Question: Question 28 (3 points) Project X is expected to have an initial investment of $20M (at T = 0) and cash inflows of +$12M and

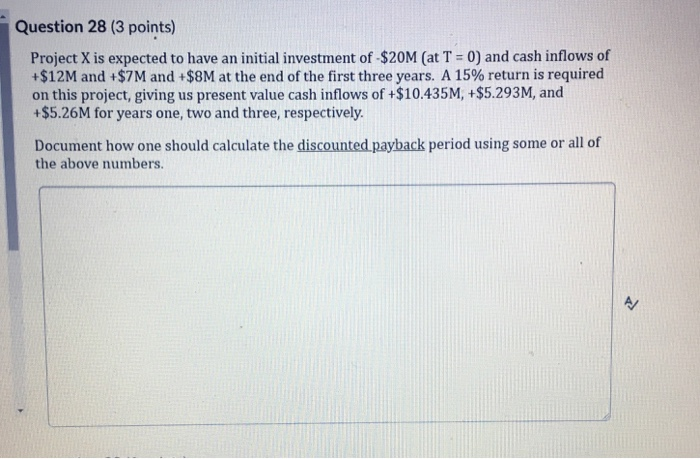

Question 28 (3 points) Project X is expected to have an initial investment of $20M (at T = 0) and cash inflows of +$12M and +$7M and +$8M at the end of the first three years. A 15% return is required on this project, giving us present value cash inflows of +$10.435M, +$5.293M, and +$5.26M for years one, two and three, respectively. Document how one should calculate the discounted payback period using some or all of the above numbers

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock