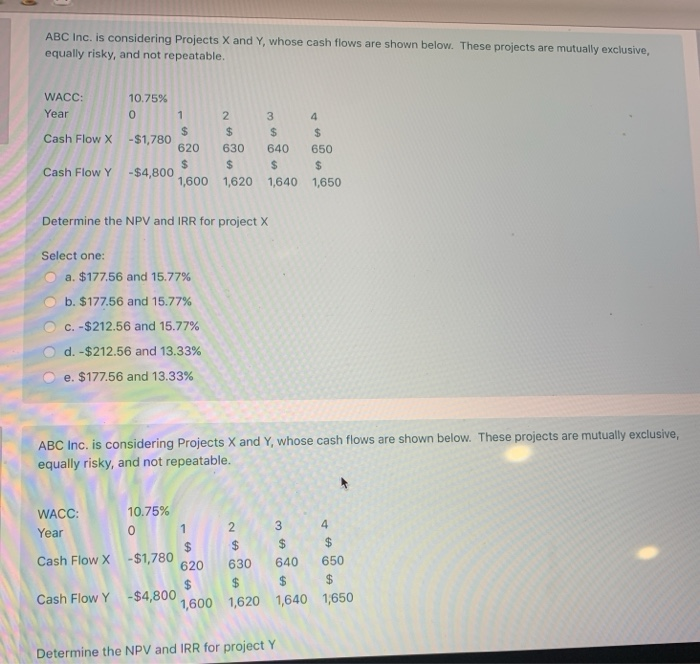

Question: ABC Inc. is considering Projects X and Y, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. WACC:

ABC Inc. is considering Projects X and Y, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. WACC: Year Cash Flow X 10.75% 0 1 2 $ $ -$1,780 620 630 $ $ -$4,800 1,600 1,620 3 $ 640 $ 1,640 4 $ 650 $ 1,650 Cash Flow Y Determine the NPV and IRR for project X Select one: a. $177.56 and 15.77% b. $177.56 and 15.77% C. -$212.56 and 15.77% d. -$212.56 and 13.33% e. $177.56 and 13.33% ABC Inc. is considering Projects X and Y, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. WACC: 10.75% Year 0 1 2 3 4 $ $ $ $ Cash Flow X -$1,780 620 630 640 650 $ Cash Flow Y-$4,800 1,600 1,620 1,640 1,650 $ Determine the NPV and IRR for project Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts