Question: ABC Inc. will generate a one time free cash flow of $27,650,000 in one year's time. The company has a debt/equity ratio of 2.0. The

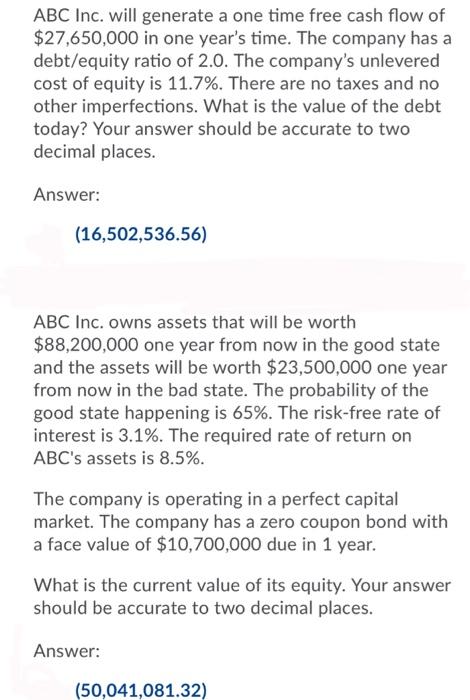

ABC Inc. will generate a one time free cash flow of $27,650,000 in one year's time. The company has a debt/equity ratio of 2.0. The company's unlevered cost of equity is 11.7%. There are no taxes and no other imperfections. What is the value of the debt today? Your answer should be accurate to two decimal places. Answer: (16,502,536.56) ABC Inc. owns assets that will be worth $88,200,000 one year from now in the good state and the assets will be worth $23,500,000 one year from now in the bad state. The probability of the good state happening is 65%. The risk-free rate of interest is 3.1%. The required rate of return on ABC's assets is 8.5%. The company is operating in a perfect capital market. The company has a zero coupon bond with a face value of $10,700,000 due in 1 year. What is the current value of its equity. Your answer should be accurate to two decimal places. Answer: (50,041,081.32)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts