa EES. E+ 4 AaBbccdd Aabbccdd AaBbc AaBbcc AaB AabCD ABCD Aalbices Mate 1 Normal 1 No Spac.. Heading 1 Heading 2 Title Subtitle Subtle Em Em Paragraph Styles 15. Suppose a 10 year bond has 8 years left to maturity. The bond has an annual coupon of $120 and a $1,000 par value. If the current market interest rate is 15%. What type of bond would this be considered, if you wished to sell today? a. Simple bond b. Premium bond. c. Discount bond d. Coupon bond. e. Perpetual bond. Justification

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts