Question: ABC, Inc.'s target capital structure is 20% debt, 35% preferred, and 45% common equity. The before-tax cost of debt (Rp) is 2.54%, the cost

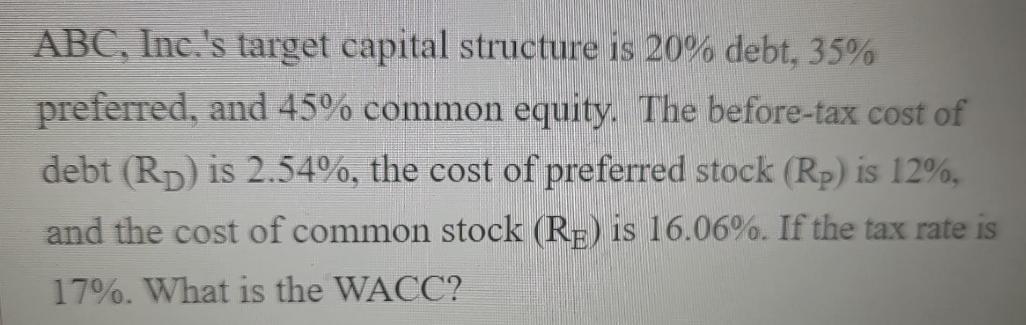

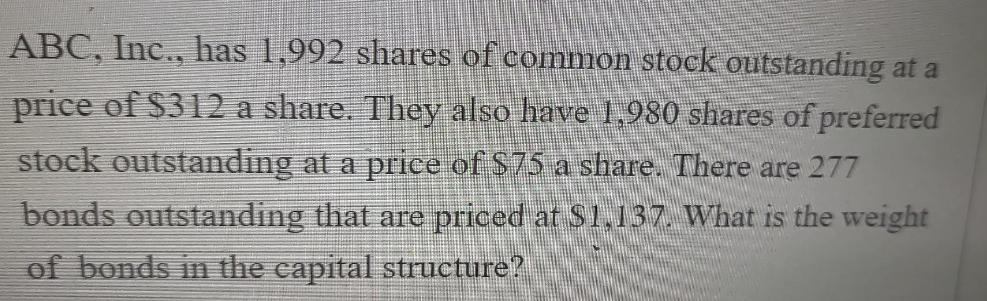

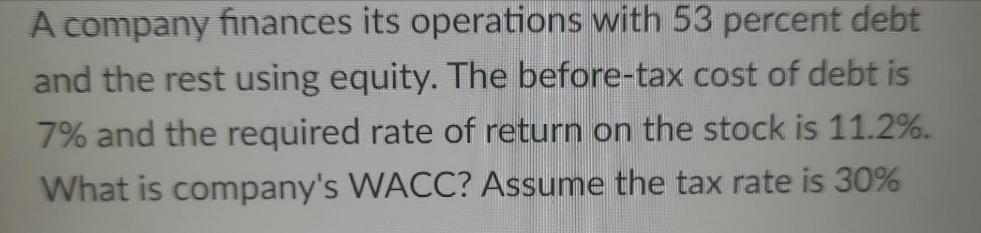

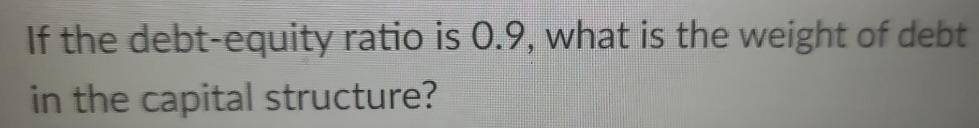

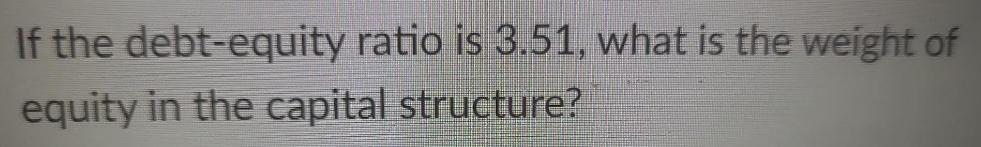

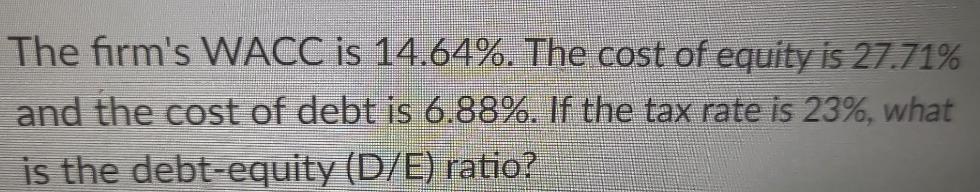

ABC, Inc.'s target capital structure is 20% debt, 35% preferred, and 45% common equity. The before-tax cost of debt (Rp) is 2.54%, the cost of preferred stock (Rp) is 12%, and the cost of common stock (RE) is 16.06%. If the tax rate is 17%. What is the WACC? ABC, Inc., has 1,992 shares of common stock outstanding at a price of $312 a share. They also have 1,980 shares of preferred stock outstanding at a price of $75 a share. There are 277 bonds outstanding that are priced at $1,137. What is the weight of bonds in the capital structure? A company finances its operations with 53 percent debt and the rest using equity. The before-tax cost of debt is 7% and the required rate of return on the stock is 11.2%. What is company's WACC? Assume the tax rate is 30% If the debt-equity ratio is 0.9, what is the weight of debt in the capital structure? If the debt-equity ratio is 3.51, what is the weight of equity in the capital structure? The firm's WACC is 14.64%. The cost of equity is 27.71% and the cost of debt is 6.88%. If the tax rate is 23%, what is the debt-equity (D/E) ratio?

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

1 Calculation of WACC for ABC Inc Weight of debt 20 Weight of preferred stock 35 Weight of common equity 45 Cost of debt RD 254 Cost of preferred stock Rp 12 Cost of common stock RE 1606 Tax rate 17 T... View full answer

Get step-by-step solutions from verified subject matter experts