Thin Co. is a private hospital offering three types of surgical procedure known as A, B and

Question:

Thin Co. is a private hospital offering three types of surgical procedure known as A, B and C. Each of them uses a pre-operative injection given by a nurse before the surgery. Thin Co. currently rent an operating theatre from a neighbouring government hospital. Thin Co. does have an operating theatre on its premises, but it has never been put into use since it would cost $750 000 to equip. The managing director of Thin, Co. is keen to maximize profits and has heard of something called ?throughput accounting?, which may help him to do this. The following information is available:1. All patients go through a ive step process, irrespective of which procedure they are having:? ?Step 1: Consultation with the advisor;? ?Step 2: Pre-operative injection given by the nurse;? ?Step 3: Anaesthetic given by anaesthetist;? ?Step 4: Procedure performed in theatre by the surgeon;? ?Step 5: Recovery with the recovery specialist.2. The price of each of procedure A, B and C is $2700, $3500 and $4250 respectively.3. The only materials? costs relating to the procedure are for the pre-operative injections given by the nurse, the anaesthetic and the dressings. These are as follows:

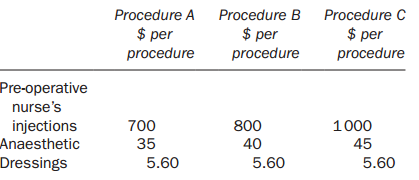

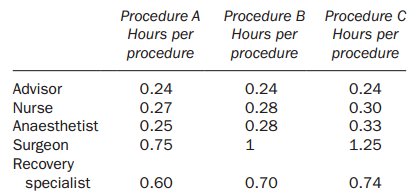

4. There are five members of staff employed by Thin Co. Each works a standard 40-hour week for 47 weeks of the year, a total of 1880 hours each per annum. Their salaries are as follows:? ?Advisor: $45 000 per annum;? ?Nurse: $38 000 per annum;? ?Anaesthetist: $75 000 per annum;? ?Surgeon: $90 000 per annum;? ?Recovery specialist: $50 000 per annum.The only other hospital costs (comparable to ?factory costs? in a traditional manufacturing environment) are general overheads, which include the theatre rental costs, and amount to $250 000 per annum.5. Maximum annual demand for A, B and C is 600 800 and 1200 procedure respectively. Time spent by each of the five different staff members on each procedure is as follows:

Part hours are shown as decimals e.g. 0.24 hours 5 14.4 minutes (0.24 360).Surgeon?s hours have been correctly identified as the bottleneck resource.

Required:(a) Calculate the throughput accounting ratio for procedure C.It is recommended that you work in hours as provided in the table rather than minutes.(b) The return per factory hour for products A and B has been calculated and is $2 612.53 and $2 654.40 llrespectively. The throughput accounting ratio for A and B has also been calculated and is 8.96 and 9.11 respectively.Calculate the optimum product mix and the maximum profit per annum.(c) Assume that your calculations in part (b) showed that, if the optimum product mix is adhered to, there will be excess demand for procedure C of 696 procedure per annum. In order to satisfy this excess demand, the company is considering equipping and using its own theatre, as well as continuing to rent the existing theatre.The company cannot rent any more theatre time at either the existing theatre or any other theatres in the area, so equipping its own theatre is the only option. An additional surgeon would be employed to work in the newly equipped theatre.

Discuss whether the overall profit of the company could be improved by equipping and using the extra theatre.

Step by Step Answer: