Question: AaBbCcDdEe AaBbCcDdEe AaBbC Normal No Spacing Heading Ch 17 Assignment NewBank started its first day of operations with $6 million in capital. S100 million in

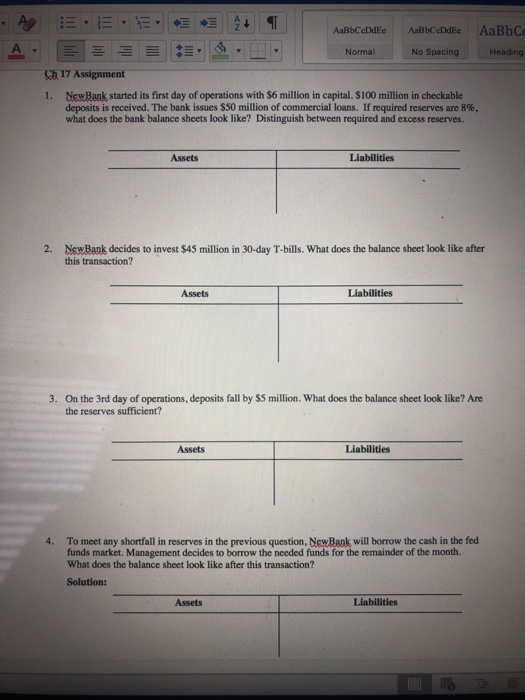

AaBbCcDdEe AaBbCcDdEe AaBbC Normal No Spacing Heading Ch 17 Assignment NewBank started its first day of operations with $6 million in capital. S100 million in checkable deposits is received. The bank issues$50 million of commercial loans. If required reserves are 8%, what does the bank balance sheets look like? Distinguish between required and excess reserves. 1. Assets Liabilities NewBank decides to invest $45 million in 30-day T-bills. What does the balance sheet look like after this transaction? 2. Assets Liabilities On the 3rd day of operations, deposits fall by $5 million. What does the balance sheet look like? Are the reserves sufficient? 3. Assets Liabilities To meet any shortfall in reserves in the previous question, NewBank will borrow the cash in the fed funds market. Management decides to borrow the needed funds for the remainder of the month. What does the balance sheet look like after this transaction? 4. Solution: Assets Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts