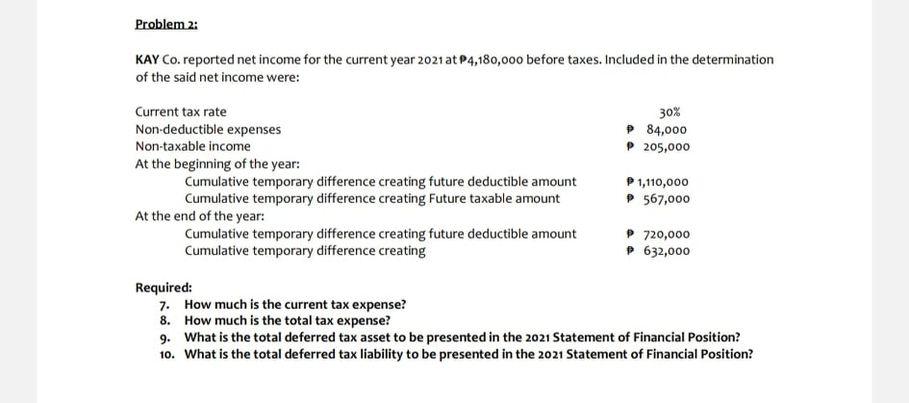

Question: Problem 2: KAY Co. reported net income for the current year 2021 at P4,180,000 before taxes. Included in the determination of the said net income

Problem 2: KAY Co. reported net income for the current year 2021 at P4,180,000 before taxes. Included in the determination of the said net income were: 30% P 84,000 P205,000 Current tax rate Non-deductible expenses Non-taxable income At the beginning of the year: Cumulative temporary difference creating future deductible amount Cumulative temporary difference creating Future taxable amount At the end of the year: Cumulative temporary difference creating future deductible amount Cumulative temporary difference creating P 1,110,000 P 567,000 720,000 632,000 Required: 7. How much is the current tax expense? 8. How much is the total tax expense? 9. What is the total deferred tax asset to be presented in the 2021 Statement of Financial Position? 10. What is the total deferred tax liability to be presented in the 2021 Statement of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts