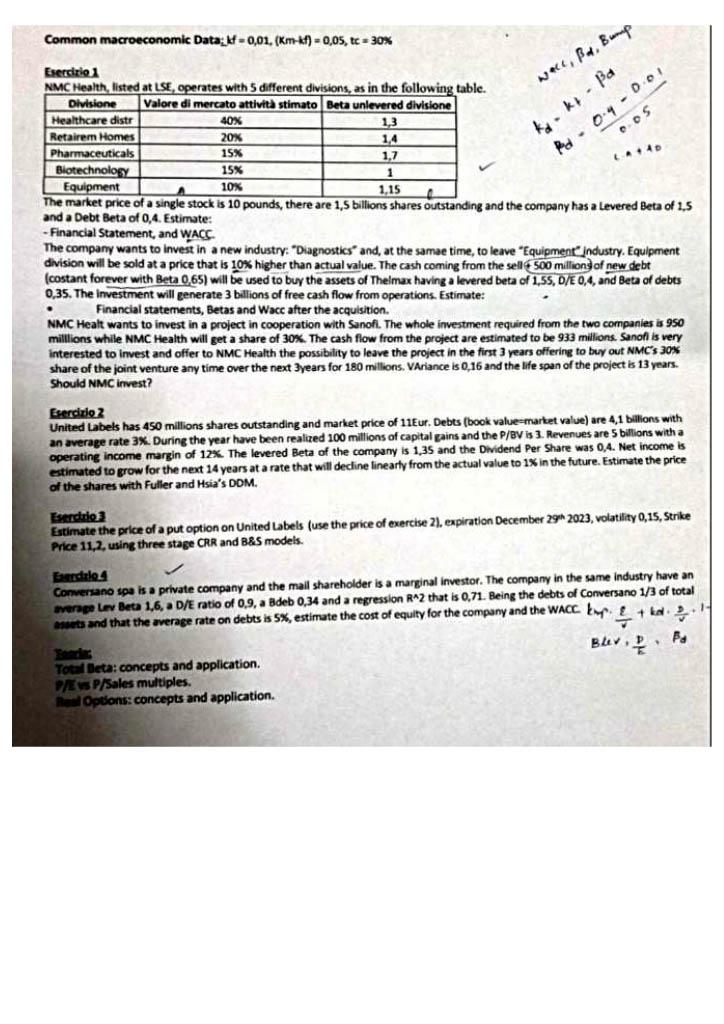

Question: Common macroeconomic Data: bf -0,01. (Km-kf) - 0,05, tc = 30% Net, Ba, Bump kaki pa Par. 0-4-001 LA40 Esercizio 1 NMC Health, listed at

Common macroeconomic Data: bf -0,01. (Km-kf) - 0,05, tc = 30% Net, Ba, Bump kaki pa Par. 0-4-001 LA40 Esercizio 1 NMC Health, listed at LSE, operates with 5 different divisions, as in the following table. Divisione Valore di mercato attivit stimato Beta unlevered divisione Healthcare distr 40% 13 Retairem Homes 20% 1.4 Pharmaceuticals 15% 1,7 Biotechnology 15% 1 Equipment 10% 1,15 . The market price of a single stock is 10 pounds, there are 1,5 billions shares outstanding and the company has a Levered Beta of 1,5 and a Debt Beta of 0,4. Estimate: - Financial Statement, and WACC The company wants to invest in a new industry: "Diagnostics and, at the same time, to leave 'Equipment Industry. Equipment division will be sold at a price that is 10% higher than actual value. The cash coming from the sell 500 millions of new debt (costant forever with Beta 0,65) will be used to buy the assets of Thelmax having a levered beta of 1,55, D/E 0,4, and Beta of debts 0,35. The investment will generate 3 billions of free cash flow from operations. Estimate: Financial statements, Betas and Wace after the acquisition NMC Healt wants to invest in a project in cooperation with Sanofi. The whole investment required from the two companies is 950 milllions while NMC Health will get a share of 30%. The cash flow from the project are estimated to be 933 millions. Sanofi is very interested to invest and offer to NMC Health the possibility to leave the project in the first 3 years offering to buy out NMCs 30% share of the joint venture any time over the next 3years for 180 millions. VAriance is 0,16 and the life span of the project is 13 years. Should NMC invest? Esercizio United Labels has 450 millions shares outstanding and market price of 11Eur. Debts (book value-market value) are 4,1 billions with an average rate 3X. During the year have been realized 100 millions of capital gains and the P/BV is 3. Revenues are 5 billions with a operating income margin of 12%. The levered Beta of the company is 1,35 and the Dividend Per Share was 0,4. Net income is estimated to grow for the next 14 years at a rate that will decline linearty from the actual value to 1% in the future. Estimate the price of the shares with Fuller and Hsia's DDM Exer drie 3 Estimate the price of a put option on United Labels (use the price of exercise 2). expiration December 29 2023, volatility 0,15, Strike Price 11, 2. using three stage CRR and B&S models. Berdale 4 Conversano spe is a private company and the mail shareholder is a marginal investor. The company in the same industry have an mverage Le Beta 1.6, a D/E ratio of 0.9, a Bdeb 0,34 and a regression R^2 that is 0,71. Being the debts of Conversano 1/3 of total sets and that the average rate on debts is 5%, estimate the cost of equity for the company and the WACC ky 2 + Pa Total Beta: concepts and application. PE P/Sales multiples. Real Options: concepts and application. Blev. Common macroeconomic Data: bf -0,01. (Km-kf) - 0,05, tc = 30% Net, Ba, Bump kaki pa Par. 0-4-001 LA40 Esercizio 1 NMC Health, listed at LSE, operates with 5 different divisions, as in the following table. Divisione Valore di mercato attivit stimato Beta unlevered divisione Healthcare distr 40% 13 Retairem Homes 20% 1.4 Pharmaceuticals 15% 1,7 Biotechnology 15% 1 Equipment 10% 1,15 . The market price of a single stock is 10 pounds, there are 1,5 billions shares outstanding and the company has a Levered Beta of 1,5 and a Debt Beta of 0,4. Estimate: - Financial Statement, and WACC The company wants to invest in a new industry: "Diagnostics and, at the same time, to leave 'Equipment Industry. Equipment division will be sold at a price that is 10% higher than actual value. The cash coming from the sell 500 millions of new debt (costant forever with Beta 0,65) will be used to buy the assets of Thelmax having a levered beta of 1,55, D/E 0,4, and Beta of debts 0,35. The investment will generate 3 billions of free cash flow from operations. Estimate: Financial statements, Betas and Wace after the acquisition NMC Healt wants to invest in a project in cooperation with Sanofi. The whole investment required from the two companies is 950 milllions while NMC Health will get a share of 30%. The cash flow from the project are estimated to be 933 millions. Sanofi is very interested to invest and offer to NMC Health the possibility to leave the project in the first 3 years offering to buy out NMCs 30% share of the joint venture any time over the next 3years for 180 millions. VAriance is 0,16 and the life span of the project is 13 years. Should NMC invest? Esercizio United Labels has 450 millions shares outstanding and market price of 11Eur. Debts (book value-market value) are 4,1 billions with an average rate 3X. During the year have been realized 100 millions of capital gains and the P/BV is 3. Revenues are 5 billions with a operating income margin of 12%. The levered Beta of the company is 1,35 and the Dividend Per Share was 0,4. Net income is estimated to grow for the next 14 years at a rate that will decline linearty from the actual value to 1% in the future. Estimate the price of the shares with Fuller and Hsia's DDM Exer drie 3 Estimate the price of a put option on United Labels (use the price of exercise 2). expiration December 29 2023, volatility 0,15, Strike Price 11, 2. using three stage CRR and B&S models. Berdale 4 Conversano spe is a private company and the mail shareholder is a marginal investor. The company in the same industry have an mverage Le Beta 1.6, a D/E ratio of 0.9, a Bdeb 0,34 and a regression R^2 that is 0,71. Being the debts of Conversano 1/3 of total sets and that the average rate on debts is 5%, estimate the cost of equity for the company and the WACC ky 2 + Pa Total Beta: concepts and application. PE P/Sales multiples. Real Options: concepts and application. Blev

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts