Question: ABC Co. reported net income for the current year 2018 at P10,000,000 before taxes. Included in the determination of the said net income were: The

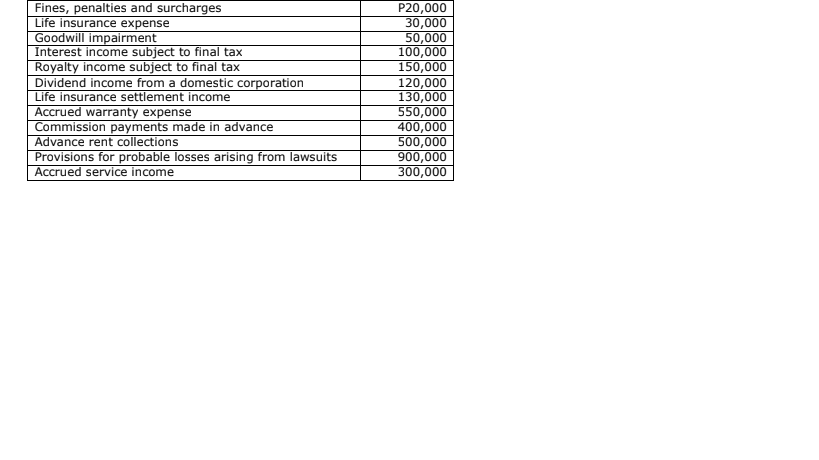

ABC Co. reported net income for the current year 2018 at P10,000,000 before taxes. Included in the determination of the said net income were:

The income tax rate is 40% and is not expected to change in the future.

What is the total deferred tax liability to be presented in the 2018 Statement of Financial Position? a. P280,000 b. P208,000 c. P200,000 d. P780,000

Assuming expected income tax rate for the following year is 35%, what is the total tax expense? a. P3,902,500 b. P3,900,500 c. P3,900,000 d. P3,700,500

Assuming expected income tax rate for the ff. year is 35%, what is the total deferred taxliability? a. P245,000 b. P254,000 c. P240,500 d. P254,500

Assuming expected income tax rate for the ff. year is 35%, what is the total deferred tax asset? a. P628,500 b. P682,500 c. P682,000 d. P652,500

Fines, penalties and surcharges Life insurance expense Goodwill impairment Interest income subject to final tax Royalty income subject to final tax Dividend income from a domestic corporation Life insurance settlement income Accrued warranty expense Commission payments made in advance Advance rent collections Provisions for probable losses arising from lawsuits Accrued service income P20,000 30,000 50,000 100,000 150,000 120,000 130,000 550,000 400,000 500,000 900,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts