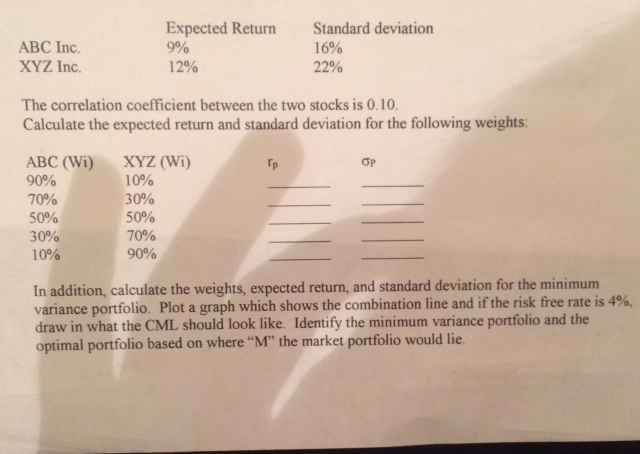

Question: ABC Inc. XYZ Inc. Expected Return 9% 12% Standard deviation 16% 22% The correlation coefficient between the two stocks is 0.10 Calculate the expected return

ABC Inc. XYZ Inc. Expected Return 9% 12% Standard deviation 16% 22% The correlation coefficient between the two stocks is 0.10 Calculate the expected return and standard deviation for the following weights: ABC (Wi) 90% 70% 50% 30% 10% XYZ (Wi) 10% 30% 50% 70% 90% Tp OP In addition, calculate the weights, expected return, and standard deviation for the minimum variance portfolio. Plot a graph which shows the combination line and if the risk free rate is 4%. draw in what the CML should look like. Identify the minimum variance portfolio and the optimal portfolio based on where "M" the market portfolio would lie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts