Question: ABC Corp. invests $500,000 this year in a five-year project. The investment will have the salvage value of $35,000. The performance of the project over

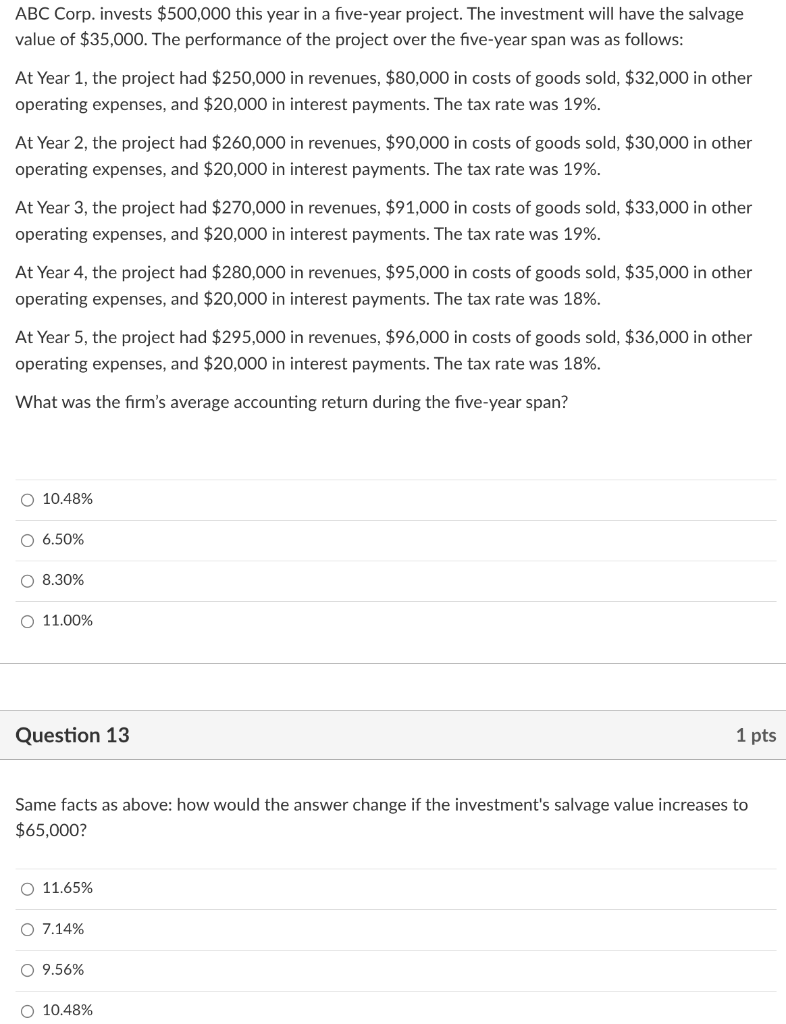

ABC Corp. invests $500,000 this year in a five-year project. The investment will have the salvage value of $35,000. The performance of the project over the five-year span was as follows: At Year 1, the project had $250,000 in revenues, $80,000 in costs of goods sold, $32,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 2, the project had $260,000 in revenues, $90,000 in costs of goods sold, $30,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 3, the project had $270,000 in revenues, $91,000 in costs of goods sold, $33,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 4, the project had $280,000 in revenues, $95,000 in costs of goods sold, $35,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 18%. At Year 5, the project had $295,000 in revenues, $96,000 in costs of goods sold, $36,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 18%. What was the firm's average accounting return during the five-year span? 10.48%6.50%8.30%11.00% Question 13 1 pts Same facts as above: how would the answer change if the investment's salvage value increases to $65,000? 11.65% 7.14% 9.56% 10.48% ABC Corp. invests $500,000 this year in a five-year project. The investment will have the salvage value of $35,000. The performance of the project over the five-year span was as follows: At Year 1, the project had $250,000 in revenues, $80,000 in costs of goods sold, $32,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 2, the project had $260,000 in revenues, $90,000 in costs of goods sold, $30,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 3, the project had $270,000 in revenues, $91,000 in costs of goods sold, $33,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 19%. At Year 4, the project had $280,000 in revenues, $95,000 in costs of goods sold, $35,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 18%. At Year 5, the project had $295,000 in revenues, $96,000 in costs of goods sold, $36,000 in other operating expenses, and $20,000 in interest payments. The tax rate was 18%. What was the firm's average accounting return during the five-year span? 10.48%6.50%8.30%11.00% Question 13 1 pts Same facts as above: how would the answer change if the investment's salvage value increases to $65,000? 11.65% 7.14% 9.56% 10.48%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts