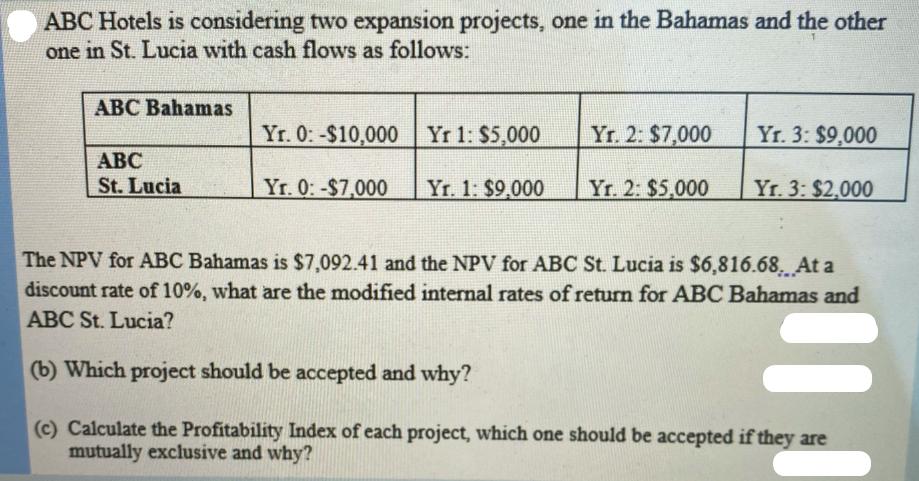

Question: ABC Hotels is considering two expansion projects, one in the Bahamas and the other one in St. Lucia with cash flows as follows: ABC

ABC Hotels is considering two expansion projects, one in the Bahamas and the other one in St. Lucia with cash flows as follows: ABC Bahamas ABC St. Lucia Yr. 0:-$10,000 Yr 1: $5,000 Yr. 1: $9,000 Yr. 0:-$7,000 Yr. 2: $7,000 Yr. 2: $5,000 Yr. 3: $9,000 Yr. 3: $2,000 The NPV for ABC Bahamas is $7,092.41 and the NPV for ABC St. Lucia is $6,816.68. At a discount rate of 10%, what are the modified internal rates of return for ABC Bahamas and ABC St. Lucia? (b) Which project should be accepted and why? (c) Calculate the Profitability Index of each project, which one should be accepted if they are mutually exclusive and why?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the modified internal rate of return MIRR we need to find the discount rate at which th... View full answer

Get step-by-step solutions from verified subject matter experts